China in your hand

Structural change accelerating in the China paper industry

In the past 20 years, China's paper industry has experienced a rapid development. Nearly 100% of the net growth of global paper and board demand was attributed to China, mainly in the packaging and tissue sectors.

The sudden outbreak of the global Covid-19 pandemic put a pause on the global economy, negatively impacting pulp and paper industry development – with depressed consumption and production, disrupted supply chain and sea freight. However, in China, with robust and effective control of the virus, industrial production resumed swiftly after a short period of suspension in early 2020 and the country achieved positive economic growth.

The Chinese paper industry was less impacted by the pandemic with demand increasing by 2%, reaching 111 million tonnes. The pandemic has caused many changes in Chinese daily life and work culture and led to new business models, some of which will have a lasting impact. Besides the pandemic, other factors are also driving the reform and the upgrading of the Chinese paper industry at the onset of the forthcoming 14th five-year period and beyond.

PfR ban

China's PfR (Paper for Recycling) import policy has led to a fibre shortage for paper production and resulted in market turbulence.

In response to the new market environment, some leading paper companies have accelerated the deployment of overseas recycled pulp and virgin pulp to ensure a stable fibre supply. This hunger for fibre is evident in the growth of recycled pulp.

Meanwhile, Chinese paper companies are actively investing in new paper lines overseas to serve the local markets and increase exports to China. An expansion of the strategic cooperation between Chinese and overseas companies is also observed.

China's PfR ban has definitely changed the global trade flow – PfR which used to be sent to China has gradually flooded South East Asia to meet the increasing needs for recycled pulp and paper production. Major exporters of PfR have also tightened their exports to a certain extent to meet local demand growth.

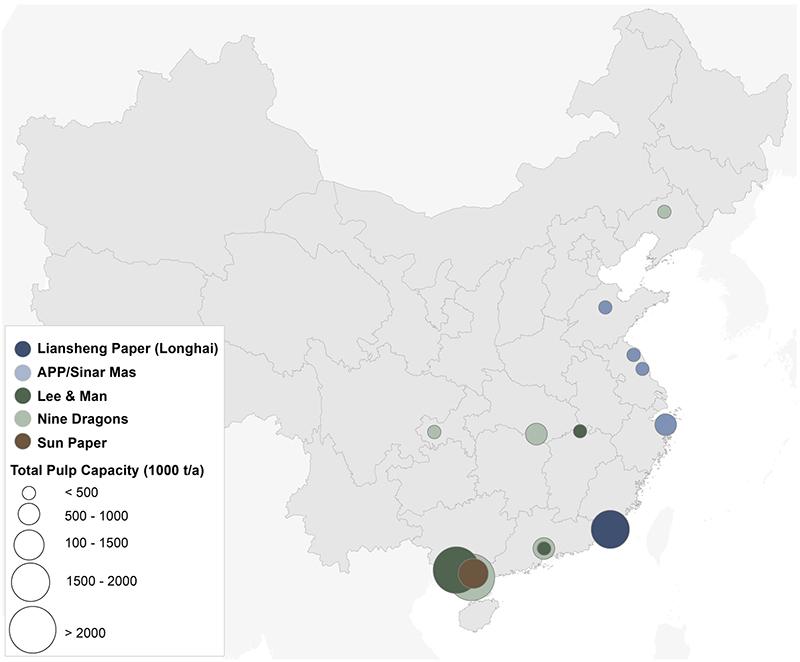

In addition, Chinese paper companies have increased investment in domestic virgin pulp, which has added up a total of 20 million tonnes in planned capacity. This would add significant pressure on the global wood market considering China’s heavy dependency on offshore wood supply.

Plastic ban

The revised plastic ban in China has brought new opportunities for sustainable packaging and promoted the market growth for fibre-based products. AFRY estimates that by 2030, Chinese demand for paper and paperboard will increase by 30 million tonnes, amounting to a net increase of 27%. Currently, the Top Ten producers have a 38% market share in terms of capacity, increased from 28% in 2011. With the elimination of less competitive capacity, the concentration of China's paper industry will be further improved.

As an alternative to filling the fibre gap, the imports of paper and paperboard increased significantly, and China became a net importer in 2018. As the Chinese fibre market reaches a new balance and production resumes, China may gradually cut imports and expand exports to ensure the full utilisation of the installed capacity, once again becoming a net exporter.

Guidance on sustainable and low-carbon development

Power outages and related topics have recently been hot search terms on social media in China, since as many as 20 provinces are suffering from power shortages, leaving businesses and ordinary residents impacted by power rationing. The power curbs have been enacted in response to Chinese provinces failing to meet energy emission goals. Like many nations around the world, China aims to reduce carbon emissions to combat climate change.

Of course, short supply of coal and its soaring price has also impacted electricity generation, which has led to a wider power gap considering the increasing demand driven by the robust recovery of China’s manufacturing industry. Such large-scale halts in industrial production have added some uncertainties and risks to capacity expansion and may also accelerate the closure of the outdated capacity.

As for the paper industry, alternating paper machine downtime plans were announced by many producers such as Nine Dragons, Lee & Man, APP, Chenming, Oji and others in response to the mandated energy-saving measures issued by provincial governments. Other sectors including packaging, chemicals, textile, steel industries etc. have also been impacted. These activities may be short-term and temporary countermeasures, and in the long run, China will speed up industrial upgrades to support low-carbon industries through promoting green technologies and making more of an effort on energy management and introducing effective measures and policies to meet the commitment to ‘carbon peak’ by 2030 and ‘carbon neutrality’ by 2060.

Upgrades in sight

In the future, the energy-intensive paper industry must shift to high-quality development through technological upgrading, production and operation optimisation to reduce carbon emissions. Renewable energy and CHP will also play a key role. Leading paper producers in China have also included "carbon footprint reduction" as one of their strategic development targets and are working diligently toward this direction by using clean energy, developing bioenergy, digitalisation transformation and adjusting fibre mix, for example.

In addition, a series of recently issued environmental policies would steer and drive the packaging industry towards sustainable solutions to reduce waste, which is probably to have both positive and negative impacts on fibre-based packaging.

As the world's biggest paper and board producer and consumer, China’s dynamic market and related policies will continue to reshape the development of the global fibre-based industries and trade flows, which breeds both challenges and opportunities for all participants in the value chains.