Consumer pulse: How are consumers responding to the boom in e-commerce and the sustainability wave?

Over the past few years, the e-commerce landscape has gone through dramatic growth, mainly driven by the COVID-19 pandemic and changes in consumers’ shopping habits. At the same time, consumers’ awareness of plastic waste in the environment, elevated carbon emissions, and global temperatures have risen to an all-time high and have become a concern for consumers of all ages.

In December 2022, AFRY surveyed nearly 600 U.S. consumers over the age of 18 to get a pulse on potential differences in online shopping habits, sustainability concerns, and e-commerce packaging preferences among different generations and regions.

E-commerce spending pre-vs. post-pandemic

The pandemic years witnessed a massive increase in online shopping, and while that shift was compelled mainly by lockdown mandates and boosted by government stimulus packages, we have now seen a structural change take place. With the continued health concerns, transition to working from home, search for convenience, and increased offer of fast door-to-door delivery services, consumers have become more accustomed to and even prefer online shopping. Today, e-commerce represents 14% of retail sales – a drop from an all-time high of 16% during the pandemic. The market is projected to grow, albeit at a slower pace.

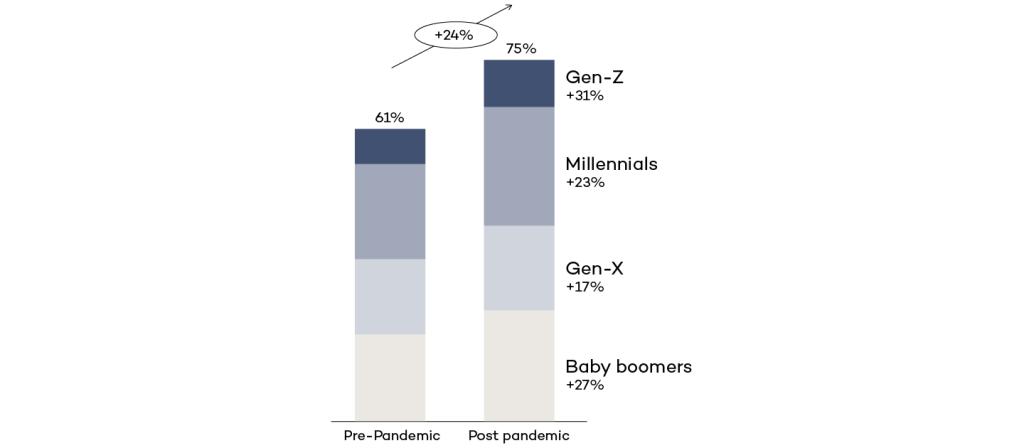

Survey results show that frequent online shopping has increased among consumers by 24% since before the pandemic – with 75% of the respondents shopping online either weekly or a few times a month. The tech-savvy Gen-Z (consumers born in 1997-2020) and Baby boomers (born in 1946-1964) had the most significant increase, at 31% and 27%, while Millennials (born in 1981-1996) and Gen-X (born in 1965-1980), present the lowest change, at 23% and 17%, respectively.

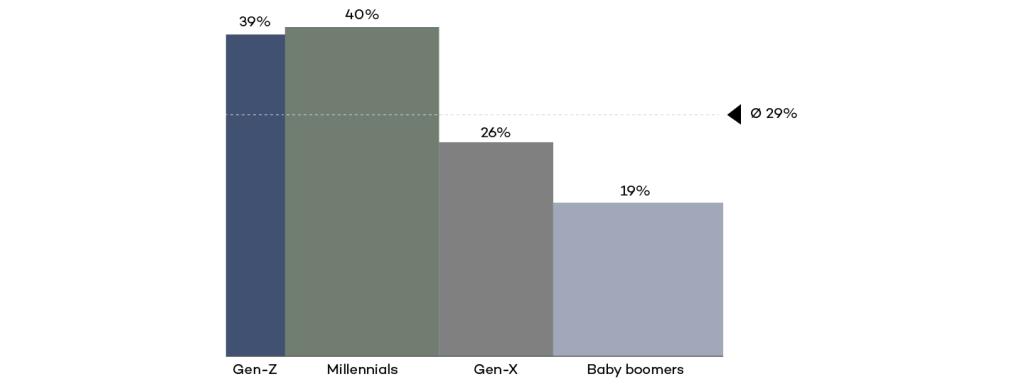

The pandemic transferred typical working structures from going into the office to more hybrid models, including work-from-home options. As consumers started to work from home, their online shopping orders grew. From our survey, 29% of the total respondents tend to online-shop more when working from home. This growth was much higher among the younger generations, at 40%.

As Gen-Z and Millennials continue to drive changes within the e-commerce channel, younger generations are also paving the way toward sustainable packaging materials. Hence, packaging companies are revamping their designs to incorporate sustainable options to satisfy consumer preferences.

Sustainability concerns across the U.S.

Sustainability has become a hot topic worldwide, with many schemes toward a more sustainable future. Europe is driving the change in sustainability within the packaging market – not only through the push from the EU regulations and taxes but also pressure from the consumers and brand owners. Major global brand owners, such as Apple, PepsiCo, Nestlé, Mondelēz, and others, have announced significant sustainability initiatives with aggressive targets – as within the next ten years, almost all the packaging needs to be recyclable.

Compared to Europe, the U.S. is only scratching the surface as no nationwide sustainability directives are in place, and the push is mainly from the brand owners and consumers. In the U.S., some states, counties, and municipalities have set regulations regarding packaging Extended Producer Responsibilities (EPR), recycled content mandates, single-use plastics restrictions, Per-and Polyfluorinated Substance (PFAS) bans, and Greenhouse Gas (GHG) emission reduction targets.

So far, Maine, Oregon, California, and Colorado are the only states with approved packaging EPR laws, and other states are looking to introduce similar legislation soon. However, the process is relatively lengthy as EPR regulations in Maine were decided in 2021 but are not expected to be implemented until the fall of 2026.

Based on AFRY’s consumer survey results, 68% of the survey participants agreed that the sustainability of the packaging materials used in the products they purchase is of primary concern to them. The highest share, at 71%, of the respondents in the West and Northeast, saw the packaging materials’ sustainability as a primary concern. That seems reasonable, considering that many Western and Northeastern states have already established sustainability requirements. In contrast, consumers in the U.S. South are generally not as focused on sustainability topics. Many Southern states have plastic ban preemption bills in place. The survey results reflect that only 65% of the U.S. South respondents see the sustainability of packaging materials as a primary concern.

Younger generations driving the sustainability trend

Aside from differences in sustainability attitudes based on where individuals reside, there are also significant disparities based on the consumer's age. Consumers are becoming more educated and selective about companies and brands they relate to and buy from. How the product is packaged, the choice of packaging material and quantity has also become of interest – mostly among younger consumers.

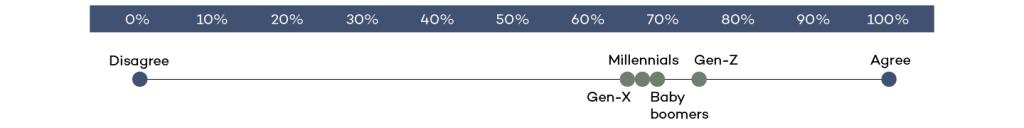

Sustainability of the packaging material is most important for Gen-Z consumers as 74% of Gen-Z respondents agreed that sustainability of packaging material is of primary concern. In contrast, only 66% of Gen-X respondents agreed with the statement. Overall, Gen-Zers are more committed to making sustainable choices that are aligned with their core values, such as: cutting down overall consumption and carbon footprint, partaking in a circular economy, discouraging spending in disposable fast-fashion, and supporting local businesses – even if it meant they needed to spend more money on sustainable options.

Out of the survey participants, 64% responded their current online purchases mainly come in containerboard boxes or paper envelopes rather than in plastic packaging. Although the West Coast is known for its ambitious goals towards a greener future, the share of paper-based packaging was the lowest, at 58%. Interestingly, the percentage of paper-based packaging was the highest in the Midwest at 71%. The use of paper boxes in the Midwest may be driven by good availability and people living in the suburbs with access to curbside recycling.

Furthermore, the survey results show that 84% of the respondents prefer paper-based packaging over plastic or no secondary packaging. The share is the highest among Gen-Zers at 86%.

Of the survey respondents who preferred paper-based packaging, 65% chose corrugated boxes over paper envelopes. Interestingly, the younger generations prefer fewer boxes: only 51% of the Gen-Zers and 63% of the Millennials would rather receive corrugated boxes over paper envelopes. Baby boomers have the highest preference for boxes at 73%. As many Gen-Zers are still students or live in apartment complexes that may not offer convenient recycling services, it might explain why there is less preference for corrugated boxes, as recycling can be difficult. They may also be living alone, which means the online orders are often smaller and, therefore, there is a lesser need for larger boxes. When thinking of the older generations, who typically have families and may order heavier bulky items and live in houses with more storage room, it is understandable why boxes are preferred.

Younger generations are pushing brands to change

Younger consumers are tech-savvy, and online shopping will remain their preferred way to shop. With values that include cutting down overall consumption and carbon footprint, partaking in a circular economy, and supporting local businesses, this generation will continue to embrace brands they can trust and identify with.

As the younger generations are paying more attention to how the products are packaged, what is the material selection and quantity, the responsibility for defining and delivering on sustainability commitments will distinguish the brand owners as “winners” and “losers” in the eye of the young and the largest population cohort in the U.S.