Developing Waste to X Solutions

The global waste industry is witnessing a disruptive shift: individuals, companies and countries are progressively moving from a “waste” concept to a “resource” concept.

This trend is enabled by innovation, as the creation of alternative waste treatment technologies, commonly known as Waste-to-X, is offering advanced solutions to decrease landfilling and increase recycling.

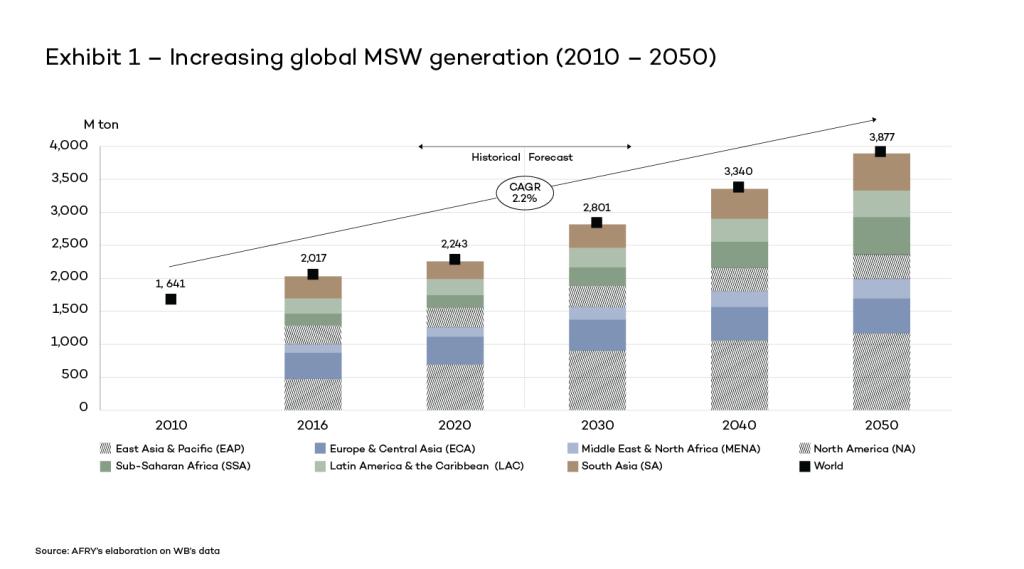

In the last decades, waste arisings have been increasing globally, a trend that is expected to continue pushed by the economic development of Eastern and Southern Asia and Sub-Saharan Africa. Municipal Solid Waste (“MSW”) generation, which can be considered as a representative proxy of this trend at global scale, increased from approximately 1,640 million tonnes in 2010 to more than 2,240 million tonnes in 2020 (+3,1% CAGR). In 2050, this figure is expected to reach 3,870 million tonnes (+2,2% CAGR).

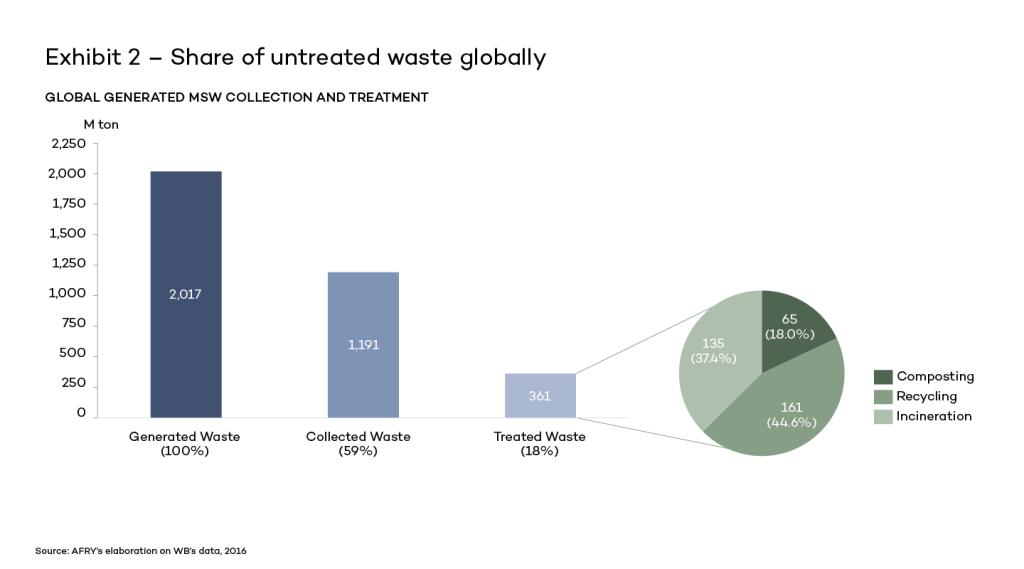

Today, existing waste treatment options are successful at treating only a small fraction of waste generated globally: 82% of generated MSW, equal to 1,656 million tonnes, is not adequately treated due to the balanced combination of limits of the local collection system and lack of technologies and infrastructure which can make treatment competitive respect to the landfilling, especially in developing countries. Only 8% of the overall MSW is properly recycled.

At the same time, global economies are putting waste more and more at the centre of their industrial and environmental policies, pushing forward regulations to provide further support for circularity trends. While the EU is at the forefront of this trend and holds the most advanced waste regulation, several other countries have been gradually incorporating provision to close the gap in their waste-related policies, in the form of tax benefits to promote circularity (e.g., China), adoption of national standards (e.g., Middle East countries) and more generally a progressive marginalisation of landfilling.

The combination of increasing treatment demand and progressively increasing attention by governments and policy makers are proving to be two powerful factors driving innovation in the waste industry. In a broader perspective, a structural shift is taking place in how people, companies, and economies look at waste: we are progressively moving from waste to resource. This is mainly because innovation is allowing us to recycle more than has been possible in the past.

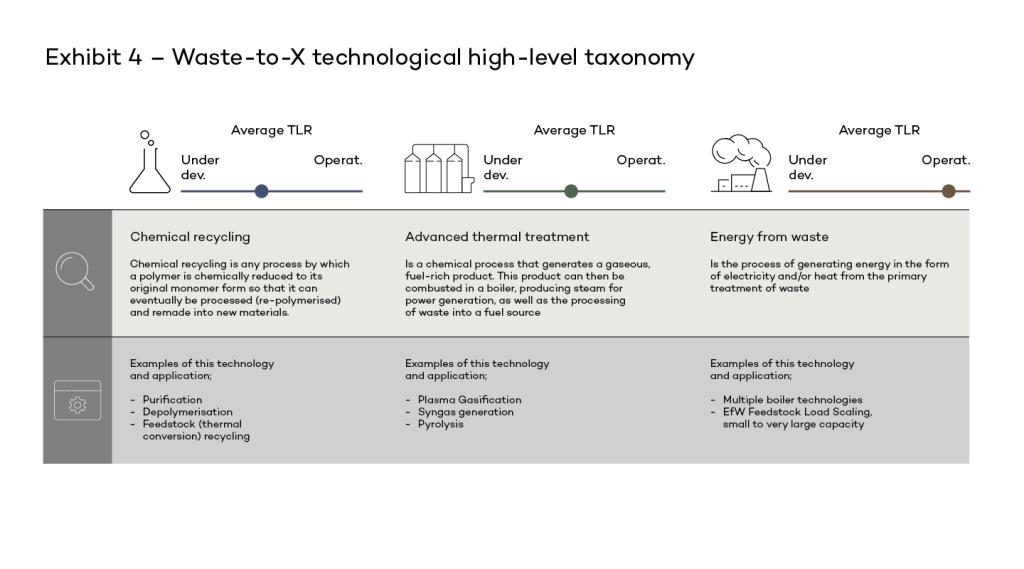

Zooming in on the global issue of waste disposal, innovation in the waste industry is effectively driving the creation of alternative waste treatment technologies that differ from conventional and well-established Energy-from-Waste (EfW) in that the processes are expected to operate at higher efficiencies than conventional Energy-from-Waste and that the outputs (i.e., resources) are prioritised over the energy output. These emerging technologies and solutions are commonly known as Waste-to-X (WtX).

Waste-to-X has several benefits differing from Energy-from-Waste, in that the prioritised outputs are future resources that follow a closer path to circular economy attributes (being a more valuable resource for other industries), whereas typically only some materials from Energy-from-Waste e.g., incinerator ash can be readily utilised, such as in the construction sector, if it meets the assessment criteria for approval.

Now more than ever, countries with developed waste infrastructure systems are looking to develop stronger landfill alternatives for waste disposal, with one of the key drivers being the decreasing landfill capacity and restriction on establishing further capacity beyond that of hazardous or essential inert waste capability. Here, in these developed waste economies, Waste-to-X as a more advanced solution offers a far more embedded waste treatment that has potential for very low disposal rates, with the benefit of carbon mitigation or clean fuel production (e.g., Blue Hydrogen). This is where Waste-to-X has seen the most growth in the market, due to its ability to work across the entire waste and resource industry in both developed and developing countries.

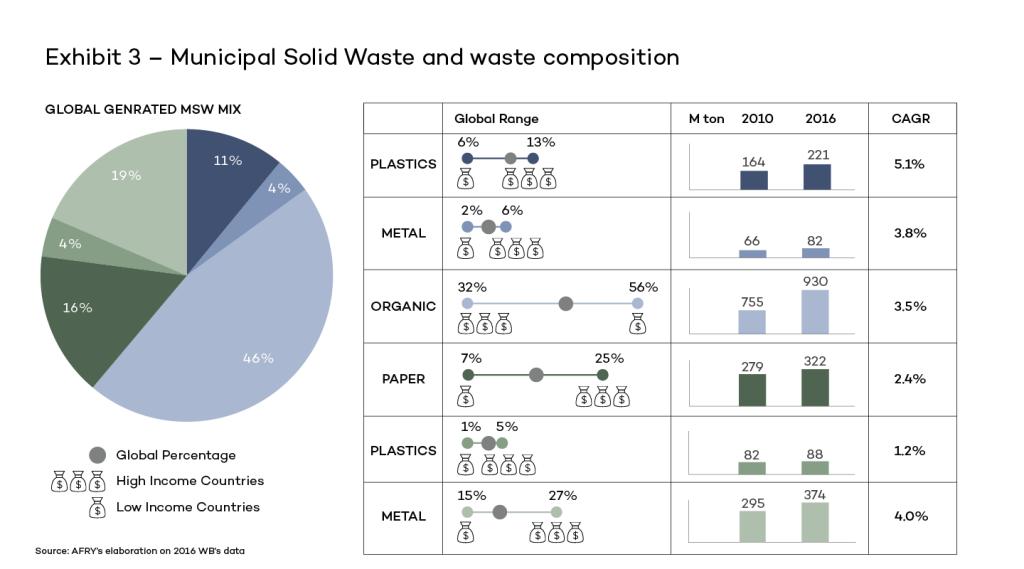

Examining the figure below it is possible to see the discordance between the generation of specific waste types within a general Municipal Solid Waste composition and the waste resource materials that have the greatest value i.e., a large majority of mixed waste is predominately low value with only a few specific types which are higher values as well as being readily recoverable. Waste-to-X has the potential to make greater use of these materials that are of lower value, which when utilised in combination with other waste treatments e.g., recycling for high grade plastics or paper, make for an effective waste solution that limits environmental impact as well as being commercially viable.

Each type of waste presents a precise level of suitability respective to a specific treatment option, which is determined by both physical (e.g., density, calorific value) and market elements (e.g., intrinsic value of the resource, expected market growth). Broadly speaking, a number of clusters of innovative Waste-to-X technologies and solution can be identified.

In such a dynamic environment, market opportunities are booming, and as a direct consequence also appetite for M&A. In 2021, the value of M&A in the waste industry reached more than EUR 17 billion, comparing to a EUR 4.7 billion yearly average in the previous decade. Utilities, that historically have a consolidated presence in the waste industry, are acting as first movers, closely followed by other players such as infra funds.

As the outlook for transactions improves by the day, a multidisciplinary approach combining market, technical and regulatory expertise can be the catalyst to assess potential market opportunities and strategies for both existing players, such as large incumbents aiming at renewing their business model towards a more sustainable setup, and newcomers, such as innovative start-ups and companies developing new technologies and exploring promising market niches.

The maturity and business potential assessment of Waste-to-X technologies and solutions, also from an M&A perspective, cover several complementary areas and dimensions, such as for example:

From a commercial / regulatory perspective:

- Availability of required feedstock, which often implies considerations highly linked to the specificities of the local context in which the project is being developed. An in-depth assessment of sourcing contracts is key in establishing the real value of a Waste-to-X asset

- Competition in the market sphere where the plant is located. Waste is a local business, and the success of a waste (and Waste-to-X facilities) is very often determined by the share of local market (both feedstock and output product) that a project / facility is able to capture. Having a detailed mapping of waste-processing facilities in the area, with details regarding capacity, technology, and if possible tariffs, is a key input for this part of the analysis

- Quality and value of the output product, as the economic case for Waste-to-X technologies lies very at least partially in the existing market potential for their final product. Additionally, when it comes to assessing the market potential for a specific technology, a consumer trend analysis is suggested

- View on regulation, which is also highly geography dependent. Tariffs and accepted feedstocks, such as constraints in the regional circulation of specific categories of waste are only some of the regulatory drivers that might impact the valuation of a Waste-to-X asset

- Intellectual property, as many Waste-to-X technologies are new and developed by start-ups / companies that need to protect their R&D effort to ensure profitability in the long-term

From a technical / environmental perspective:

- Capacity of the asset under different scenarios: waste related processes are in general quite unstable depending on the quality of the feedstock. Sensitivities are needed to make sure that the investment is profitable even in lower-than-optimal cases

- CAPEX, as waste facilities are usually capital intensive projects. This is even more relevant for Waste-to-X, considering that these technologies are usually quite new on the market and maturity has not been achieved yet

- OPEX, which may significantly differ among technologies considering the nature of feedstock (e.g., organics, plastics) and the related needs of managing it within the overall technological process

- Environmental related expenses and potential dismantling costs

- As a more general area of due diligence assessment, which has both commercial and technical implications, the concession agreement (where applicable) and the related provisions usually define the boundaries for a facility to be operated, i.e. by defining potential caps to the revenue formation mechanism, imposing commercial costs such as royalties, allocating to the project sponsor ownership of specific CAPEX categories

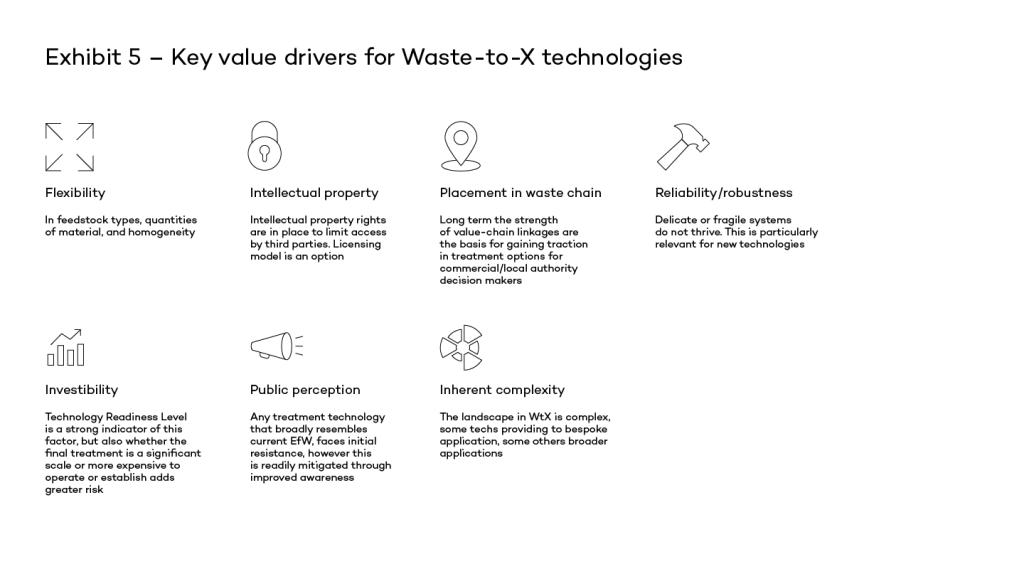

As a more general framework, the most promising technologies are represented by highly flexible solutions which allow to obtain high value output and are characterised by a number of distinctive features.

AFRY is a leading international engineering, design, and advisory company. Our experts possess unique and worldwide expertise to successfully support companies in the waste and resource management industry. At AFRY, we combine extensive market knowledge with unparalleled technical track-record, and:

- We are at the forefront of the Waste-to-X industry: we can offer a highly multidisciplinary approach, resulting from years of experience and countless assignments, ranging from extensive understanding of the future competitive and regulatory trends of the waste and Waste-to-X industry to hands-on experience of the most innovative and promising technologies

- We can offer a one-stop-shop support across the strategic, market and technological aspects of the waste and Waste-to-X industry. Thanks to years of experience in providing consulting and engineering services, AFRY guarantees efficient and smooth support for the most complex assignments. We possess cutting edge competence to understand and model the client sales, contract base, potential future developments and associated technical challenges and costs

- We combine international expertise with focus on national issues: AFRY's team includes experts covering all geographies and key markets, offering specific knowledge of national and local issues and trends (e.g., local waste processing infrastructure, expected demand trends for waste fractions, regulation) and at the same time offers the breadth of knowledge typical of an international team. Our experts have worked in several EU and global markets and will contribute a wealth of knowledge / benchmarks

- We are a trusted Advisor: AFRY is highly regarded in the energy investment community as independent commercial, regulatory and technical adviser for transaction projects. This increases the credibility of our assessment results especially for potential investors and financing parties involved in transaction processes

Our transaction offering covers all aspects of the waste and resources industry, and our experts can contribute a wealth of high-value, hands-on expertise to support you in even the most complex transaction. Come talk to us if you have questions and we will create the solutions to meet your needs.

Authored by Greg Logelain and Carlo Ghiglieno