Ensuring Northern European wood supply security: the impact of the Ukraine conflict

Sweden, Finland and Poland dominate the Baltic Sea wood market

Domestic supply meets most of the wood demand in all countries around the Baltic Sea basin, where Sweden and Finland are the largest importers. Sweden has imported mainly from the Baltic Countries and Norway, while Finland imported primarily from Russia before the Ukraine conflict.

The pulp sector is the largest wood consumer in Sweden and Finland, and the majority of imports has consisted of pulpwood and chips. There is theoretical potential to increase harvesting volumes in all countries: a large part of this potential originates in Finland and the Baltic countries. At the same time, Poland has significant potential in its state forests. In Sweden, the industrial wood potential is minimal, as most of the remaining harvest potential is harvesting residues.

About 10 Mm3 of wood, or 35% of total imports, was imported from Russia and Belarus in 2021. Finland, Poland and Lithuania were the leading importers.

Some 70-80% of Finland’s wood imports came from Russia before the crisis, the main assortments being hardwood pulpwood and softwood chips. Sweden imports mainly from the Baltic Countries, with only marginal volumes coming in from Russia and Belarus.

The Nordic Countries have a long history of sustainable forestry providing resilience in times of supply disturbances

There has been an accumulation of growing stock, with an increase of 20% over the last 20 years, and imports from Russia represented less than 10% of the total wood supply. Forest growth is significantly higher than the harvesting level, even though there has been a recent decline in forest growth because of uncertainties related to the impact of climate change.

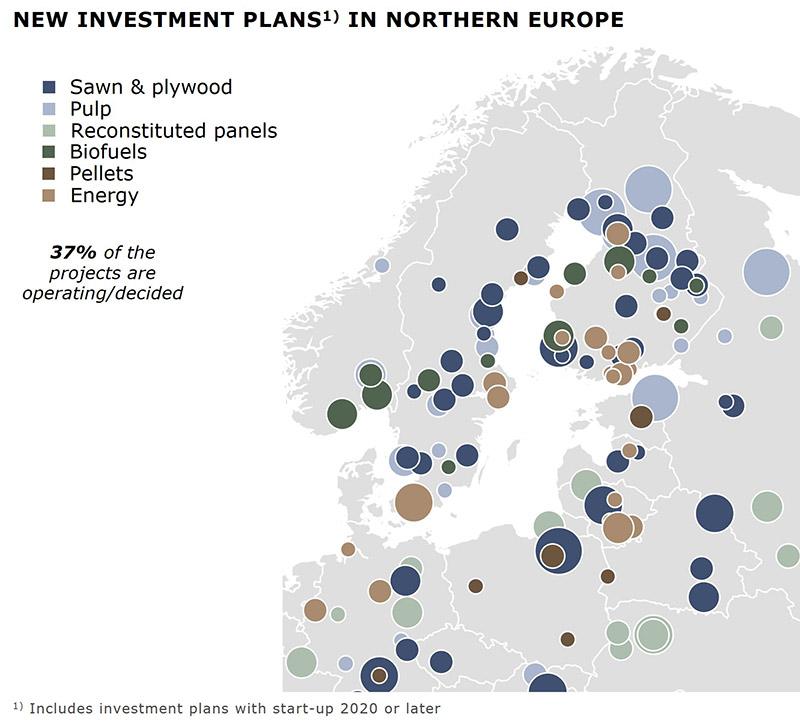

However, further potential to enhance forest growth still exists, and harvesting levels have steadily increased during the last 20 years. Development trends in Sweden are similar to Finland, and new EU regulations have created uncertainties for future harvest potential. The investment pipeline has a combined wood demand of 50 Mm3. Despite that, future wood supply risks slow down investment activity.

Increasing domestic supply plays a key role

The Baltic Countries and Norway have some potential to substitute for Russian volumes in international trade. In addition, several measures help Finland adjust to terminated imports from Russia:

-

Conversion of hardwood pulping to softwood

-

Postponed phase-out of peat in bioenergy

-

Increased domestic supply (thinnings, use of small logs to pulp)

-

Increased imports from the Baltics and other regions

-

Possibly, shut-down of marginal capacities

Since the termination of Russian imports in Q1/2022, Finnish imports have declined drastically with a gradual re-direction towards the Baltic Countries. Softwood pulpwood costs have hiked in the Nordic Countries, but depreciated euro has retained global cost competitiveness.

Wood supply risks resulting from the Ukraine conflict are primarily temporary and have already largely mitigated

Imported Russian wood is primarily substituted by increased domestic supply in Finland and elsewhere, with increased exports from the Baltics, Sweden and other countries filling the supply gaps.

Other drivers, such as the EU policies, have a reducing effect on supply potential, particularly in the mid and long term.

Reduced wood availability has increased wood prices, resulting in a downward shift in the cost competitiveness of the Nordic Countries. Russian wood supply will not be relied on in any foreseeable future, even if the Ukraine crisis terminates.

Bioindustry Management Consulting

Bio-based alternatives and a circular economy approach have increased in their importance and are becoming the new norm. To survive and flourish, industries and companies need to adapt and innovate at an ever-increasing rate. This generates a growing and exciting market for our consulting services.