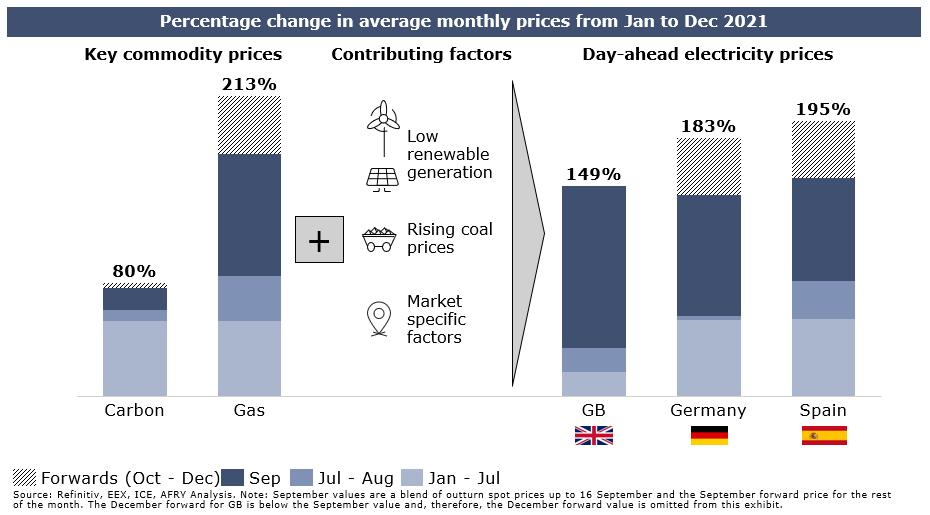

Global fundamentals have driven GB and European electricity and gas prices up spectacularly; prices are likely to decline, but only gradually.

Several factors have driven end-user energy costs up to their current levels. Most of these are expected to unwind (as forward curves suggest for Q1 2022), but not immediately. There is a lot of noise about this issue in the media – here we try and unpick the reality from the hype.

NBP and TTF gas prices have grown at unprecedented speed, in particular in September 2021. Climate factors - such as the summer heatwave in Asia, the drought in Brazil (reducing hydro output) and low renewable electricity output in Europe - combined with the post-Covid kick-start of the global economy have driven up global demand for gas. On the supply side, European storage levels were untypically low, Russian supplies to Europe were lower than expected and US shale gas production had not recovered to pre-pandemic levels.

Gas-fired generators set price in most hours across European electricity markets; as a result the rise in gas price has been the main trigger of similarly fast and steep increases in wholesale electricity prices in European markets. In addition, high carbon prices (driven by tighter decarbonisation targets and higher coal output), a similar uptick in coal prices (which is less important in the European context than elsewhere), low renewable energy output, and market specific factors (e.g. generator outages and a fire at a substation in the UK) have contributed to the rise in wholesale electricity prices across European markets.

While this situation is expected to last into early 2022, prices are expected to return to lower levels, unless there is a very cold winter, with increased gas supplies from the US (as new shale rigs come online to increase LNG exports) and Russia and continued renewable capacity growth.

High prices will have a big impact on the industry, but the picture is more complex than often presented.

As with most market shocks, there will be both winners and losers from the current situation. Contrary to the oversimplified picture presented by some commentators, it is not always clear which types of market participant will suffer and which will see this as an opportunity for growth. For example, some (structurally long) generators will have taken short positions through their hedging activities; whilst some retailers will have found themselves contractually long.

In very general terms:

- Those with contractually long positions – generally but not necessarily generators and gas producers – could earn windfall profits.

- Those with contractually short positions – generally but not necessarily retailers (especially the smaller ones who find it more difficult to hedge) – will suffer losses, in some cases existential ones.

- Flexibility holders could earn significant premiums for the services they provide to the system – though whether these sit with asset owners or offtakers will depend on contractual arrangements.

- Cashflow issues are complex but taken together will likely drive many retailers to bankruptcy. But the ones that survive will likely emerge stronger, potentially recapitalised and with larger market shares.

- As companies fail, there could be a cascade of impacts as seemingly hedged positions unwind. Ultimately, those with the biggest balance sheets will survive and in the long term, costs will be recovered from end users (or possibly taxpayers, depending on potential government intervention).

Looking forward to next Spring, what might have changed in the GB electricity and gas industries?

Firstly, it is unlikely that security of supply will have been compromised, unless we have a very cold winter in Europe and Asia.

Secondly, there will be winners and losers amongst market participants. Those that have most obviously benefitted should beware of windfall taxes or other political reactions. And of course, the electricity and gas retail landscape will look very different in 6 months, with fewer but probably stronger companies.

Thirdly, customers will be paying the costs of the crisis for some time, with sticky customers likely to pick up the biggest share of the costs. Whilst there will be much recrimination over this, on balance most end users have probably benefitted from competition in recent years even taking account of the current ‘crisis’.

Finally, expect a wide-ranging review of energy market design, with continued tension between the politically driven instinct to take more control of markets and the reality that markets are global, and shocks are inevitable. Ultimately, we think the overall structure of the market is also likely to survive, but potentially a patchwork of smaller changes could change market dynamics in the future.

What about the longer-term future?

In the context of massive global changes in the energy industry, the current crisis will eventually be seen as a ‘blip’. Whilst the world continues to transition away from fossil fuels, and global demand grows for low carbon energy, the road to net-zero is unlikely to be smooth or predictable. Market participants should brace themselves for both supply- and demand-side shocks to become more frequent. Effective hedging and financial robustness will be ever more critical.

Our energy market experts have the deep industry expertise needed to navigate these difficult times. Come talk to us if you have questions and we will help you find the solutions you need to handle this complex and difficult situation.