Future Investment

Green Finance consists of all forms of capital invested in projects or companies that support or provide sustainable development projects and initiatives.

The criteria at the basis of the evolution of Green Finance are driven by important milestones set during the last decade, such as:

- the Non-Financial Reporting Directive (2014) , introducing Environmental, Social and Governance (ESG) metrics for disclosing non-financial information,

- the "Sustainable Development Goals" (SDGs), as part of the United Nations' 2030 Agenda for Sustainable Development,

- the EU Taxonomy Regulation (2020), introducing specific criteria to define business activities as "sustainable",

- the Sustainable Finance Disclosure Regulation (2021), introducing mandatory EHG disclosures for financial market participants,

which represent disruptive regulatory changes for investors and companies in relationships with stakeholders.

Despite expectations to see sustainability overshadowed by the financial crisis triggered by the pandemic, Covid-19 has pushed companies and institutions to strengthen their commitment to promote a more sustainable recovery. Similarly, it has made investors systematically consider the ESG implications of their investment decisions, given the direct correlation of high ESG ratings with the financial performance of their portfolios.

Companies with a structured ESG-based risk-management approach are in fact considered to be less risky by the market, owing to the lower probability of incurring compliance or reputational losses. In this context, the interest of investors, historically focused mainly on environmental issues, has been growing on other "S" and "G" topics, due to the strict relationship between the structured ESG commitment and the financial performance of companies.

Several studies show that businesses characterised by higher ESG ratings obtain higher differential returns. The market particularly rewards companies that pursue good practices, especially in all the three fields of environment, social and governance rather than in just one of them. The best strategic portfolio-investment schemes are those that combine ESG ratings with a fundamental analysis of the KPIs, in particular the Price/Earnings Per Share ratio, further demonstrating the advantages obtainable in asset allocation from an integrated approach. An in-depth analysis on the determinants of performance for stocks industrial index reveals that companies with high ESG ratings have been more efficient both in increasing turnover volumes and in improving the operating margin and the dividend yield.

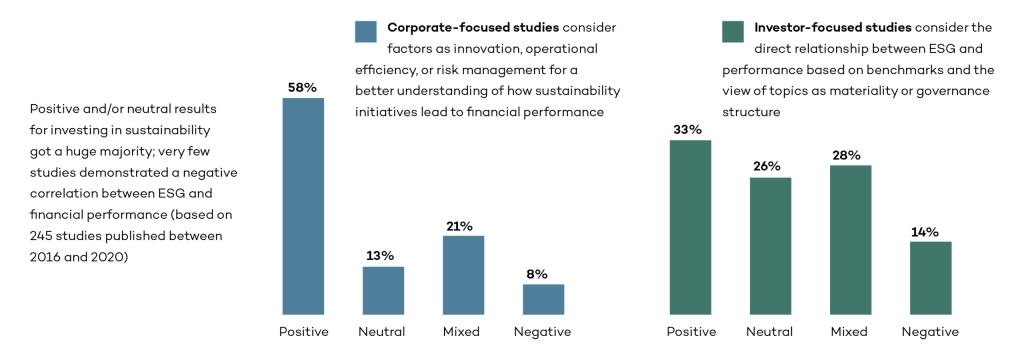

Several studies and reports demonstrate the already close relationship between ESG commitment and financial returns:

- Reports on the results of a study compiled by the NYU Stern Center for Sustainable Business and the Rockefeller Asset Management: After analysing the correlation between ESG and financial performance in more than 245 research papers from 2016 to 2020, a positive relationship was found in the majority of the studies.

- Considering the Banor SIM study of Stoxx® Europe 600 index on the period 2012-2018, the study shows that the enterprises with higher ESG ratings obtain higher returns.

Green finance, through ESG driven choices, represents therefore a high-potential market, channelling investments into the transition to a sustainable, resource-efficient and fair economy. In 2020, in the EU, sustainable investment funds had a turnover of Є 223 billion, almost double in relation to the previous year. Issuance of green debt instruments continued to grow in the first half of 2021, with volumes more than doubling to over Є 200 billion compared to H1 2020, which represents a record for any half-year period since market inception in 2007. This is an obligation which, at the end of a certain period of time, results in a return on investments having a green effect (energy efficiency, eco-friendly construction, new models of management, treatment and disposal of waste) with the related interests.

As confirmed by ISPI (Italian Institute for International Political Studies), the total issuance of green bonds in 2021 was worth more than Є 300 billion and could reach the threshold of Є 1 billion within two years. More generally, ESG financial instruments, which also include green bonds, are now worth ten times as much and in the third quarter of 2021 they almost reached US$ 4 trillion.

In order to deepen the discussion about the mission of companies to deliver both ESG purpose and business profit, several books and reports are available - one of them is surely Alex Edman's recent book "Grow the pie"(www.growthepie.net), about the increasing societal urge to match investors' and stakeholders' interests.

Act now

Companies today are focused on challenges with a strong environmental connotation, but in order to face them it is necessary to adopt a wider sustainability structured approach. This is necessary in order to avoid that the effects of these challenges lead to social and governance implications of equal importance (workers’ health and safety, social conditions, corruption risks, etc), involving "collateral" costs and worse financial KPIs.

In this context:

- investors need to verify how their portfolio companies are performing in terms of ESG ratings and scorings;

- companies need to increase their commitment on all the sustainability topics, by fixing quantitative ESG targets (including the setting of MbOs not limited to the financial KPIs);

- financial institutions require evidences for ESG commitment, allowing a decrease in cost of capital for companies with higher ESG scores.

Integrating sustainability into the corporate strategy means evaluating such risks in advance and acting on the creation of company value.