Impact of European Green Deal on the EU ETS

The European Green Deal is likely to have a significant impact on wholesale electricity prices and investment portfolio valuations

Carbon prices are a critical component of electricity prices, accounting for 20-50% of the wholesale price across European markets. Currently, the focus on carbon prices is intense, due to proposed reforms under the European Green Deal which aims to make the EU’s economy climate-neutral by 2050.

These changes are likely to have significant impacts leading to the following questions:

- How might the operation of the EU ETS be impacted?

- What could be the future level and path of carbon prices?

- What is the impact on wholesale electricity prices and investment portfolio valuations?

To appropriately manage this risk, we can provide answers to these questions through our analysis outlined below.

Our offering

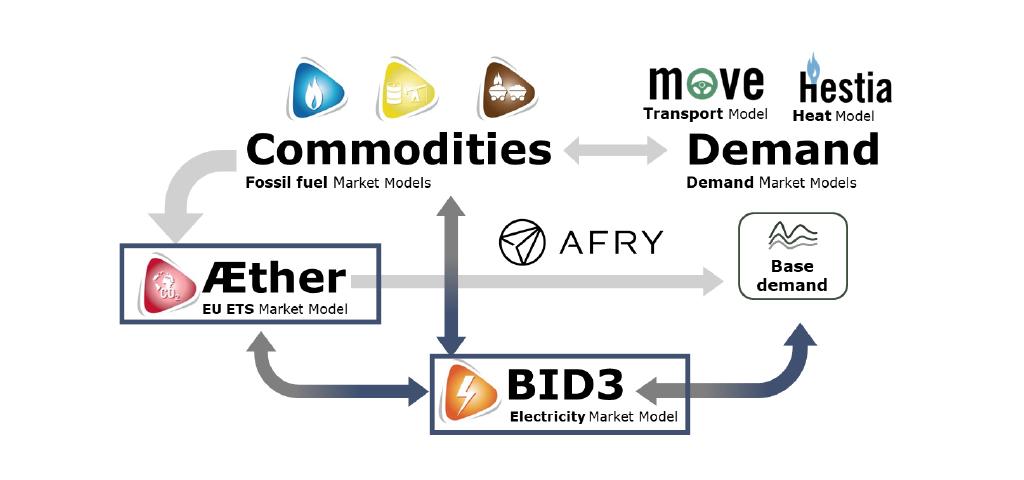

AFRY proposes undertaking a future carbon market sensitivity add-on to our standard 2021 Q1 EMQA subscription which explores the various EU ETS design parameters around our Central scenario to give corresponding carbon price projections, and associated wholesale electricity prices[1].

This will complement our Central scenario, giving foresight of the various outcomes, and providing a range of prices around our base case.

We are offering clients two different options:

- Phase 1 - ‘ambition only’ – exploring how carbon prices respond to changes in ambition (e.g. -60% by 2030, -100% by 2050) and MSR design parameters (upper/lower threshold limits, and MSR intake rate); or

- Phase 2 - ‘ambition and scope change’ – as above, but also considering the impact of bringing a number of new sectors (maritime, heating, road transport, international aviation) into the EU ETS.

Deliverables

Phase 1 – ambition only

- Powerpoint report providing a sensitivity key/description of inputs.

- Access to online data tool for easy visualisation of results, and access to underlying data, including

- carbon: carbon prices; volumes of supply/demand/surplus; and MSR activity/stock levels.

- electricity: indicative baseload wholesale electricity prices for the market(s) the client has signed-up for.

- Conduct a client-exclusive webinar to discuss our key messages from the analysis.

Phase 2 – ambition and scope change

- As per Phase 1 but also including an additional powerpoint report covering:

- Marginal Abatement Cost (MAC) curves for maritime, international aviation, road transport, heating; and

- a qualitative discussion of MAC curves including role of non-economic factors driving deployment.

- Access to online data tool for easy visualisation of results, and access to underlying data, as per Phase 1 but also covering scope change sensitivities.

- Interactive workshop to discuss key messages.

Timing

- Phase 1 results will be made available alongside our standard 2021 Q1 projections by the end of March.

- Phase 2 timeline to be discussed.

Please note the development of these phases is dependent on a sufficient number of clients committing to the study (in the case of Phase 1, by end of January 2021).

Register your interest

[1] Please note:

i) These wholesale electricity prices do not reflect fully internally consistent scenarios like the Central price track – they incorporate first order effects like, fuel switching rates and capacity build, but not second order effects like the potential impact on electricity demand as a result of the carbon price or optimising cross-border flows.

ii) These sensitivities are not available for all markets, e.g. GB is currently not covered as it is now subject to a UK-only ETS.