Keeping it real-time

The availability of ever-cheaper and better sensors, in combination with high-capacity communication platforms, opens a whole new world of opportunities for enhanced electricity grid information.

While smart meters and other measuring devices have been rolled out at volume in the latest decade, we now see a new generation of advanced multi-sensors for overhead lines and cables coming to the market. The big question is - how can we create value out of more real-time grid data?

Under usual circumstances, the electricity grid is a robust and well understood technology, built to operate reliably over decades. Yet in new market conditions, the utilisation of these assets changes considerably. The green transition of the electricity grid means greater fluctuations of loads, higher utilisation of thermal capacity and a larger share of cables. This gives rise to a greater need to better understand the implications of this shift on the grid assets.

Modern electricity grid sensors allow for the registering and transmitting of real-time data on a wide range of variables. There are several sensor solutions already present in the market. The sensors may cover some or all electricity data – voltage, current, frequency, ground fault – but also environmental data, including line temperature, humidity, line inclination and sag, movement and more. This combination of different data streams provides totally new opportunities for the electricity network management.

A recent study conducted by AFRY Management Consulting regarding overhead-line sensors revealed that most network operators are unaware of the specific benefits of these solutions and are often hesitant about the integration of these IoT devices into their existing IT infrastructure. Our study revealed four key use cases that grid operators are currently exploring in more detail, which vary both in terms of maturity as well as the affected section of the grid:

- Dynamic line rating (DLR) increases available grid capacity: While an electricity line has a certain rated, static capacity, using information on real line temperature can increase useable line capacity by as much as 20-25% in certain periods.

- Ice detection to prevent heavy ice loads on lines: Identifying early ice build-up on electricity lines allows for implementing mitigating measures well ahead of reaching critical conditions.

- Fault location detection: Particularly in rural and hard-to-reach areas, sensors can help to quickly identify the fault location and to direct maintenance crews to the appropriate position.

- Remaining lifetime assessment (Predictive Maintenance): Some old lines require lengthy analyses, in some case even physical samples, to determine the remaining lifetime of the asset. With advanced analytics, sensors promise to better estimate the remaining lifetime of components and better direct maintenance activities to extend this lifetime.

The value of sensors thus materialises in several areas - lower costs, better quality, improved safety, and strengthening the network companies' role in the green transition. But more data alone is not sufficient to create value. The challenge grid companies face is to evaluate business cases for these sensors considering the different type of value and cost implications associated with each of these use cases.

First, it has been shown that the different applications cannot be scaled equally to the entire grid. DLR, for example, is particularly relevant for highly congested lines, ice detection for regions with a high ice-load potential, and these might not necessarily overlap.

Use cases might also differ in their requirements to integrate with various IT systems. A key issue in this respect is that many manufacturers use cloud services to provide data analyses as a service that raises security concerns if integrated in the SCADA world of control room systems. A hybrid integration of cloud and SCADA systems is very uncommon in the space of network operation. Additionally, different use cases also require connecting to a range of internal as well as external data sources, such as for example substation sensors, drone footage, weather data or smart meter data.

The AFRY study also showed that the introduction of and the investment in grid sensor technologies can vary considerably owing to different regulatory regimes. Particularly the shift of regulation from CAPEX to TOTEX regimes is expected to greatly favour sensor implementation in the future.

For overcoming these challenges early movers in electricity network sensors tend to initially concentrate on a single-purpose use case, such as for example ice load, DLR, or fault detection. This approach may be useful as part of a learning process, but clearly underexploits the full, potential value this sensor data can provide.

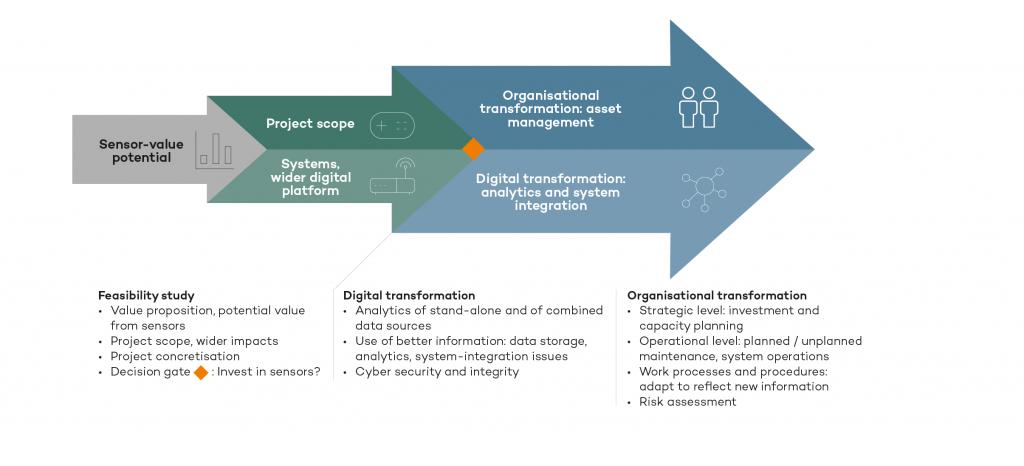

More mature companies are using a more holistic picture to determine the future value of sensors. They see grid sensors as part of a wider long-term vision that will enable them to create a digital simulation of the grid. With immediate effect, they invest in developing the digital as well as organisational capabilities that will be required to address the technological challenges of this decade. To drive this digital transformation, they need to define the future targets for their data management, analytic and control capabilities. From an organisational perspective, they must define targets for a new asset management framework and adapt work processes and procedures in line with an updated risk profile of these assets.

So, when looking at the value of grid sensor technology initial investigations will require separate and detailed understanding of the cost-benefits of each of the envisaged use cases. This narrow focus, however, should not ignore the long-term implications that grid sensors can have in achieving the operational and digital transformation goals of network companies.