North American tissue industry is strong but in need of modernisation

With four of the top 10 largest global tissue manufacturers in China, future North American investments are set to target advances in scale and technology, and over 80% of the new capacity is believed to target the private label market.

Investments in new large-scale state-of-the-art tissue manufacturing assets continue to be active in North America, although in terms of the global tissue investment context, Asian and European tissue producers have surpassed North American producers in the race for capacity growth. The private label segment is expected to continue to grow in North America, which includes the US, Canada and Mexico. Many new machinery investments are targeting the sector, especially with ultra-premium quality technologies.

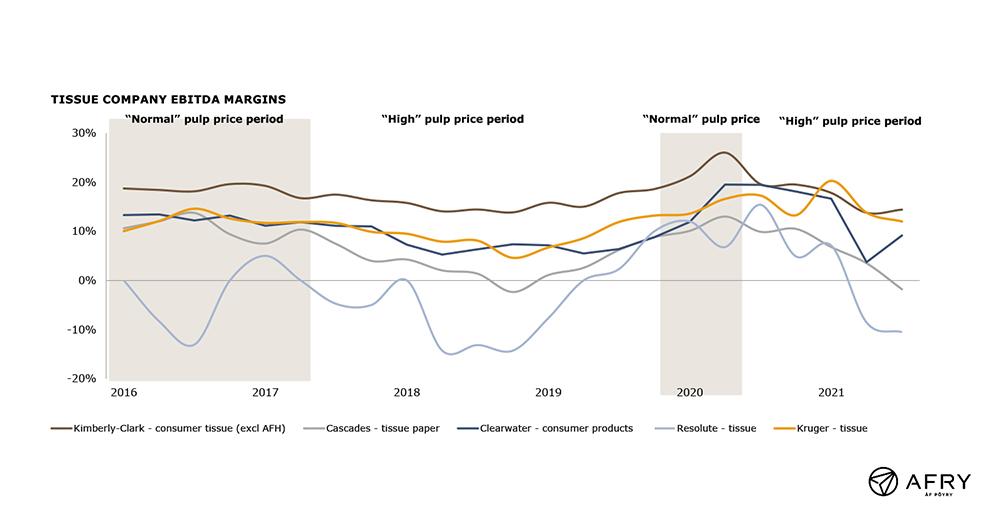

The long term financial performance of the tissue sector is healthy, typically at or above 15% EBITDA, but impacted by the cyclicality of market pulp prices. Although pulp is the key cost driver for tissue companies, pulp integration remains rare.

Investment: new large scale tissue machines continue to be built in North America

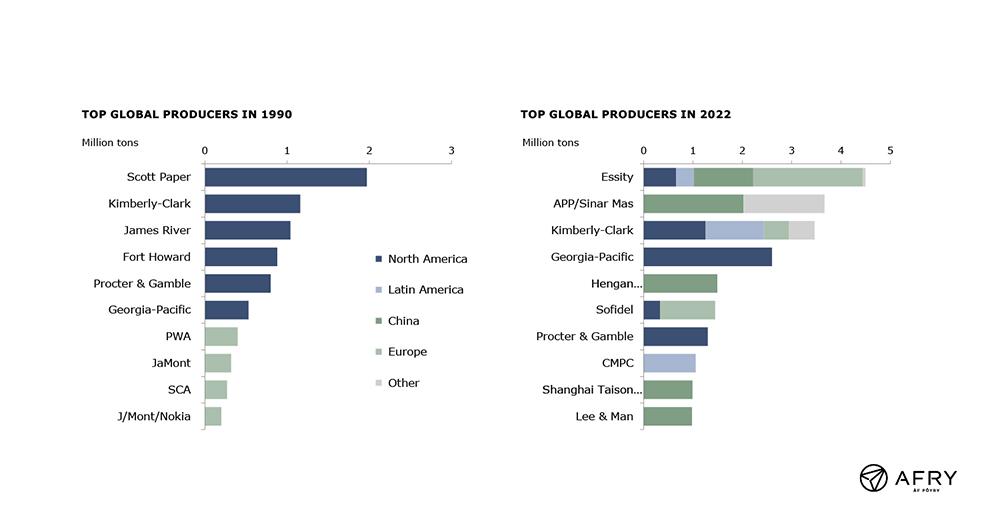

Over the past three decades, the global tissue sector has gone through a strong period of growth, capacity build and consolidation. If we take a quick peek down memory lane and think about how the global top 10 players’ landscape looked like in the 1990s, we only see North American and European companies. In fact, the six largest tissue companies in the world were all North American companies.

In the late Nineties, we saw Asian – back in the day mainly Japanese – companies enter the top 10 list, and at the same time, industry consolidation started to take place and was the driving investment force in the early 2000s. But it wasn’t until the beginning of the 2010s that we saw the Asian companies starting to grow significantly and reshuffling the global leading players’ landscape.

Currently, four of the top 10 largest global tissue manufacturers are from China. Fittingly, China has become the largest tissue machine capacity base in the world at close to 17 million tonnes of installed capacity, according to AFRY’s global tissue asset database. In comparison, here in North America, we are estimating the installed tissue manufacturing capacity at close to 10 million tonnes.

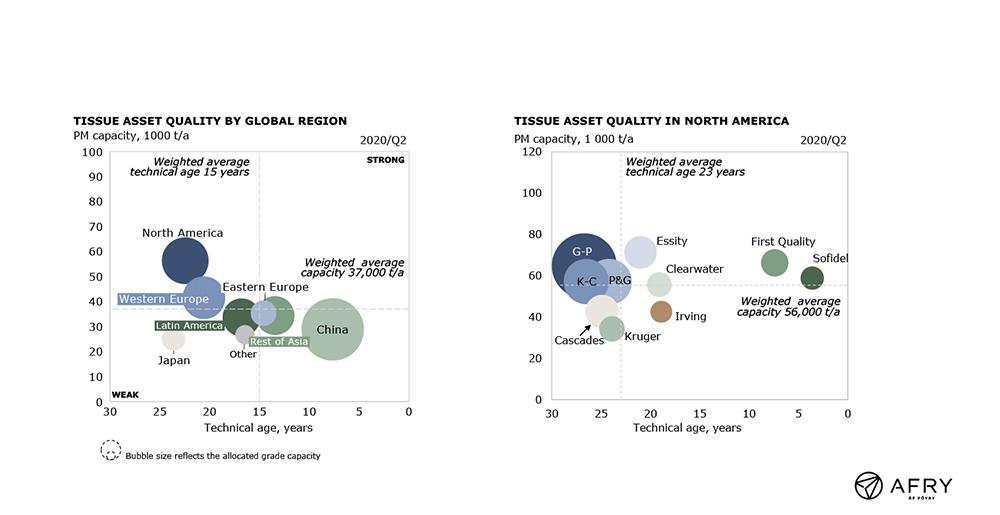

As a result of the aggressive growth and investments in the tissue sector in emerging markets, the North American tissue assets have become old (23 years on average on technical age) in comparison to what is found in other regions (the average tissue machine technical age globally is at 15 years; while only eight years in China), although the North American tissue machines are still on average larger (on average at about 56,000tpy) than in other regions (global average tissue machine size at 37,000tpy).

If we focus on North America, the leading North American tissue manufacturers have been consolidating and renewing their asset base, while the medium-sized players have been growing their market share. Currently, the top three producers of tissue account for 55% of the installed capacity in the market, which is down 5%-points from just six years ago. Both Georgia-Pacific and Kimberly-Clark have idled tissue machines at Augusta (two machines in 2018), Crossett (one machine in 2019) and Fullerton (two PMs in 2020) while bringing in new capacity online, but with an overall minor increase or decrease in the company tissue capacity. At the same time, producers like First Quality Tissue, Sofidel, Kruger, Irving and Clearwater have been growing their tissue capacity footprint. And the same trend is set to continue.

There are seven new tissue machines with a total capacity of about 450,000tpy announced to enter the market over the next three years. Six of those are medium-sized or newer entrants to the North American tissue market.

State of the industry

The essential industry’s financial performance is strong, although market pulp price cycles continue to challenge the consistency of the financial performance. Retail tissue companies had a record year in sales growth and margins in 2020, thanks to tissue product panic buying during the pandemic and low market pulp prices. The escalation of market pulp prices and deflated demand pressed down margin performance in 2021 for tissue companies.

Tissue manufacturing asset investments in North America continue active. Overall, the tissue machine scale is increasing via investments in state-of-the-art large scale assets and as small tissue machines are closed. The trend towards TAD technology machines continues, targeting the retail private label market. The capacity growth is likely to create at least short-term supply/demand pressures until the companies with the largest asset and capacity footprints are likely to remove high-cost capacity. For their margin’s sake.

This article was originally published on the Tissue World Magazine website under the name of ExitIssues: North America’s tissue finances are strong… but ageing machinery will need to be replaced to meet the rise of China and Europe on April 25, 2022.