Post-pandemic shifts in consumer behaviour

Upheaval of the Bioindustry Sector

It’s a fascinating time to be part of the conversation about pulp and paper and the sector's transformation, with the ever-increasing focus on sustainability and circular economy. New technologies and digital tools allow us to take a big step forward, which will help future society make the most of the limited resources that we have.

Sustainability is rightly one of the strongest trends both on an industry and a consumer level. However, daily choices of consumption are not only affected by sustainability but also by periodically contradicting trends – long-term, short-term and also shock impulses, such as COVID-19. Any potential impacts that COVID-19 has had on consumer behaviour and whether those changes are here to stay are fascinating topics that we have decided to investigate.

Point of No Return

The world has started to move past the COVID-19 pandemic by getting better at managing the disease and protecting the most vulnerable through vaccinations as well as other preventative measures. Even though our daily lives won’t return exactly to the way they were in 2019, we could call the direction that we're heading towards an evolution. The pandemic has changed the way we work, the way we shop and what we value. This ongoing shift continues to impact market demand and consumption patterns for all parts of our broader pulp and paper sector. Before we dive deeper into the implications for our sector, the stage needs to be set and what has changed needs to be brought forward to the spotlight.

Recently in Germany, a mother and her young daughter entered a small shop. The mother was taking a sandwich out of the cooling shelf and asked her daughter if she would also like to have one. The little girl replied: "No, mum, it's packed in plastic." Thinking about consumers, it's important to look to the next generations.

Listening to the conversations happening all around us, it’s clear that we all agree the pandemic has especially changed the way we work.

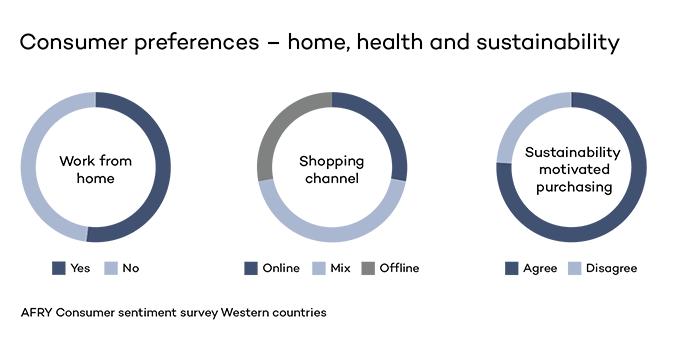

For many people, working at home has become the ”new normal” – Based on a recent AFRY consumer survey conducted in Germany, the UK and the US, more than half the people in the Western countries plan to continue to work from home, at least some days of the week, even now. Working at home, we obviously spend more time and consume more inside our residences, preparing meals or consuming packaged convenience or frozen foods as we jump from one conference call to the next. Thus, the pandemic gave a boost to various online services, such as home food delivery and takeaway services, or online shopping in general. The food is usually ordered on our smartphones and still delivered covered in plastic, but increasingly in cartonboard or moulded fibre containers.

The same applies to other products ordered online. Based on the same AFRY survey, one third of people continue to prefer online shopping. The brown corrugated shipping boxes and delivery envelopes continue to fill our front porches and our recycling bins afterwards. Including recycled content in product packaging is a mandate, or at least a goal, for many consumer products companies, while consumers themselves pay attention to reducing the use of single-use plastics. According to the consumer sentiment survey, 88% of consumers in Germany and 84% in the UK are committed to limiting single-use plastics, which creates demand upside and opportunities for our sector.

After experiencing a global health crisis, many of us have become more health-conscious, trying to eat healthily and exercise more. We also prefer locally produced food and products, at least when we have the time and money to do so. As consumers across Europe are feeling the pinch on their wallets from rising inflation, as well as the instability caused by the war in Ukraine, concerns over the economy have shifted consumer purchasing attitudes more towards affordability rather than label or brand. In a survey conducted by Statista earlier this year, over two thirds of consumers in the UK stated that they consider purchasing private label packaged food as well as home and household care products. The fact that private labels are often cheaper than national brands has been beneficial, as financially strained consumers have been tightening their purse strings.

Implications for the Pulp & Paper Industry

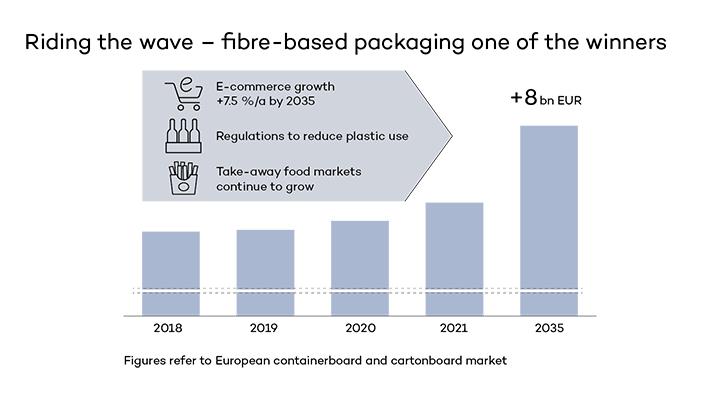

Recent changes in consumer behaviour have had unequal impacts on our wider pulp and paper sector by segment, but one of the winners has definitely been the fibre-based packaging industry. The consumer packaging segment has risen to new heights, driven by strong sales of essential goods that need packaging, such as in the food and beverage segments. Time and money spent dining out were reduced, while home food delivery and takeaway services grew simultaneously, leading to increased profits for paperboard suppliers in the food service sector. Other factors have been influencing the market as well, such as sustainability. The trend that started before COVID-19 has become even stronger in the recent past, expedited by the revised regulations in the EU that promote the market growth for fibre-based materials.

The packaging market is currently very tight, and the availability of raw materials impacts the ability to push new innovations to the market. Brand owners and converters have faced challenges in getting the necessary packaging material volumes. This situation is likely to prevent a rapid transition to a larger offering of fibre-based packaging, delaying the plans to replace plastics which are still the prevailing packaging solution. The tight market has even forced some to regress back to plastic.

Hopefully, this is only a temporary situation, as the project pipeline is evolving and there are new machines or additions to capacity, especially in China, but also in Europe and the Americas. Even so, e-commerce penetration reached the expected 5-year development in only one year during the pandemic. Just imagine what people all over the world have ordered in the last 24 months, using channels such as Amazon.

Online shopping is now part of the new normal. Containerboard producers, corrugated box makers and other producers of protective shipping packaging are benefitting from the structural change in people’s “click & deliver” purchasing habits. We can also expect to see new packaging designs as most of today’s packaging has been optimised for traditional brick-and-mortar requirements. Nevertheless, E-commerce brings challenges to the industry as well: the traditional fibre loop is contested as packaging is delivered directly to consumers instead of retail outlets that have served as major sources for fibre collection. This impacts the quality of recycled fibres, as the already deteriorating fibre quality is not improved by mixed post-consumer waste.

In addition to the pandemic that has kept the packaging markets tight in Europe, the war in Ukraine was, and still is, the next game-changer. With various expected impacts, ranging from macroeconomic downturn to the flow of refugees to countries where the household expenditure per capita is on a different level compared to Ukrainian standards. The upcoming two to three years will play a significant role in defining the next period for the industry’s green transition. The question is whether the sustainability trend will still be able to remain strong and whether the change that we have been witnessing in the European packaging markets will be a lasting structural change.

Bio-based products hastening the shift to sustainability

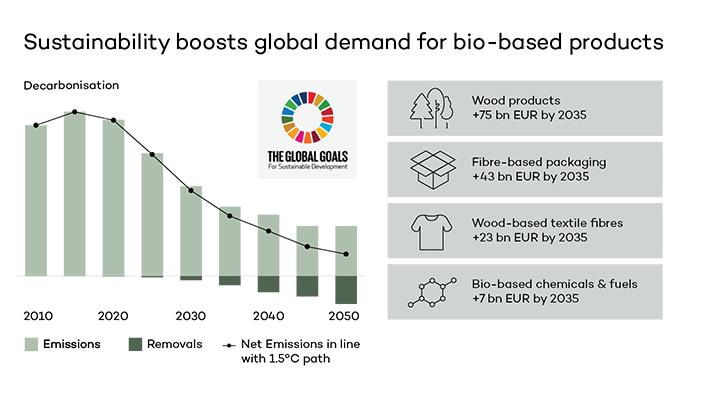

The bioindustry cluster has so much to offer on our path towards a more sustainable world, and when we take a broader view outside the limited scope of fibre-based packaging, there are large business opportunities in other bio-based sectors globally.

- Wood-based construction products that act as carbon sinks can be used to replace concrete and steel, both of which emit carbon in the production process, to support the fight against climate change.

- Wood-based cellulose fibres used in textiles are 100% renewable, biodegradable and recyclable, and can provide an essential new vehicle to partially solve textile waste recyclability issues as well as the microplastic problem related to synthetic textiles.

- Bio-based chemicals are important tools for carbon emission reduction, and carbon-neutral biofuels can support the European efforts of becoming independent of Russian oil – two areas where the market is developing fast thanks to recent investment and legislation changes.

From an individual consumer's perspective, it is naturally important that sustainable solutions are cost-competitive, particularly since there is increased economic uncertainty following the war in Ukraine and inflation. This is the challenge for many companies that are developing novel solutions to replace prevailing technologies and solutions and are investing significantly there.

The road to more sustainable solutions requires systemic changes that cannot be achieved without contributions from various stakeholders of bioindustry value chains. Consistent work to proactively influence the regulatory environment is a necessity to ensure the conditions for success.

The coherent voice of the forest-based industry should be made heard at the table with interest groups of other industries. Continuous identification of relevant partners with the most advanced competencies and initiatives support game-changing innovativeness within our industry. In this context, conferences and other opportunities to get together are important so that we can connect the dots across the industry and develop bio-based solutions for a circular economy, shedding fossil fuels on the way.

The Way Forward

Some changes in consumer behaviour introduced by the pandemic have clearly become permanent. At the same time, if we take a step back and look at the big picture, we can also see COVID-19 as a short time period of two years which didn’t fundamentally change the megatrends that continue shaping the world, consumer behaviour and the bioindustry sector – urbanisation and digitalisation will continue, as will the struggle against climate change and making efforts for sustainable solutions and the circular economy. We at AFRY want to actively contribute to new solutions – together with our partners and other industry experts. As we say at AFRY: Making Future for generations to come.