Reflections on the Electricity Generator Levy: the UK's new windfall tax for low carbon generation

On Thursday the 17th of November, the UK Government announced a new ‘Electricity Generator Levy’, one of a number of tax rises announced in the Chancellor’s Autumn Statement. This will replace the Cost Plus Revenue Limit announced during the Truss interlude. This note presents our initial reflections, based on a review of the Technical Note which the Government posted on its website.

Compared to the Cost Plus Revenue Limit, the Electricity Generator Levy looks more like a windfall tax in that it will be calculated on an annual basis and collected by HMRC in the same way as corporation tax. However, like the previous proposal (and similar to the EU revenue cap), it will be applied only to ‘excess’ profits above a certain level – in this case a £75/MWh benchmark price. Note also, that this tax will not be deductible for main corporation tax purposes, and tax deductions for corporation tax (such as capital allowances) do not appear to apply for the Electricity Generator Levy.

The Levy will apply to nuclear and renewable generators, excluding those with CfD contracts. It does not apply to fossil fuel generators or to electricity storage. ‘Renewable’ includes biomass generators – our assumption is that this would include energy-from-waste, although this is not explicitly mentioned. It will be applied at the corporate group level, but only to groups who generate more than 100GWh per year from qualifying nuclear and renewable generation. For a wind generator at 30% load factor, this is equivalent to around 38MW. For a solar generator at 11% load factor the equivalent capacity is 104MW, while for a 90% load factor baseload generator it is 13MW.

The formula for calculating the tax is: (Generation receipts – Electricity generation * benchmark price – Allowance) * Tax rate

where:

- ‘Generation receipts’ is essentially all wholesale market revenue, whether realised in PPAs, forward sales, day-ahead or intraday trades, or balancing market trades. Imbalance costs can be netted off. Sale of ROCs and capacity market revenue is not included.

- ‘Electricity generation’ is the total electricity volume generated by in-scope generating assets in a given tax year.

- ‘Benchmark price’ is £75/MWh

- ‘Allowance’ is set at £10m, meaning that ‘excess profits’ need to exceed £10m for the group before any tax is due.

- The tax rate is 45% (this is additional to any normal corporation tax applicable on these profits – 25% from April 2023.)

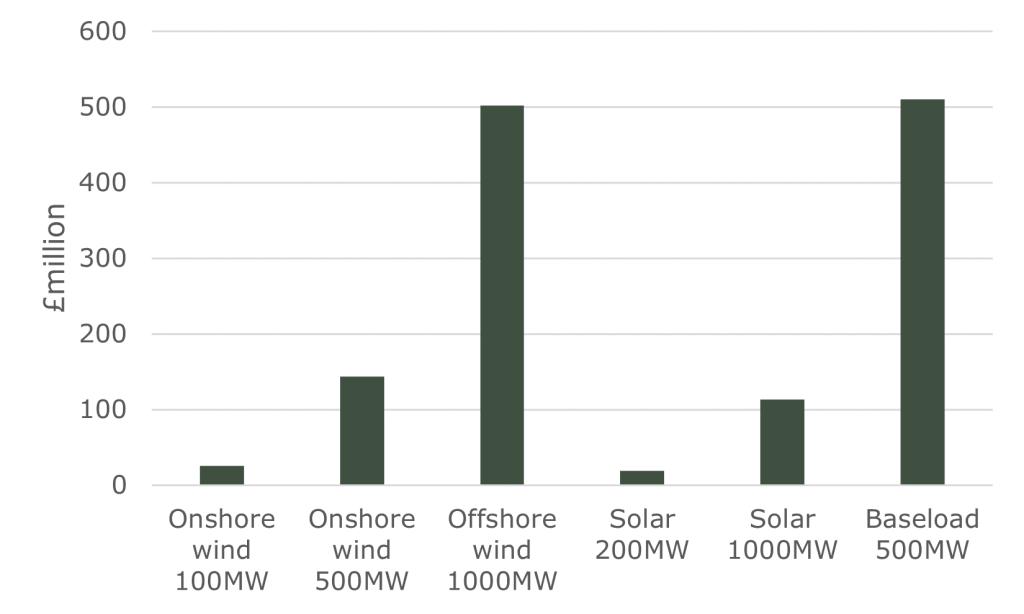

The Levy will take effect from 1 January 2023, and will remain in force until 31 March 2028. This end date is designed to allow time for any reforms from the Government’s Review of Electricity Market Arrangements (REMA) to take effect. If wholesale market prices return to more ‘normal’ levels before the end date then tax receipts will simply decline over time. The Government has forecast that the Electricity Generator Levy will amount to around £14bn over its life. The chart below shows some estimates of what the impact might be for different types of generators. It shows the projected tax bill for 2023, assuming each type of generator sells its output at our latest AFRY central scenario capture price for that technology for 2023. Many generators will have hedged forward or will sell using different routes to market, so the figures below should be treated as illustrative only.

The chart demonstrates that larger portfolios will pay significant amounts of tax – perhaps hundreds of millions of pounds. Note, however, that the tax rate on ‘excess profits’ is only 45%. This contrasts with the EU revenue cap where the tax rate is effectively 90-100% of profits above the cap level (which is set at a maximum of €180/MWh but is expected to be lower in many countries). Similarly the now obsolete Cost Plus Revenue Limit proposal was a tax at 90-100% above a cap, although the cap level was never announced.

The Government’s Technical Note states that further consideration will be given to how to tax joint ventures. This is likely to be a significant point, as many renewables projects are owned by consortia of investors. For example, if an investor owns 51% of a wind farm, will the entire wind farm count as part of the investor’s corporate group, meaning that the majority shareholder picks up the tax liability for the whole wind farm? Would a 50/50 joint venture be treated as an entirely separate entity, or would each shareholder’s share be treated as part of its wider corporate group? Once there is more clarity in this area one could imagine some restructuring of JV arrangements, and perhaps some disputes between JV partners.

The Levy could also trigger some re-thinking or optimisation of PPAs. Given the backwardated forward curve, rather than enter into a short term PPA above £75/MWh, a longer PPA longer term PPA at lower price would reduce Levy payments. There may be scope for buyers and sellers to restructure existing PPAs in both parties’ interests.

Whilst there are still some areas needing clarification, the announcement at least provides a basis for estimating the impact of the Electricity Generator Levy in the shorter term. In the longer term there is still a high degree of policy uncertainty arising from the Government’s wide-ranging Review of Electricity Market Arrangements (REMA). Details of AFRY’s recent public report on REMA can be found here: