Revealing additional asset value through technical and operational due diligence

The Covid-19 pandemic and current geopolitical turmoil have had a limited impact on the surging M&A market, however ever-increasing competition amongst investors alongside pressures to optimise the bottom line has forced the market to identify additional levers for value creation during transaction processes.

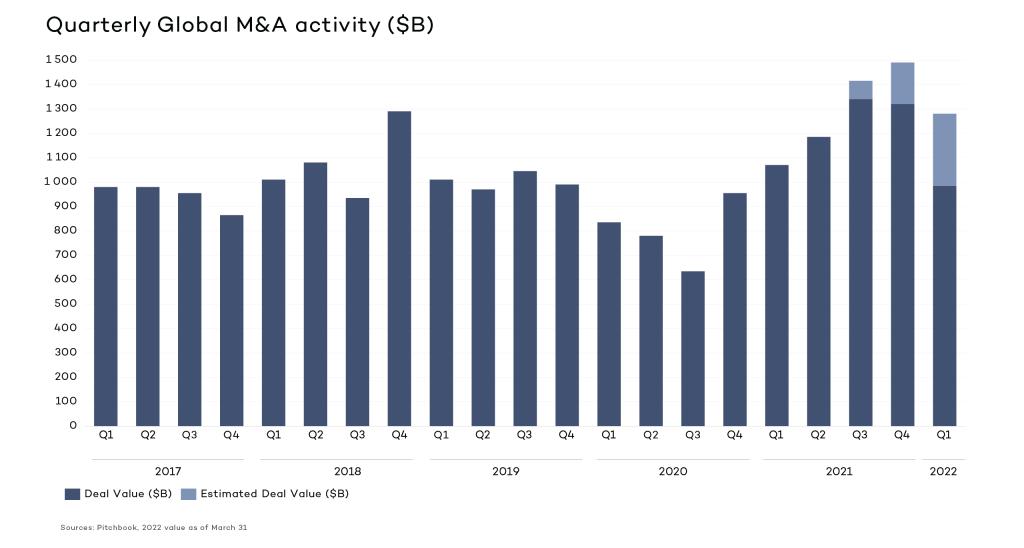

The market has experienced a new high level of transactions in 2021, compared to the previous years (+60% in deal value in 2021 vs 2020). This trend was partially fuelled by growing optimism in the market, as the uncertainties on economic outlook eased and confidence in a strong economic recovery became evident. The market reacted by showing favourable macroeconomic indicators such as low unemployment rate and low-interest rates.

Despite the current geopolitical turmoil, deal volumes in the capital intensive industries, such as infrastructure and energy, are expected to continue to move along a growth trajectory, notwithstanding an increase of interest rates or sectors in general having to rethink their supply chains. Indeed, the current geopolitical situation has brought to the fore the fragility of the global supply chain and dependency on fossil fuels and raw materials imported to Europe from Ukraine, Russia, and China. On one hand, this situation has raised an imminent need for Eurocentric investments to secure manufacturing capabilities and supply chains for the future. At the same time, in the short-term, high oil and gas prices have reinforced the attractiveness of renewable assets and clean thermal energy sources (e.g. geothermal, biomass, waste, nuclear, etc.), and have put pressure on companies and investors to seek greater operational efficiencies.

Fundamentally, the more exposed Power and Utilities sector has also experienced growth in investments, despite the current economic and geopolitical climate. Total deal value increased by 119% in 2021 to reach USD 260B compared to 2020 and reached new highs in Q1 2022, as the markets gained more traction after a slow start into 2022.

The renewable and sustainable energy sector has seen a growing number of high market-cap deals in recent years. The growth arising from the investors’ ever-increasing demand for attractive renewables, bioenergy, waste recovery/recycling, water, new technologies (batteries/hydrogen), sustainable infrastructure and circular businesses will both weather and fuel the global energy transition. At the same time, this will improve the ESG risk profile of the investors, while benefitting from favourable policy regimes. The current geopolitical situations are likely to accelerate the trends forward.

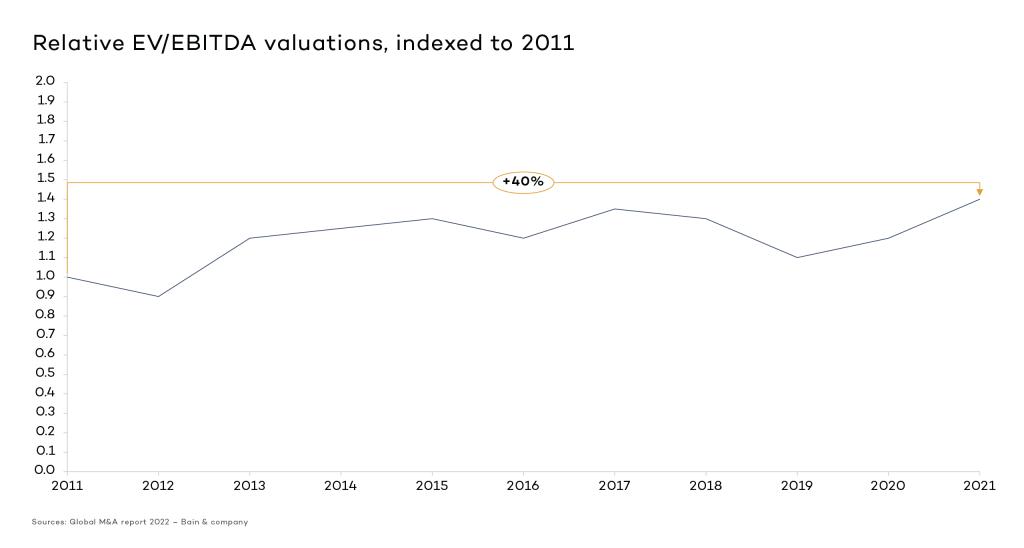

In this rapidly growing market, with continuous and growing capital inflows year after year, it is likely that infra fundraising in 2022 will exceed USD 100B. This increasing volume of dry powder signals a voracious appetite among the investors for attractive assets in the coming years. Foreshadowing the market conditions, the majority of the transactions in recent years have seen fierce competition amongst potential investors, yielding more often than not sky-rocketing successful investment bids with EV/EBITDA multiples exceeding 30 in several cases, with successful parties largely banking on growth opportunities, potential upsides, and cost efficiencies, in equal measures, to achieve their investment goals.

In such an environment, focussed industry acumen coupled with decades of industry experience of due diligence advisors can be the catalyst to identify and unlock potential upsides and achieve operational excellence.

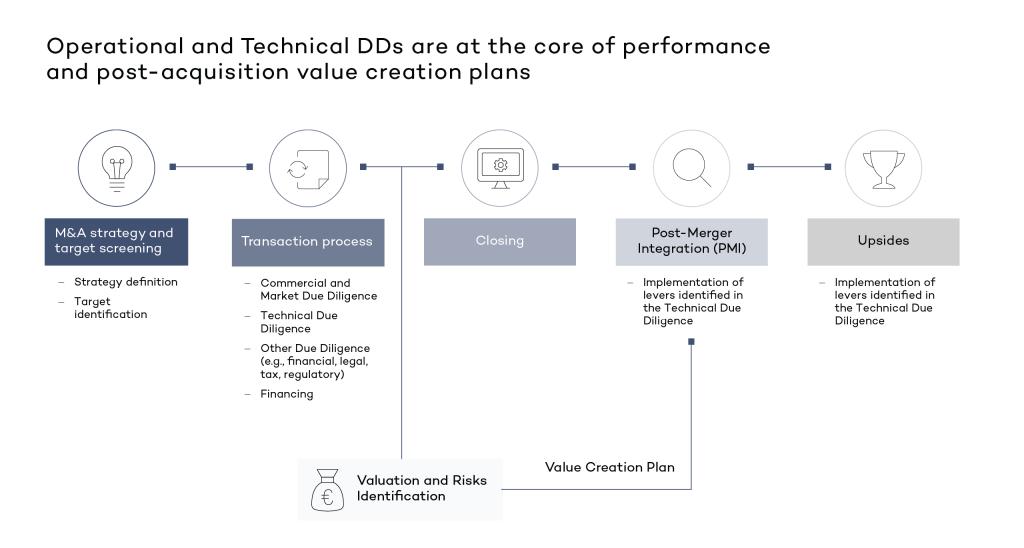

The Due Diligence phase is an extensive process undertaken by a potential buyer before bidding to acquire a firm to completely assess the target company’s business, assets, capabilities and financial performance. Whilst Technical Due Diligence evaluates the quality of existing and future assets, Operational Due Diligence provides a path toward operational performance and business model improvement. Both these Due Diligences introduce the buyer to potential upsides.

Technical and Operational Due Diligences

In Technical and Operational Due Diligences, two main objectives must be distinguished:

- Identify and mitigate risks before the acquisition (non-exhaustive list):

- Technical: what is the quality of the asset base? Is the asset base resilient and able to support the future business plan driven by growth? What additional investments and risk premiums must one factor in valuation?

- Operational: is the operational modus operandi, systems, and organisation adequate to meet the most stringent business needs? Is the organisation adequately positioned to grow and execute the business plan? How can systems be evolved, and processes be streamlined, to reduce lead times and gain efficiency in costs?

- Identifying potential levers for the value creation plan:

- Technical: extension of the lifetime of the assets, retrofitting of assets with new technologies, O&M performance improvements

- Operational: new operating model (processes, organisation, IT)

The aforementioned value creation objectives can be achieved during the strenuous timelines of Technical and Operational Due Diligences by a seasoned advisor in a phased approach:

- Phase 1 - Outside-in analyses of the current situation as the Technical and Operational Due Diligence projects are performed by the advisor with little or no interaction with the Target. In this Phase, the advisors rely on their experiences and industry benchmark to inform on best-in-class industry practices, underlying risks faced by the asset, and potential mitigants

- Phase-2 - Technical and Operational Due Diligence advisors work closely with the potential buyer to layout the future operating model. The objective is to agree on the Value Creation Plan to be implemented during the Post-Merger Integration (blueprint, KPIs, etc.).

3 key upsides: Performance improvement, synergies, and acquisitions at a competitive yet fair price

Technical and Operational Due Diligences allow the investors to unlock 3 key upsides – performance improvement, synergies, and acquisitions at a competitive yet fair price:

- Performance improvement - Focus on intrinsic improvement of the performance of the target by, for example, defining a new efficient organisation and improving process efficiency

- Synergies - Focus on identifying and implementing synergy-enhancing programs to increase greater utilisation and minimisation of redundancies, for example, by pooling the maintenance spare-part inventory between the newly acquired and parent company’s other assets

- Acquisitions at a competitive yet fair price – A combination of potential upsides that are beyond the Seller business plan (i.e. growth by acquisitions, moving to adjacent markets, etc.) and cost-optimisation potential through operational excellence will enable investors to unlock greater value beyond the business plan

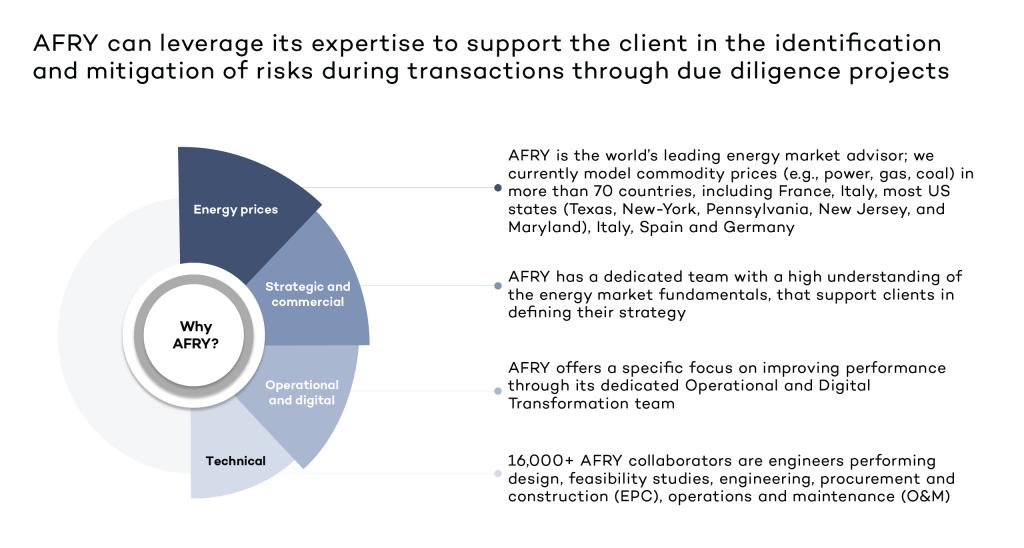

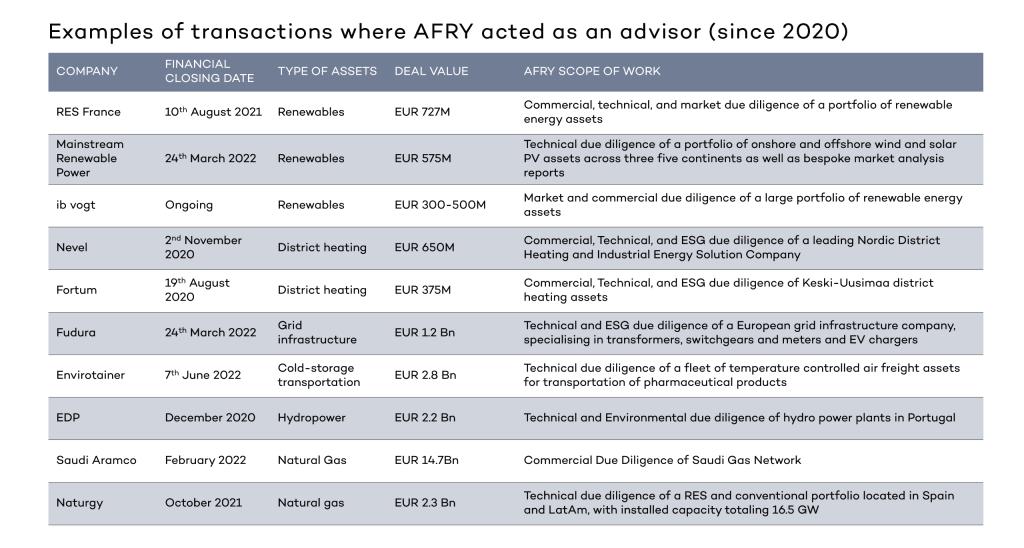

AFRY is a leading international engineering, design, and advisory company

As AFRY, we combine unique and worldwide expertise to better identify additional value during Technical and Operational Due Diligences. Indeed, we combine:

- Market, strategic and commercial: we have a dedicated team of more than 600 consultants and experts globally experienced in a variety of infrastructure sectors, energy markets, bioindustry, sustainability, and digitalisation

- Operational and Digital: we have a dedicated team focused on improving performance through Operational Excellence and Digital Transformation

- Technical: we have 16,000+ engineers worldwide performing design, feasibility study, Engineering Procurement Construction (EPC), Operation and Maintenance (O&M)

Our transaction experts have the deep industry expertise to support you on even the most complex transaction. Come talk to us if you have questions and we will create the solutions to meet your needs.