Strategic mine planning - early phase concept development defines the future

The market shakedown and unpredictability affect the mining industry

The past and future shakedown in the market prices of precious, ferrous and nonferrous metals, “battery metals” and industrial minerals is guiding the development of open pit and underground mining projects. The effects of the COVID-19 pandemic and recent economical fluctuations due to the situation in Ukraine have affected industries globally. Unpredictability in production, transportation and supply chain has impacted the mining sector heavily.

These impacts affect the operating mine's costs and forecasting the future has become more difficult. In the wake of the markets, companies are not only focusing on the economics but also impacts of the mining has become even more important. But how these business environment challenges can be tackled in greenfield or brownfield mining investments?

It all starts with early-phase strategic mine planning. In this mine development phase, different mining concepts are evaluated with decent technical and economic feasibility studies - not forgetting environmental impacts. The mining concept selection and implementation strategy need to be planned and also optimised to secure the optimal outcome. And last, when strategic targets and mining concepts are defined, the focus must be on investment project implementation and how to make it successful.

This is Part 1 of the insight focusing on early phase of mine strategic planning including evaluation of different concepts for open pit and underground mines. Part 2: Finding the optimal mining strategy by using evaluations focuses on the mining investment project evaluation in order to decide the long-term mining strategy. You may also be interested in How to select the right Mining project implementation method?

Evaluation of multiple mine concepts and project implementation methods are a key to success

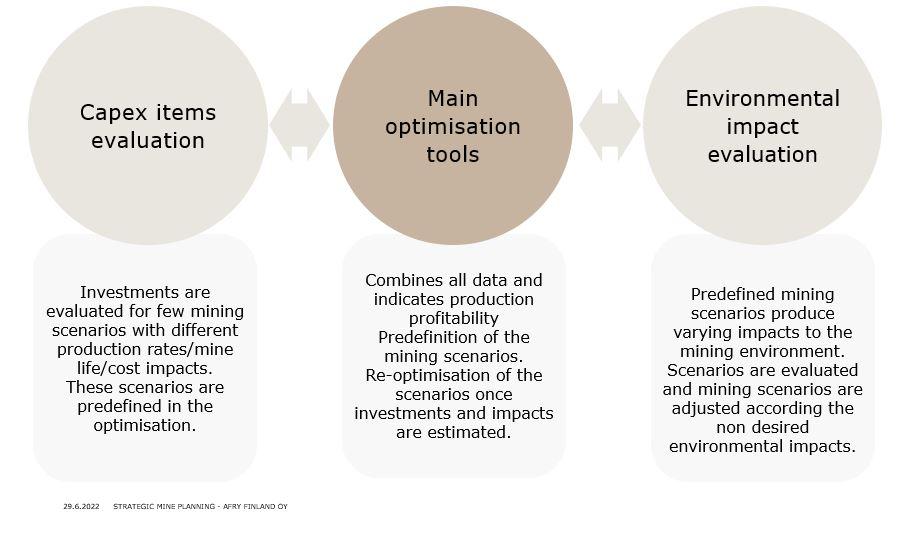

Mining companies that are developing projects and operating today ensure that mining operations are not only based on forecasting and minimizing operating costs and maximizing economic benefits over the lifecycle of the mine. Companies are also looking at the impacts of mining projects beyond the minimum requirements of environmental permits set by the government authorities. The complexity of mining projects is considerable, and the overall evaluation of projects is considered extremely difficult, especially when the mining project consists of downstream hydrometallurgical or pyrometallurgical processing, i.e., a full production chain. Thus, early-stage mine development projects should evaluate both multiple different concepts for mine operations and also evaluate different implementation strategies in order to find the most optimal alternative for the investment project.

Let’s talk about the importance of strategic mine planning

Strategic mine planning is a fundamental part of profitable, sustainable, and viable mining operations, regardless of whether mining is privately or publicly funded. The strategic mining plan presents a realistic plan from the extraction of ore and waste rock material all the way to the final product e.g., battery chemicals from the downstream processes.

In this case, we are talking about a conceptual mine plan. There are several challenges in developing a viable and optimal strategic mining plan. Before the optimisation and design of the mine can begin, the input data to the evaluations must be confirmed. Initial data such as the quality and extent of mineralisation, the prices of the end products, and the amounts of contaminants in the waste rock, must be carefully evaluated to create reliable outcomes and an optimal strategy.

Set the main objectives of your mining project in the first phase

Before any technical or economic feasibility study is carried out, the strategic goals must be clear for the project developer. During the early conceptual study phases, consulting engineering firms frequently help the project developer with potential objectives. The strategic goals outline the targets for which the mining company aims during the various study phases and, eventually, during the project implementation phase.

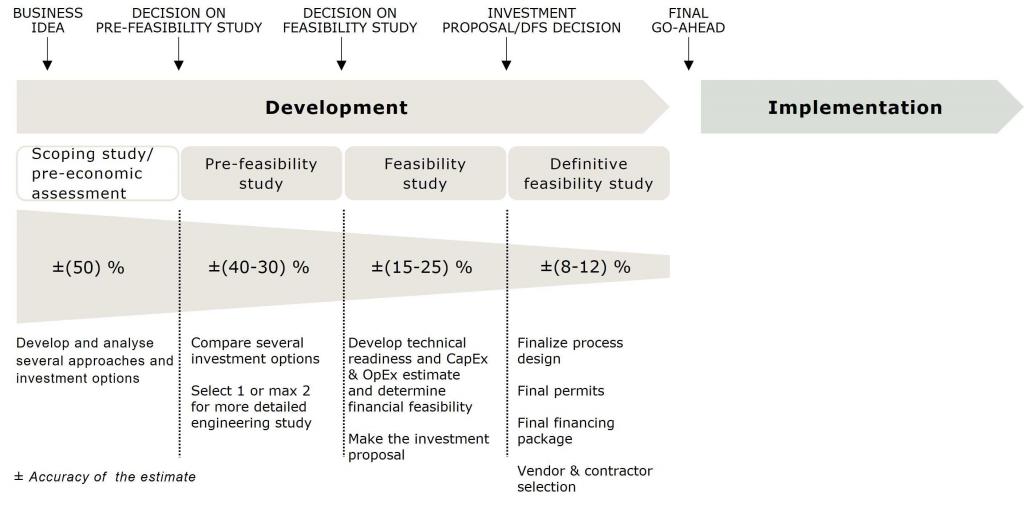

Economical and technical studies narrow the project options during the development phase and understanding the importance of a stepwise approach in the project development is a key to success.

Consider the entire value chain of the mining operations early enough

Whether the target of the mining project is maximum yearly profits/minimum initial capital costs, minimal environmental impacts or long, high capacity and stable cash flow later with high net present value in the end, the target must be understood prior to and during technical and economic studies. Setting new targets during operations is common regardless of the business. The same principles apply regarding the engineering work of the open pit mine development. Mines can change their approach and develop new value from additional resources, for example, battery minerals.

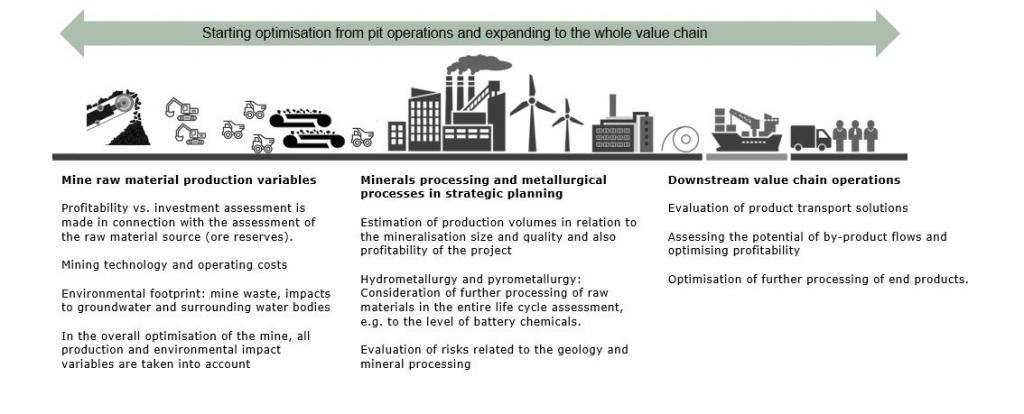

Mine planning is often focusing only on the mine and processing inputs/outputs. However, in order to optimise the benefits of strategic development, the entire value chain should be considered in the analysis early enough.

Going big or small - selecting the optimal size of the mining operations with a stepwise approach

New greenfield and brownfield mining projects are designed to optimise profitability and cash flow first, which means mining and processing the best ore material first and that way reducing operating and capital costs. This applies to most mining projects globally. However, there are cases where lower profitability scenarios are studied and then applied to project execution. The owners of major mining projects with considerable mineral resources aim mainly at maximizing net present value. Economies of scale is the key in large projects; with low operating costs that will provide the greatest long‑term economic return. In mining ventures, there are generally two opposing orientations.

- The first option is to shorten mine life and/or reduce production volumes by

- selecting a smaller open pit /underground mine size

- focusing on extracting only high ore grades and

- simultaneously reducing project risks.

This approach also considers the sustainability perspective. In this scenario, the project is minimising the total amount of waste rock and tailings produced during the lifecycle of the mine. As a result, the mine's overall footprint is decreased. Smaller operations, for example, with lower production rates, are considered as the future of the mining industry, where initial CapEx is decreased and seen as more appealing to investors. Small CapEx projects are commonly the starting point for junior companies. Smaller mining operations, open pits, are frequently chosen because of a desire to preserve a sensitive natural habitat, such as a lake/river water system for example.

- The second option is to go boldly with a large deposit with a higher capacity, a larger open pit or underground mine, and with the downside of a significant amount of waste rock and tailings. Larger operations are high CapEx projects that may be challenging for greenfield projects run by junior companies. In high CapEx projects, it is often the bigger industry players who take the project to the implementation phase.

There are many factors playing in

Shorter mine life and smaller operations reduce the risks related to the profitability of the mining project and can also be easier to justify for investors due to lower CapEx at the trade-off of the lower net present value. Smaller capacity and production volumes don´t benefit from the scale effect, which results in lower unit costs.

Mine sizes can be also restricted by environmental factors. For example, a lake or river water system or environmentally protected land area can be in the vicinity of the planned mine. It will be more justified and feasible not to apply for mining permits and commence mining in environmentally sensitive areas as permitting becomes more challenging and expected approval times can be very long.

A large-scale high-capacity production may offer some advantages that small-scale production doesn't. A longer mine lifetime means more long-term employment opportunities. A longer mine lifetime also evens out production and gives more room for adjusting the mining strategy later on. From the environmental permitting point of view, going directly to a larger operation can be difficult, and therefore the project might be more justified if the operations are structured in stages.

Summary

Ensuring success during the entire mine lifecycle starts in the early development phase. The step-phase approach includes the following key steps

- Evaluate different mining concepts including i.e. mining methods and size

- Take the entire value chain into consideration in the analysis from mining operations to minerals processing and end-product markets

- Set the strategic goals of the mining operations

- Define and start step-phase implementation approach with a clear plan

- Do technical and economical feasibility studies for different concepts

- Evaluate environmental impacts in different alternatives.

- Secure initial data accuracy such as the quality and extent of mineralisation, the prices of the end products, and the amounts of contaminants in the waste rock to create a reliable analysis and an optimal strategy.

When strategic mine planning with clear targets, different optional mining concepts as well as long-term implementation approach are evaluated and decided, the focus must be shifted towards investment project implementation and how to make it successful. Read more on the right investment project implementation method selection from insight Finding the optimal project implementation method for mining projects.

On the author: Mikko Lamberg, Head of Mining & Metals, Finland.

Mikko has more than 13 years of experience in mining (design, mineral reserve estimation and rock mechanics) projects ranging from conceptual through feasibility design levels and operations support. He has undertaken and managed large strategic mine planning and rock mechanics projects for the mining industry in Finland and Nordics, having been mainly responsible of supervising design, quality and scope.

AFRY’s services for mining, minerals processing, and metal industry extend from preliminary exploration activities and environmental permitting to finished goods for use in further production, to end-of-life recycling. We offer a full range of consulting and engineering services to help mining and metals companies in shaping and developing their ideas and concepts into technically, financially and environmentally sound solutions. We can identify the optimal technological options for each project as we are completely independent of machine suppliers.

This is Part 1 of the insight on Strategic mine planning. Part 2: Finding the optimal mining implementation strategy by using evaluations. You may also be interested in How to select the right Mining project implementation method?