Tricky trade-offs: challenges for the future of the EU ETS

On 15 September 2020 the College of Commissions of the European Union (EU) is expected to announce the strengthening of the EU’s 2030 decarbonisation target – potentially to as much as 55% emission cuts relative to 1990.

This change will likely force a redesign of the EU’s Emissions Trading Scheme (ETS), resulting in wide-ranging impacts across Europe’s energy markets.

Ahead of this crucial announcement, AFRY has prepared a White Paper exploring what design challenges lie ahead, possible solutions, and how they might affect companies under the ETS. Key questions facing companies and regulators alike will include:

-

Should the scope of activities covered by the ETS be expanded and, if so, how? How the EU will do this will have the most direct impact on the future carbon prices. Integrating new demand into the European carbon market has traditionally involved the expansion of supply as well – but questions remain about what volume of allowances to issue, or even if they should be issued at all.

- Will the Market Stability Reserve still be required in its present form to address concerns over the strength of carbon price signals? This mechanism was created in order to stem the oversupply that had depressed carbon prices during 2013-8. However, it is not clear that in a more ambitious ETS this is the most salient issue to worry about, with many being more concerned that future prices will escalate instead.

- Does Europe need border adjustment mechanisms to protect the competitiveness of its industry? So far European industry has been protected against competition from importers not exposed to the carbon price through the allocation of free allowances. However, under a tighter cap not all industries can expect to receive the same level of protection as before. Can we expect an alternative mechanism to function better, while also not fundamentally affecting the supply-demand in the carbon market?

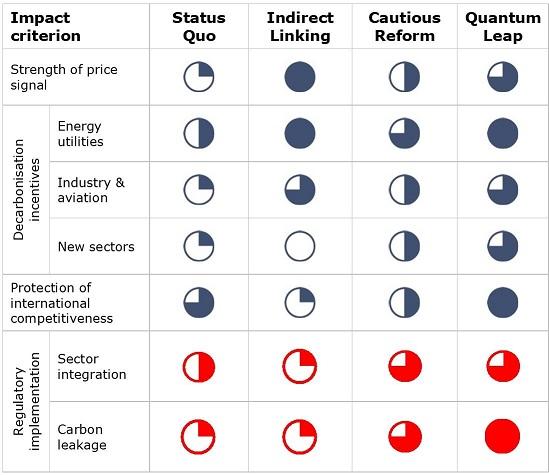

Decisions in each of these areas can lead to very different future ETS designs and impacts. Our White Paper presents four possible future ETS designs: Status Quo, Indirect Linking, Cautious Reform and Quantum Leap. These differ in the extent of the transformation of the ETS from its current form and have very different implications for carbon prices, decarbonisation incentives and competitiveness.

As we show in the table below, we assess that, all other things being equal, radical design revisions are more likely to deliver uniform progress across all sectors towards the EU’s wider decarbonisation objectives. However, bold changes are difficult to implement, so regulators and market participants must engage with each other urgently to deliver robust solutions that will be acceptable to all.

The ETS has been at the centre of the EU’s energy and climate policy up to now. How it will support enhanced decarbonisation ambition in the future is still uncertain. Our White Paper highlights the complexity of any re-design and the broad impacts for large parts of Europe’s industry. For concrete questions and modelling requests, please contact the authors.

Notes:

- The debate around how to weave these issues into a more ambitious EU ETS is likely to last at least three more years. The decision by the EU’s College of Commissioners will be accompanied by the launch of the impact assessment for raising the 2030 climate target. This document will help inform the debate that will commence in the European Parliament and the Council once the Commission produces its formal Proposal to reform the ETS in the summer of 2021. This inter-institutional debate will likely last two years, during which period stakeholders will be able to inform their decision-makers how effects will emerge in European energy market and beyond as a result of the various possible permutations. We foresee that the resulting political compromise will be implemented from 2024 onward.

- This White Paper builds on AFRY in-house expertise in carbon and commodity markets extending back for more than 15 years. Our team has been working on projections for the European carbon market since 2005. These have been integrated since 2007 into our Energy Market Quarterly Analysis, which contain consolidated scenario-based analysis of electricity and natural gas markets. Further work by AFRY on the EU ETS includes:

- The key drivers of carbon prices – AFRY webinar, 2020;

- Regional carbon price floor in the EU ETS in the Nordic and Baltic energy markets – Finnish Prime Minister’s Office, 2019;

- Evaluation of Cost Effectiveness of Emission Reduction Measures – Finnish Prime Minister’s Office, 2019;

- “Get Brexit Done“: The impact of Brexit on EU ETS carbon prices – AFRY Insight, 2019;

- EU ETS Policy Coherence Mechanism – Fortum, Vattenfall, Statkraft, 2017;

- Impact assessment of Emissions Trading Directive renewal for Finland – Finnish Prime Minister’s Office, 2017;

- Impact of the EU 2030 climate package on European power markets – Norwegian Oil and Energy Ministry, 2014; and

- Assessment of the Allowance Supply Adjustment Mechanism – Fortum, 2013.