What's hot, what's not

In late 2021, when memories of lockdowns in Europe were fading and workers started to return to the office, M&A transactions came thick and fast.

Postponed deals were resuscitated, and many new deals came to the market. Credit markets were active, buoyed up by the continued low interest rate environment, and Private Equity firms had funds which had not been deployed during the pandemic.

Those paper and packaging companies exposed to the more discretionary end-use markets and which had been negatively impacted by the pandemic saw a wave of huge consumer demand, and the consequent restocking resulted in companies returning to growth. In this post-pandemic period of optimism, many deals in the packaging sector came to market and were successfully completed; it seemed that a recovery in M&A activity was in full swing.

New paradigm

However, beneath the wave of returning normality, an undercurrent of the long-term economic impact of the pandemic was evident. The outbreak of war in Ukraine served to expose the fragility of the economy fully and has put recovery into doubt; the prospect of a global recession has become a reality.

Towards the end of 2021, inflationary pressures were starting to take hold, such that the debt and equity capital markets became increasingly cautious.

For the period to July 2022, advisory and underwriting fee income at European banks fell 37% on average, and US banks suffered a 49% drop for the same period. Global banks took USD 32 billion less in advisory, debt and equity underwriting and syndicated loan income in the first seven months of this year compared with the same period of 2021 as rising interest rates, inflation, and the war in Ukraine deterred deal-making. According to Refinitiv data, investment banking fees of USD 64 billion through to the end of July this year are 33% lower than they were for the same period in 2021 and were, in fact, at their lowest level since 2017.

The legacy of high leverage in deals previously done and rising interest costs, coupled with depressed profitability, spells covenant breaches and defaults. Lenders are exercising a high degree of caution such that in the lead-up to the European summer break, risk spreads had widened across both corporate and high-yield borrowers to the extent that M&A deals in the market struggled to access financing at almost any cost.

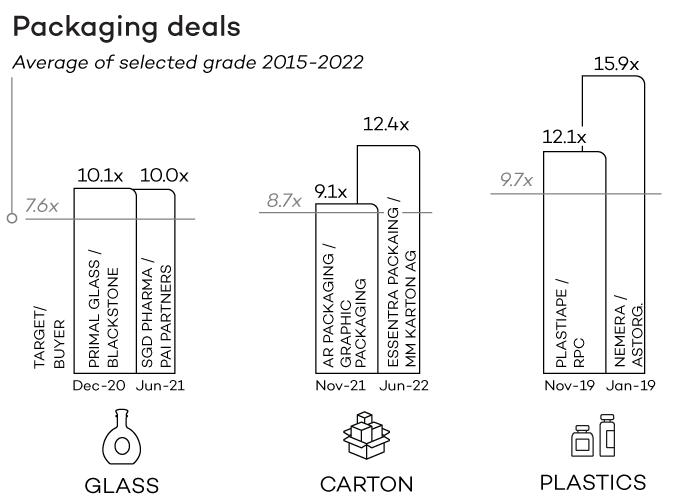

At a time when valuations of companies and transaction multiples are compressing and credit appetite is tight and expensive, we are seeing a significant slowdown in M&A activity. Budgets and forecasts for 2022 and beyond now look optimistic, and M&A deals which were preparing to launch post-summer are now playing ‘wait and see’.

M&A activity will resume

Notwithstanding difficult market conditions, history tells us that no matter the circumstances, M&A activity will resume. Acquirers may need to dig deeper and be more selective to ensure that the potential target displays characteristics which will prove resilient during the recession. Due to the diversity of the end-use markets served, the paper and packaging sector covers just about every risk profile that investors could possibly want. We explore here the key drivers of value within the paper and packaging universe to understand which niches of the sector are likely to attract the most interest.

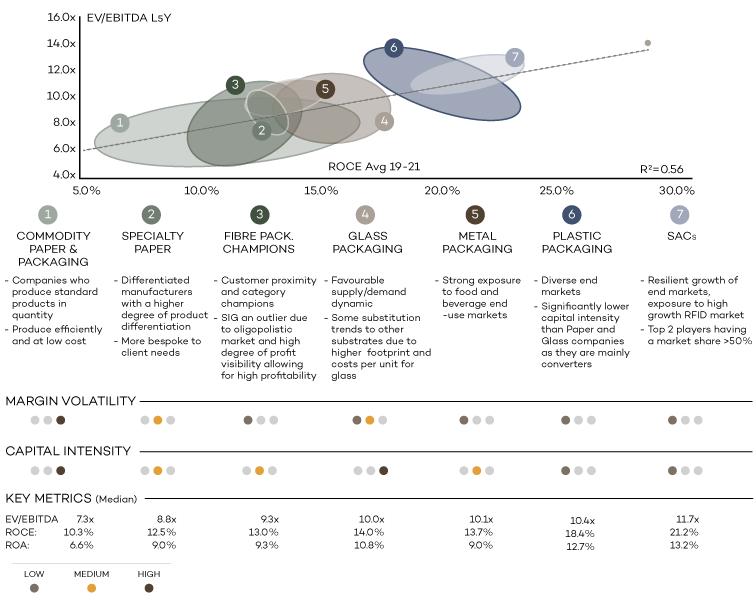

It is about the ROCE

Pre-pandemic, high margin and high growth appeared to be the driving factors for high valuations in the paper and packaging sector. Yet with so much of the packaging sector linked to resilient yet low-growth markets of food and beverage, acquirers needed to search to find niches with real growth in revenue.

Packaging concepts, which closely follow the convenience, sustainability and digitalisation trends, and which therefore display good growth and healthy margins, appear to attract the highest multiples in the sector consistently. Examples of such concepts include labels with RFID technology, dispensing closures with measured dosing, single-serve, easy-pour, easy-close packaging, game-changing recycled packaging and cosmetic packaging; all of these niches have historically attracted high valuation multiples. However, with single-serve being replaced by family packs and cosmetics being less relevant, it was ironically some of the above areas which were hit the hardest by the pandemic.

It was this anomaly that led AFRY Capital to examine more closely which financial metrics really do drive valuation levels in the paper and packaging sector.

In a broad selection of paper and packaging companies, it was surprising to find that there was a weak correlation between revenue growth and valuation. Surprisingly, the link between pure profit margin and value was also unconvincing. The most compelling correlation is, in fact, the return achieved between valuation and return on capital employed (ROCE).

Underpinning markets matter

Companies that are efficient and can drive good ROCE attract higher valuations. This being true, companies with strong ROCE serving resilient end-use markets with a good level of co-dependency between supplier and buyer will be the winners during a recession.

Good examples of resilient demand (rather than high growth) are healthcare and pharmaceutical packaging markets.

Ironically, during COVID, parts of the healthcare market were negatively impacted as healthcare systems around the world were overloaded with the immediate needs of the pandemic. As visits to doctors and elective surgeries were postponed and fewer medicines were prescribed, packaging related to these medicines temporarily dipped. However, investors have conviction around the long-term growth of healthcare assets and continue to be attracted to invest in these healthcare packaging assets and will pay high multiples for acquisitions in this niche.

Key attractions being:

- Healthcare is resilient

- Healthcare packaging requires regulatory sign-off

- Self-care and self-treatment are increasing

- The cost of the packaging in relation to the contents is immaterial

- IP drives a higher price and margin in primary applications and dispensing

Platform assets

Names of even the very largest packaging companies: Westrock, Amcor or Owens Illinois will not mean anything to laymen, and yet they are amongst the largest in what they do. Despite the strong consolidated top end, there are hundreds, even thousands of niche operators covering the specific needs of packaging markets. These companies tend to be leaders in their region and are often owned by families.

Specific niches of packaging, such as label and carton board converters and flexible packaging companies, continue to be fragmented. Companies in these niches often have lower capital intensity and benefit from a diversified client base. These attractive targets often have strong, long-term relationships with their customer base of smaller clients, which allows higher margins in the business. They bear less risk and will therefore continue to be sought out for acquisitions.

The strategic players in these segments are actively looking to consolidate the market whilst Private Equity companies continue to seek out opportunities to buy mid-sized operators to which they can then add to a string of pearls, achieving synergies as they consolidate the market.

"Green packaging"

Over the last five years, concerns relating to the climate crisis have intensified significantly. Certain materials have become villainised. For a short period of time, anything made out of plastic was off the menu. Companies manufacturing one-way plastic packaging for the food and beverage markets attracted the most scrutiny and have been continuously substituting plastic with other substrates. Indeed, the production of plastic packaging in Europe has been gradually decreasing since 2017. During the first wave of the pandemic, this decrease accelerated – in fact, a decline of almost 230,000 tonnes out of an EU total of 1.45 bn tonnes was observed in the period from April to October 2020.

Investors have, however, come to recognise that plastic has an important role to play in product preservation, shelf-life prolongation and protection. Companies which have made exceptional strides in their ESG profile and approach to recycling, e.g. Logoplaste and Faerch, will attract premium multiples. Whilst those companies which have proactively addressed their use of non-recyclable plastics and have increased their quota of recycled content will, in our view, continue to be 'doable'.

Paper is the stand-out winner

However, it is true that investor appetite for assets in one-way plastic packaging businesses is increasingly difficult to secure. The substrates, which are used to substitute away from plastic, have been growing in popularity and of all the substrates which have benefitted from this phenomenon, paper stands out.

Fibre-based packaging companies have demonstrated tremendous resilience during the pandemic, as we saw a short-term blip but an incredibly strong recovery. This was partially due to the very strong momentum in ecommerce and delivery packaging being made primarily out of paper. The plastic-to-paper (P2P) trend continues way beyond COVID, and we see increasing demand for paper based packaging companies from financial sponsors and strategic buyers, driving valuations ever higher.

AFRY Capital

This article was originally published in the Autumn 2022 Bioindustry edition of AFRY Insights.