Wind of Change: A guide to improve your wind farm’s profitability

In recent years, wind energy marketing has shifted from long-term granted feed-in tariffs through auctions to the direct sale of power using competitive PPAs or the spot market. Through this transformation, competition has increased, putting pressure on the price of power generated from wind farms and, therefore, on the profitability of wind energy. As a result, investigation of measures to increase portfolio profitability is now of critical importance to wind farm owners.

The main drivers of profitability are revenues from power sales, and costs of capital expenses (CAPEX) and operating expenses (OPEX). Revenues are the conjunction of wind energy sold and the price accepted by the buyer. While those relations are considered common sense in the business community, the question is how to use these levers to drive higher profitability.

How choice and design of pricing impact your revenues

To optimise the pricing of wind energy, we support our clients from the strategic choice of pricing mechanism through the tactics of its use to the most effective operating model. Depending on the regulatory framework there are up to four pricing mechanisms available:

- feed-in tariffs,

- tariff auctions,

- power purchase agreements (PPA) and

- merchant sale on power markets.

While feed-in tariffs were there from the beginning of support schemes for renewables, many countries have transitioned to using tariff auctions. The objective is to lower the cost of renewables through competition. The direct sale of power on the free market is chosen in countries with no pricing support mechanisms or in cases when developers do not win at tariff auctions but would still like to realise the wind farm. In the free market, power prices are set on the spot market or via PPAs. We have advised clients on both options:

- the design and operation of wind farms to optimize for the price on the spot market, and

- the design of PPA contracts, with various references for both buy-side and sell-side.

With regards to the former, there are two ways the captured power price can be optimised:

- In the design of the wind farm, the production profile is optimised with respect to the expected price profile on the spot market. This may be achieved by selecting a site with beneficial seasonal and daily wind patterns and a well-suited turbine model, such as a low wind speed model.

- In operational assets, maintenance can be performed in periods of pronounced cannibalisation effects, i.e. a slump of power prices due to oversupply of wind power.

Modelling future power prices and power system dynamics, combined with measured and modelled site-specific wind data are core to our approach. Overall, the tactics of using pricing mechanisms is an interplay of three key components: understanding regulations to play the mechanism right, weighting risk and risk premium, and evaluating future price developments. The final step is the design of an appropriate operating model, with operational excellence providing the insights needed to implement the chosen pricing mechanism in the roots of the organisational structure and processes.

Powering up your production in the planning phase and operations

Along with price of energy sold, revenue is driven by the energy produced from a wind energy asset. Considering this, which levers can an owner, operator, or investor use to increase energy production?

There are two phases along the life cycle of a wind farm when energy production can be significantly influenced, (i) the planning and design phase, and (ii) the operations phase. While both phases provide opportunities to increase energy production, every measure that is undertaken has an associated cost, and thus, the decision on implementing improvement measures rests on the business case.

Historically, focus has been on the planning and design phase, where there are three levers to increase energy production:

- Siting: Siting defines wind resource availability and therefore caps the maximum possible energy production. AFRY’s Pricing Atlas for Green Electricity supports developers throughout the siting process, via a precise and neutral assessment of the market value of a wind farm.

- Wind farm layout: The design of the layout of wind turbines within the wind farm defines the aerodynamic interaction and associated power losses. Optimising the layout allows to reduce such power losses and consequently increases production of energy. While energy production can be increased, such optimisation also needs to consider the costs associated with a layout, specifically costs in road infrastructure, electrical infrastructure and associated losses, as well as turbine foundations.

- Wind turbine type: The type of modern wind turbines is largely characterised by hub height, rotor diameter, nominal generator power, and power and thrust curve. The interplay of these drives the annual energy production of the turbine and the amount of power losses of adjacent turbines.

In more recent years, optimising power production of existing wind assets has come into focus, that is during the operations phase. The approach is to upgrade or update the existing operations and control software of the wind farm and wind turbine allowing to increase the energy yield.

On the wind farm level, the objective is to coordinate the operation of the wind turbines in the wind farm to reduce power losses, which are a result of the aerodynamic interaction of wind turbines through wakes. Present solutions achieve an increase in annual energy production (AEP) of up to 1%.

On turbine level, three approaches can be used to increase power production.

- In the first, underperformance of wind turbines in a wind farm is examined. Often poor calibration of sensors and operation set-points result in power loss. Data-driven analysis detects and allows to solve these issues resulting in AEP increases of up to 6%.

- In the second approach, the nominal power output of a wind turbine is elevated allowing it to capture more power above rated wind speed. As a result, AEP is increased by up to 4%.

- In the third approach, the maximum operational wind speed is extended higher. Hence, more power is captured at high wind speeds driving up AEP by up to 3%.

As these approaches are largely data-driven they allow to create value from Big Data generated by wind assets, which also addresses a common challenge of operators about how to leverage their data effectively. Additionally, as these approaches merely require software upgrades or add-ons, initial capital expenditures of such investments are low, while the rewards are promising.

The cost benefit of operational excellence, digital and best-in-class procurement

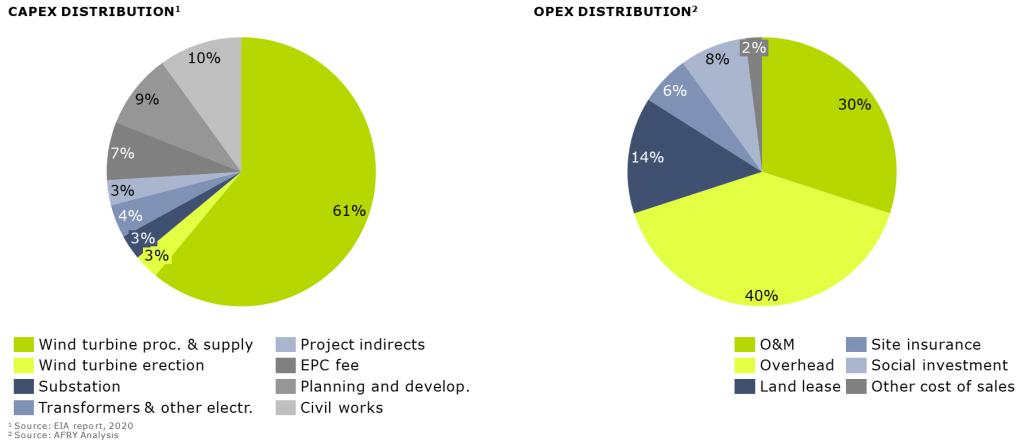

Next to improving profitability by optimising power price and energy production, optimising cost is the other important lever. Costs are typically split into capital expenses (CAPEX) and operating expenses (OPEX). Figure 1 shows an exemplary distribution of the main components of CAPEX and OPEX. 68% of CAPEX is attributed to the procurement and logistics of wind turbine components and the electrical infrastructure for grid connection. Excellence in procurement is therefore a key capability to optimise CAPEX. Such excellence, however, needs to be well aligned with the development supply chain comprising of the planning, development and construction activities. Misalignment would result in cost overrun and potentially affect the power production capability of the wind farm.

The two largest components of OPEX are overhead and operation and maintenance (O&M) costs. While optimising overhead is typically a matter of business operational excellence, optimising O&M costs additionally also involves technical operational excellence. There are three key areas to optimising O&M costs: (i) AI-predictive maintenance, (ii) the operation of wind farms with the objective to extend the asset’s lifetime, and (iii) optimised service contracts and service organisations.

With regard to the first, the advent of powerful computing combined with Big Data has opened the opportunity to train artificial intelligence (AI) that can be used to perform predictive maintenance. Typically, the approach is to develop an AI for each component, for which failure shall be predicted. The AI is trained with measurements from sensors in the surrounding of the component, where correlation between component failure and measured data can be established. In operation, the AI is fed with current measurements of these sensors and predicts either the remaining lifetime of the component or probability of failure. A human-AI interface dashboard then informs the wind farm operator who can take action with maintenance, repair or replacement. As a result, there are three key financial benefits:

- reduced downtime of the wind farm and hence increased revenue,

- extended use of components until shortly before failure resulting in lower replacement costs, and

- reduced O&M logistics costs as a result of optimised coordination of logistics to the wind farm site based on the prediction of component failure.

Our clients can draw on our knowledge and experience in successfully building AI-driven business solutions to develop tailored predictive maintenance. This could be building a solution from scratch, upgrading legacy solutions or advising on the choice of solutions offered on the market.

The second area is an upcoming technology to optimise the control system of the wind farm with the objective of extending the assets lifetime. The operation of wind turbines is coordinated as to mitigate the fatigue loads of wind turbines resulting from the aerodynamic interaction of wind turbines through wakes. While the technology is currently in development, it is expected to enter the market in the coming years.

Finally, third, scrutinizing service contracts and optimizing inhouse service organisations allow to increase wind farm availability, and hence revenue. AFRY’s solution focuses on the speed of action of the service team, while also keeping an eye on the wider business environment around the wind farm, that is grid performance, grid owner service team and the spare part supply organisation. Furthermore, the dominance of OEM’s on the O&M service market has driven up service fees. Lately, independent service providers have gained more ground, creating more competition and forcing the OEMs to reduce their margins. Nonetheless, there is still room for optimization. Hence, when scrutinizing service contracts, we identify these margins and cut associated costs.

Next to optimising costs of the sole wind farm, collocating wind turbines with other generating assets such as photovoltaic power plants, battery storage and / or hydrogen generation can provide further cost optimization potential. Such hybrid power plants create beneficial synergies in CAPEX, such as saving costs in the grid connection, and in OPEX, such as maintenance cost or land lease expenses.

To conclude, there is a suite of solutions owners, operators and investors can use to strengthen the profitability of their wind energy assets. AFRY is here to support on which solutions to choose, why to choose them, and when.