AFRY Management Consulting Rises in Global Advisor Rankings and Strengthens International Transaction Service Capabilities

Infralogic confirms AFRY Management Consulting as an internationally leading advisor delivering market, commercial, regulatory, technical, operational, IT, environmental and ESG/HSE due diligence services.

Infralogic – a leading online platform which combines news, data and analytics in the energy and infrastructure deal space, is the preeminent source for ranking advisors in terms of the number of transactions with client success and deal value. AFRY has solidified its place among the top 5 advisors for M&A in energy and infrastructure.

Scoring High in Infralogic's Quarterly Rankings

In the latest Q3 2023 update of Infralogic's quarterly rankings, AFRY Management Consulting secured 4th place among the World's Technical Advisors in overall deal count. This represents an advancement of three positions compared to the Q3 2022 period. Additionally, in the 'Global Renewables Technical Advisory' sub-category, AFRY has further elevated its standing by two spots, ascending to 3rd place. This progression underscores AFRY's growing influence and expertise in the energy and infrastructure sectors and dedication to accelerating the green energy transition. It is worth noting that in the Infralogic rankings, the category 'Technical advisory' encompasses not only technical but also market, commercial, regulatory, operational, IT, environmental and ESG/HSE due diligence services.

The Leading Advisor in Energy and Infra Mergers & Acquisitions

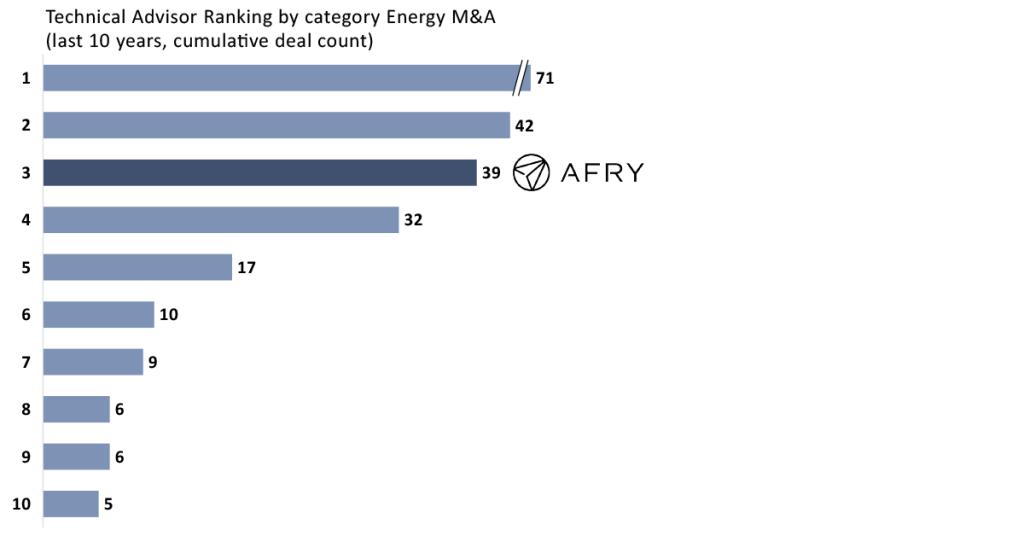

AFRY Management Consulting has successfully guided clients through over 170 investment transactions, including 39 brownfield energy infrastructure acquisitions. This track record cements AFRY’s status as one of the top 3 global energy M&A advisors of the past decade. AFRY's expertise is further underlined by its impressive track record of more than 100 successful brownfield transactions, when also including power and renewable transactions. It is important to highlight that the Infralogic rankings only include transaction projects that resulted in a successful outcome for the client. Should all transaction projects ever advised by AFRY be considered, the total count and value of deals would be significantly higher.

The Go-To Technical Advisor in Europe

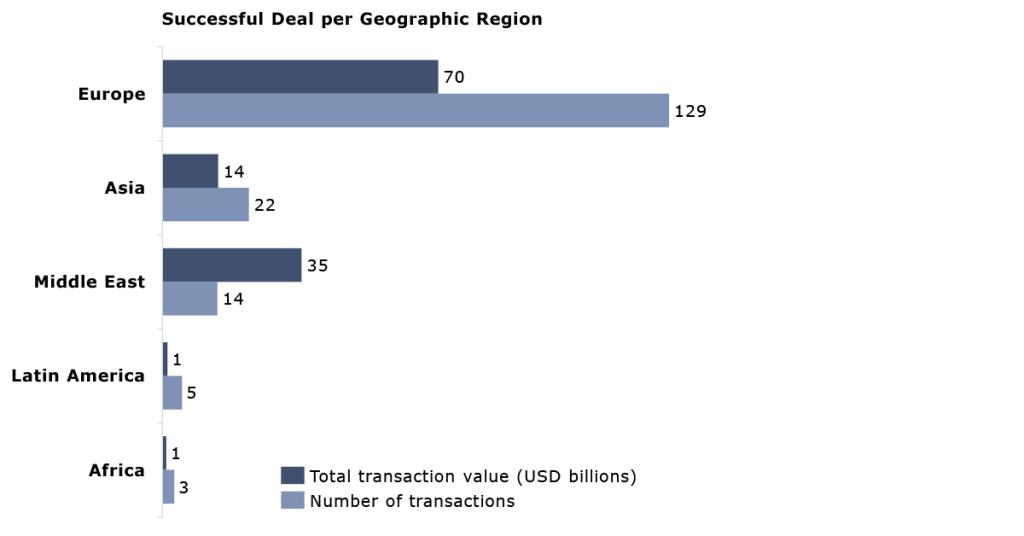

AFRY’s clients have benefitted from its advisory services to the sum of over USD 120 billion in successful public deal value. The breadth of transaction success spans across regions, with a rapidly growing history of transactions won in areas beyond Europe. In Europe, AFRY has a particularly strong presence, consistently ranking in the top 3 advisors, both in terms of deal value and count.

Advising Clients Towards Successful Investments

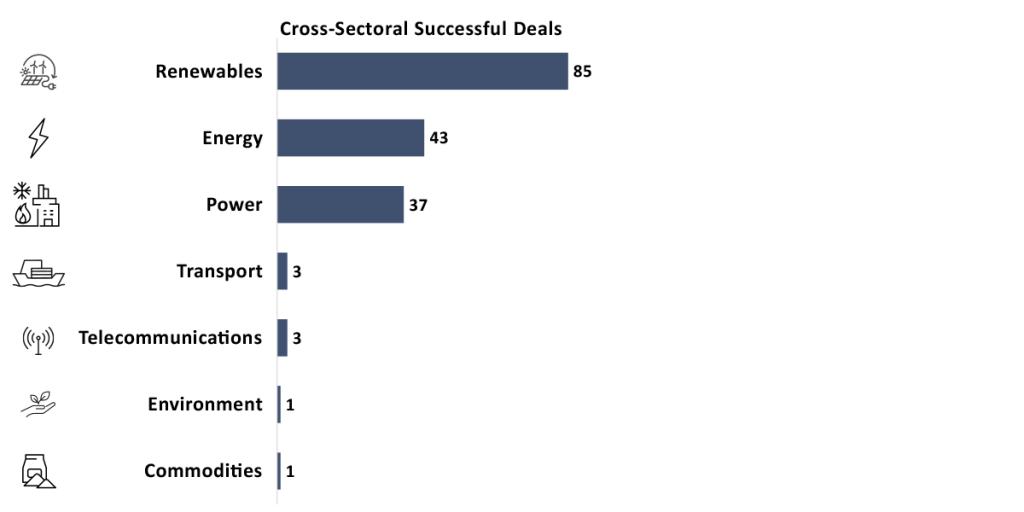

AFRY Management Consulting are considered the go-to advisor globally for energy and infrastructure related transactions, with a strong focus in renewables, district energy, thermal generation, gas storage and transportation, biofuels, and electricity networks just to name a few.

AFRY’s core competences are:

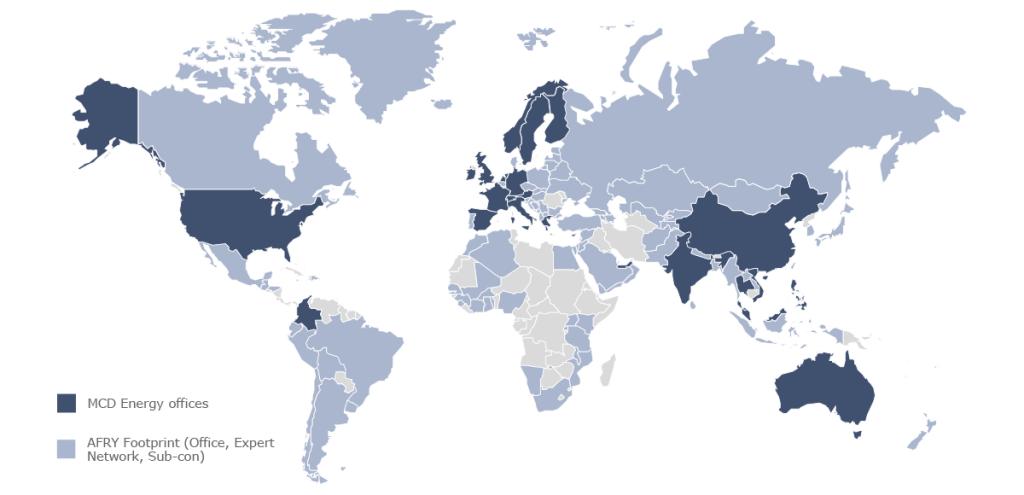

A Global Presence Ensures Transactions Support on Every Continent

AFRY Management Consulting stands out with its extensive global reach and a deep reservoir of knowledge from thousands of successfully completed transaction projects. This unique combination equips AFRY to cater to a diverse array of client needs and industry demands, making AFRY a leader in providing tailored solutions in nearly every part of the world.

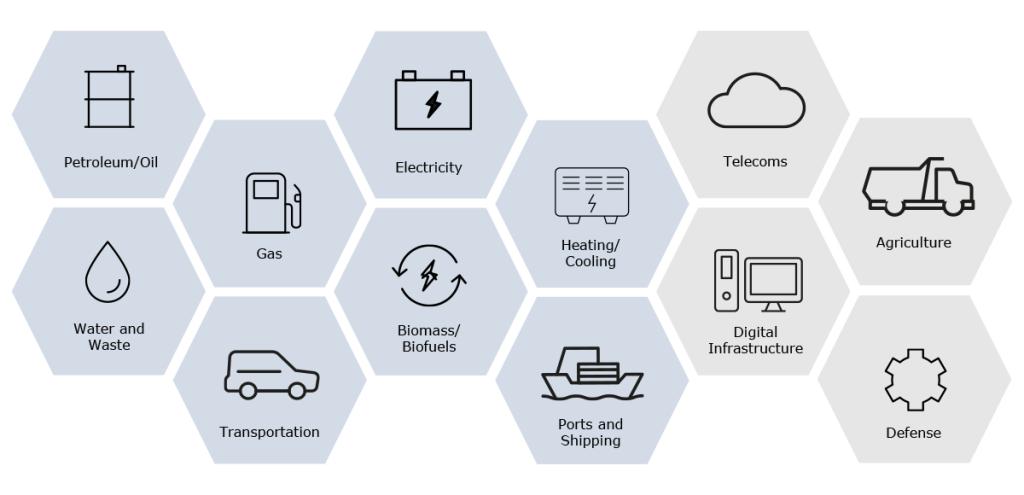

With the strategic expansion of AFRY Management Consulting’s leadership team and a targeted approach to talent acquisition, AFRY is broadening its scope beyond the energy sector into sectors such as logistics operators, commodity traders, waste management, water, chemical parks, as well as terminals and ports. By harnessing the vast expertise of over 19,000 colleagues across the parent group, AFRY Management Consulting positions itself as a fully equipped, versatile advisor, capable of guiding any asset-based transactions with unparalleled proficiency and insight.

AFRY Management Consulting’s range of due diligence offerings cover the full spectrum of sell- and buy-side as well as (re)financing advisory from a market, commercial, regulatory, technical, environmental, operational, digital, HSE and ESG perspective.

As part of AFRY Group, AFRY Management Consulting capitalizes on its unique access to an extensive network of subject-matter experts. This enables AFRY to combine its core transaction service expertise with, for example, operational excellence advisory. This approach is designed to unlock additional value for AFRY’s clients by focusing on operational streamlining and cost-saving strategies. This synergy between transactional expertise and operational insights allows to deliver a more comprehensive, value-added service, tailored to meet the specific needs of each client and enhance their overall operational efficiency.

About Us

AFRY is a leading international engineering, design, and advisory company.

As AFRY, we combine unique and worldwide expertise to better identify additional value during Due Diligences. Indeed, we combine:

- Market, strategic and commercial: we have a dedicated team of more than 800 consultants and experts globally experienced in a variety of infrastructure sectors, energy markets, bioindustry, sustainability, and digitalisation.

- Organisational and Digital: we have a dedicated team focused on improving performance through Operational Excellence and Digital Transformation.

- Technical: we have 19,000+ engineers worldwide performing design, feasibility study, Engineering Procurement Construction (EPC), Operation and Maintenance (O&M).

Our transaction experts have the deep industry expertise to support you on even the most complex transaction. Come talk to us if you have questions and we will create a solution to meet your needs.