Corporate Climate Adaptation and Resilience - An Imperative for Our Times

The EU Climate Adaptation Strategy Plan 2021 starkly warns, "Halting all greenhouse gas emissions will not prevent the ongoing impacts of climate change".

As extreme weather events become more frequent, people worldwide and businesses across all sectors are feeling the pressing need for climate adaptation and resilience.

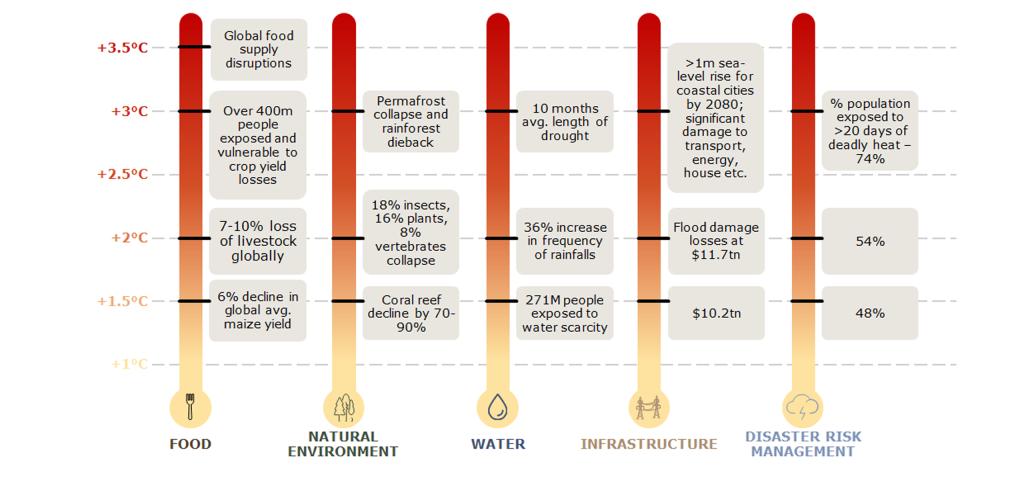

Researchers and experts in climate science are not surprised by the extreme weather events influenced by climate change. However, they are alarmed at society's vulnerability—entire cities can be devastated within hours, proving that wealth and knowledge alone cannot shield us from these changes. The era of 'Global Boiling,' as termed by UN Secretary-General António Guterres, is already upon us. Adaptation to climate change is not merely an option; it has become a survival imperative.

The Issue at Hand

While many businesses are already familiar with ‘mitigation’— setting science-based emission reduction targets and roadmaps to net zero — there has been less attention given to the need to build resilience and adaptation. Economic losses from frequent extreme events in the EU already average over EUR 12 billion per year, underscoring the necessity for adaptive strategies and measures. The EU Climate Adaptation Strategy notes that "mitigation and adaptation go hand in hand", with this dual approach addressing the complex challenges of climate change most effectively.

As climate impacts accelerate, adaptation costs accelerate; investment today is an insurance for tomorrow. In short, instead of the often slow and incremental approach most businesses take to climate risk-related disclosure, businesses must now accelerate their adaptive strategies to ensure long-term sustainability.

So Why Adaptation?

- Build operational resilience: Futureproofing against acute and long-term climate-related disruptions that could threaten business.

- Legal, regulatory, and reputational implications: Making certain that companies comply with all necessary legislation, present and future, to avoid negative repercussions.

- Employee wellbeing: Ensuring a safe and stable work environment is non-negotiable, and talented employees are increasingly demanding climate action from any company they might work for.

- Cost efficiency: Adaptation measures can result in significant financial savings in the long-term, and the most cost-efficient time to invest is today.

- Strategic alignment: Refinement of sustainability goals and better financial returns through risk mitigation, also ensuring smoother pathways more resilient to shocks.

- Sustainable communities: The surrounding environment can also benefit from these measures, including both natural ecosystems and the communities that rely on them.

The State of Progress

A study by AFRY, focused on our clients, highlights the role of ESG frameworks like the EU Taxonomy and the Task Force on Climate-Related Financial Disclosures (TCFD) in driving adaptation measures.

The EU Taxonomy

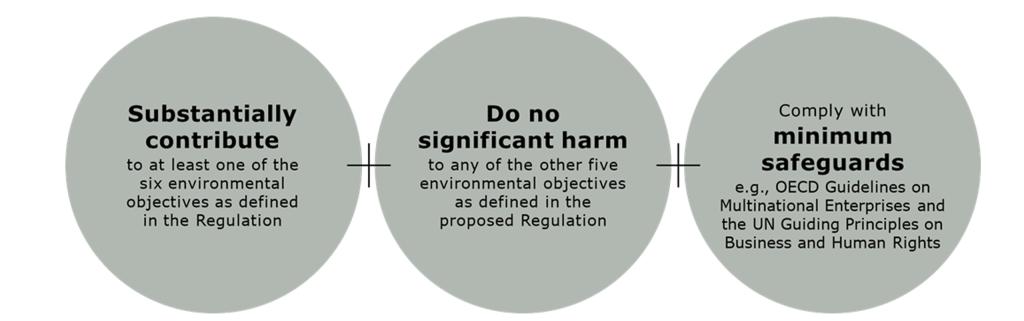

The EU Taxonomy provides a common language for sustainable business. It guides companies in what they need to achieve to successfully align with six environmental objectives. One such objective is Climate Change Adaptation. This means that for initiatives to be deemed sustainable, they must either substantially contribute to climate change adaptation or do no significant harm to adaptation where they contribute to an alternative environmental objective (Climate Change Mitigation, Circular Economy, Pollution, Water, and/or Biodiversity).

The Task Force on Climate-Related Financial Disclosures (TCFD)

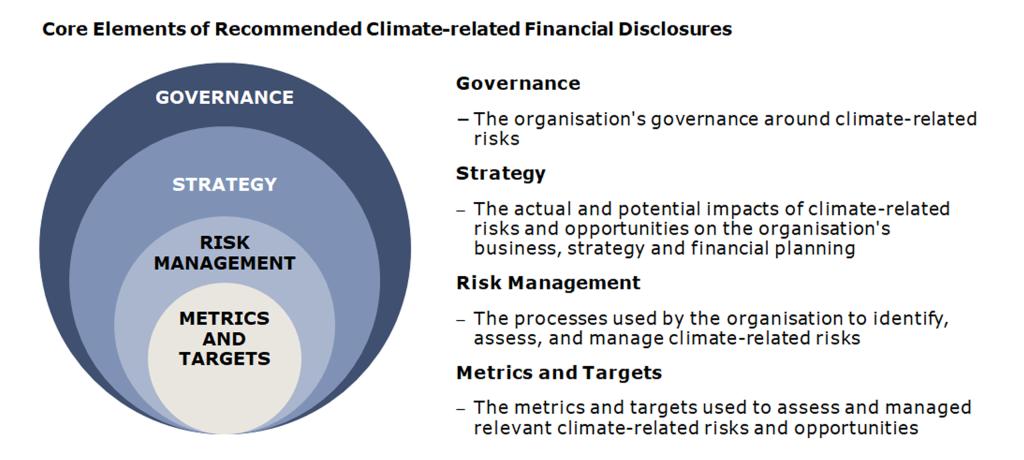

Meanwhile, the TCFD framework presents 11 disclosure recommendations underpinned by its 4 core elements. The identification, mitigation, and reporting of climate-related risks are well integrated into the TCFD requirements, thereby encouraging companies to actively consider and prepare risk management strategies for physical climate risks.

Obstacles and The Way Forward

However, we've observed that companies often struggle to adhere to these frameworks effectively, largely due to:

- An overshadowing focus on mitigation;

- The lack of guidance and standardisation;

- The evolving frameworks and regulations; and

- A lack of coherence among ESG frameworks.

Even when businesses do set adaptation targets, they are often infrequent and absent of measurable commitments.

To build a resilient future, businesses must adopt a holistic approach starting with the creation of awareness and fostering of ambition across stakeholders, internal and external. Technical capacity building is also essential, as is providing access to financial resources and technology. The roadmap for resilience involves assessing impacts, vulnerabilities, and risks, followed by effective implementation and continuous monitoring.

What can we do?

At AFRY, we are devoted to accelerating the transition to renewables and net zero. Yet, we are also taking a closer look at preparedness: understanding the range of physical climate impacts on regions, communities, and assets, identifying vulnerabilities, and helping our clients choose the right adaptation measures and resilience implementation schedules.

How vulnerable to physical climate impacts are your assets, supply chains, electricity supply, the health of your employees, and the wider communities you operate in? How can you direct investment towards protecting your operations and ensuring that you are prepared when unpredicted weather events hit?

Adaptation considerations need to permeate our organisations to make measures meaningful and impactful. Just like net zero aims, adaptation plays a part in every decision taken in an organisation. Decisions can no longer be based on historical data alone. AFRY can help you understand climate model outputs and what those mean for your business in terms of operations and reporting.