Key to green transition

Realising sustainable transition

The EU Taxonomy alignment will facilitate access to financing and is also likely to have an impact on company valuation. The EU Taxonomy classifies what is green, and alignment with it is a way for companies to future-proof themselves.

Sustainable finance, according to the EU Taxonomy, includes what is nowadays already deemed eco-friendly, and it is referred to as green finance. Transitional financing enables the transition to comply with EU objectives and becoming green in the future. The latter is expected to exist only in the short and medium term, with green finance taking over in the long term.

Enabled by improved transparency, financial institutions and banks are starting to rank the “greenness” of their investments based on the corporations’ Taxonomy disclosures.

What is the EU Taxonomy

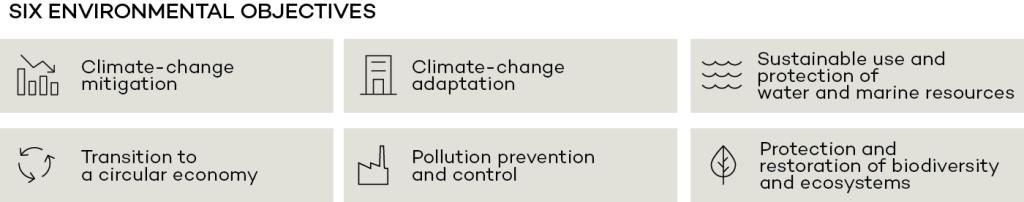

The EU Taxonomy provides a common language, guiding companies in what they need to achieve, to reach six environmental objectives.

Taxonomy eligibility refers to whether an activity is covered by the EU Taxonomy. About 150 economic activities have currently been identified in this field. Taxonomy alignment refers to whether an activity meets the EU Taxonomy Technical Screening Criteria, i.e., making a substantial contribution to at least one of six environmental objectives while simultaneously doing no significant harm to the other five. Alignment also requires complying with the minimum safeguarding criteria, e.g. OECD Guidelines on Multinational Enterprises and the UN Guiding Principles on Business and Human Rights.

EU is taking the lead – with a tight time schedule

Taxonomy classification is pivotal in most new and future EU initiatives, policies, and regulations. The disclosure of the EU Taxonomy will be mandatory for 50,000 companies, along with the new CSRD/ESRS reporting requirements for corporations and the SFDR for financial market participants and financial advisors. As a consequence, demand for taxonomy-aligned products and services will increase in most value chains, including design, development, production and distribution.

The EU has a tight time schedule: in 2023, it became mandatory for large, listed corporations to disclose EU Taxonomy eligibility and alignment for two climate objectives. In June 2023, the EU published additional economic activities covering all six objectives, to be reported on already in 2024 for the fiscal year 2023.

The enormous investments required to address the climate and nature crises are driving the global development of taxonomies, similar to the EU Taxonomy. The EU is taking the lead – and the EU Taxonomy is a forerunner providing the framework for other taxonomies.

The taxonomy landscape is quickly evolving in Asia. However, contrary to the EU, the region has a fragmented market without an overarching regulatory body to implement ESG legislation. Taxonomies already exist or are under development in Singapore, Malaysia, China and India, while the Association of Southeast Asian Nations (ASEAN) has established the ASEAN Taxonomy for Sustainable Finance.

The US Environmental Protection Agency (EPA) is looking into the EU Taxonomy and is discussing ways to develop one of its own.

The Canadian Taxonomy Technical Experts Group (TTEG) has developed a recommended framework architecture to guide Canadian green- and transition finance taxonomy development.

Practical pathway to alignment

A company on the path towards Taxonomy alignment faces several challenges:

- Articulating sustainability objectives and action to close the gaps as part of its business strategy

- Complying with higher environmental and social standards

- Investments in data collection and processing

Preparing for EU Taxonomy alignment as early as possible is crucial, as it provides a common base for all new EU Green Deal regulations and standards.

Becoming Taxonomy-aligned is a transition process, which is why it is recommended to engage an EU Taxonomy expert to ensure its swift advancement and efficient execution. The expert can support in defining the roadmap for eligibility and alignment assessment, provide the tools for closing the alignment gaps and assist in reporting requirements.

A close and strategic cooperation between different corporate functions is important. Starting with objective- and target-setting, identifying key stakeholders, and establishing a project team including finance, operations and sustainability management.