Make or break

Is packaging’s reuse option finally materialising?

The environmental impacts of packaging and packaging waste are mounting problems the world must solve on the path towards net zero. The European Packaging Association (EPA) estimates that packaging materials make up close to 30% of municipal solid waste generated in the US. Pictures of plastic bags taking over beaches and of sealife being suffocated by beverage rings and straws have made the reduction of single-use plastic packaging the first step of action for many consumers, companies and legislators alike.

However, what is the best way to substitute single-use plastics? What is the right path towards net zero for packaging? And how does the European debate on reuse fit into this picture?

We at AFRY surveyed 1,000 consumers in Germany and the US to gain insight into what consumers think about packaging and its sustainability, as well as what they are willing to do to support circular economy goals. We especially wanted to understand consumers' perceptions of reusable packaging and recyclable packaging, as both formats have been presented as pathways towards net zero.

From linear to circular

It is clear that consumers’ awareness and preference for more sustainable packaging has grown. In our survey, 81% of the respondents indicated that the sustainability of the packaging materials used is of primary concern to them.

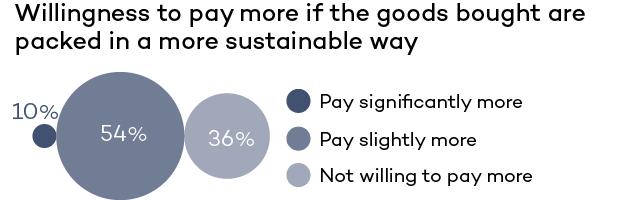

Furthermore, consumers are also willing to pay more for sustainability. 54% of the respondents were willing to pay “slightly more” for sustainable packaging, while 10% of consumers are even more committed to putting their wallets where their values are and are willing to pay “significantly more” to limit the burden of their consumption habits on the environment and society.

Consumers, packaged goods companies and legislators are all, in their own ways, taking steps to move packaging away from a linear model of production, use and disposal to a model of circular economy. Sustainable performance of packaging has four pillars:

- reduce packaging waste and pollution by packaging and process redesign,

- ensure the packaging protects and enables consumption of the goods by, e.g. reducing food waste or damaged goods,

- reuse and/or recycle packaging materials and

- introduce an end-of-life plan, e.g. through Extended Producer Responsibility schemes.

Draining the plastic ocean

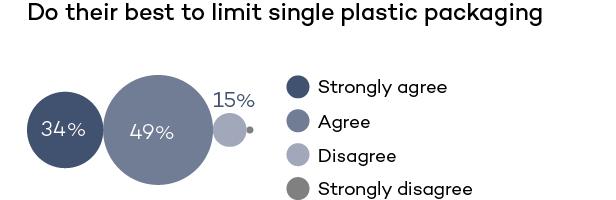

Consumers are backing the goal of curbing the world’s plastic addiction. In our survey, 83% of people stated that they are doing their best to limit the use of single-use plastics. Accordingly, introducing new packaging formats, which either use less or no plastics, has been a valid option for brand owners towards achieving net zero targets.

Outright bans of single-use plastics in applications such as food service or carryout bags have been emerging across the world.

The European Union has its Single-Use Plastics Directive (SUPD), which bans materials such as plastic straws, plates and EPS (expanded polystyrene) containers altogether. To reach zero plastic waste by 2030, Canada banned, as of the end of 2022, the manufacture and import of six single-use plastic categories, including bags and takeout containers. In the US, there is no movement in federal, nationwide, single-use plastic regulation. Rather, individual States are moving ahead on their own, California being the most progressive with its Plastic Pollution Prevention and Packaging Producer Responsibility Acts.

Packaging recycling is mainstream

Recycling: The reprocessing of discarded waste materials for reuse, which involves collection, sorting, processing, and conversion into raw materials, which can be used in the production of new products – Oxford English Dictionary

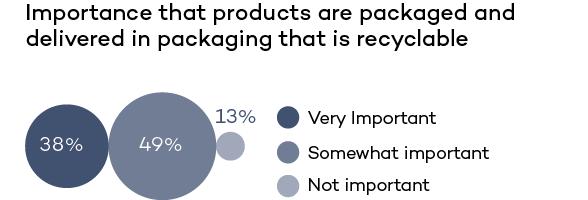

Consumers have learned to expect that the containers, boxes, pouches, sleeves, bottles, jars and other forms of packaging that they use can be recycled. For 87% of the consumers we surveyed, it is very or somewhat important that packaging is recyclable.

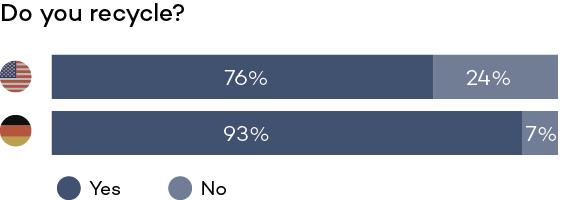

People actually recycle. Especially in Europe, recycling is a part of life and expected behaviour. In Germany, 93% of the respondents indicated that they diligently sort different wastes in separate bins at home or return them to the retailer or a community recycling centre. The figure was much lower in the US, where only 76% of respondents actively and regularly recycle.

To our surprise, we did not find Millennials recycling more than Gen X and Baby Boomers. That indicates that people in the US across all age groups seem to be aware of the benefits of recycling and how to do it. Although, Baby Boomers are more likely to have better access and resources to recycle in their suburban homes than recent college graduates living in big cities.

Return to reuse economy

Reusable: It can be used again - Oxford English Dictionary

Reusable packaging has (re)emerged and has been promoted as another way towards the same goal. Therefore, reusable packaging has been increasingly included, and even favoured, as a mechanism for legislative frameworks guiding jurisdictions towards net zero.

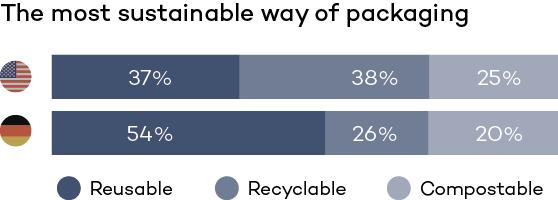

In our survey, we asked 1,000 German and US consumers which packaging format they think is the most sustainable way of packaging products: recyclable, reusable or compostable packaging?

Considering the public debate in Europe around reusable versus lack thereof in the US, it is not surprising that the results differ by region.

In Germany, reusable packaging was perceived as the most sustainable packaging format by the majority (54%) of the respondents. In the US, the most sustainable packaging format was a close tie between recyclable (38%) and reusable (37%) packaging. This reflects that – aside from many reusable packaging pilots by consumer products companies, with Starbucks’ reusable coffee cups being one of the most visible ones – reusable consumer packaging is still rather limited and not a headline topic of conversation in most US States.

Reusable is getting first traction in Europe now

Reuse is now one of the cornerstones in a draft proposal of the overarching EU legislation called the Packaging and Packaging Waste Regulation (PPWR). The PPWR has the power to change the feasibility of reusable packaging significantly.

The European goal of 50% reusable e-commerce packaging by 2040 may sound distant, but players are already moving ahead in creating new reusable packaging concepts. Logistics companies and European national mail systems are partnering with packaging start-ups to find the most workable packaging solutions and are already testing those in practice. Retailers welcome the developments and are increasingly participating in the decarbonisation of supply chains.

One of the key misunderstandings that many still have about reusable packaging is that returnable packaging equals reusable. This is clearly not the case, given how the PPWR is formulated right now. It will not be sufficient to be able to tear the packaging open and then seal it again to ship back the shoes that didn’t fit.

In order to comply with the formulation of the draft PPWR, packaging is required to not be destroyed during opening and closing. Basically, the packaging needs to be clearly designed for reuse. It needs to be standardised for cleaning and repair – and for as many rotations as possible. Loop systems (comparable to those for pallets or returnable fruit boxes) are still to be established. And finally – but not to be forgotten – it will take some time until consumers are fully educated on how the new packaging concepts work.

The bottom line is that the PPWR draft is challenging old thinking patterns that tell us that recollecting packaging for reuse is not viable as it is too costly, consumers are too scattered, and the overall supply chain is too complicated and slow to change. Instead, the packaging and logistics sectors are already piloting new reusable packaging solutions, experimenting with deposits and pricing formulas to see what works.

Against all odds, reusable packaging has started to make inroads. The key question has changed from "Are reusable packaging systems possible?" to "Where are reusable packaging systems a viable solution towards net zero packaging?"

Bioindustry Management Consulting

Our service offerings from corporate strategy to design of processes and from market insights to operational efficiency backed up by an understanding of best practices, detailed in-house databases and analysis led by experts in the field ensure your outstanding performance. We want to be your trusted partner.