PPA markets in Asia Pacific: A strategy playbook for corporate renewable energy leadership

Some 6,000 companies, including many of the world’s largest, have set science-based greenhouse emission reduction targets or pledged to do so. 1

The switch to renewable energy has emerged as a key lever, but despite the growing interest, companies still face formidable roadblocks when it comes to securing renewable energy. Whether it is to power offices and factories or to reduce suppliers’ footprint, those striving to take next steps are now finding themselves short of easily accessible, credible, and competitive options.

Sustainability executives operating across Asia Pacific (APAC) markets face particularly prevalent barriers. APAC is considered amongst the most challenging region globally for businesses seeking to make the renewable transition, according to a 2020 survey conducted by RE100, a membership-based initiative with a mandate to drive corporate renewable energy consumption globally. 2 Markets such as Australia, mainland China, Indonesia, Japan, Singapore, and South Korea have been highlighted.

These geographies differ vastly in terms of renewable energy policies, power market rules, and market fundamentals. For climate-ambitious corporates looking to leverage market-based renewable energy solutions in APAC, key questions remain:

- What renewable energy technologies and solutions are available in the market?

- Which procurement options are considered good practice?

- How can corporates develop an effective renewable energy strategy?

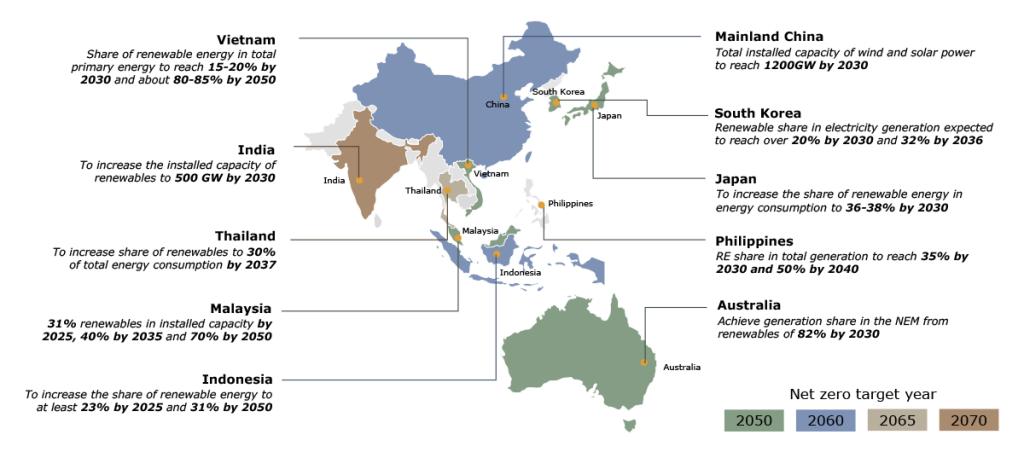

Market outlook for renewables is positive across APAC

Recognising the urgent need to address climate change, governments across APAC have set ambitious Net Zero targets and outlined aggressive renewable energy development goals. Across regions where AFRY develop local electricity market projections 3 , we anticipate that over 1,300 GW capacity of wind and solar power will be added online out to 2030. This is more than three times as much as Europe’s cumulative wind and solar capacity as of 2022. 4 The growth outlook provides impetus for corporates looking to procure from markets that may experience short-term supply shortage.

Figure 1: Selected government targets across APAC

Source: AFRY analysis

For corporates, a forward-looking view on the renewables market can help them plan renewable energy procurement. But how such increased supply of renewables will be funneled to the end user is not just a fundamentals question but a policy one. Understanding how local market rules are drawn up, as well as how they may evolve, is key for a future-proof corporate renewable energy strategy.

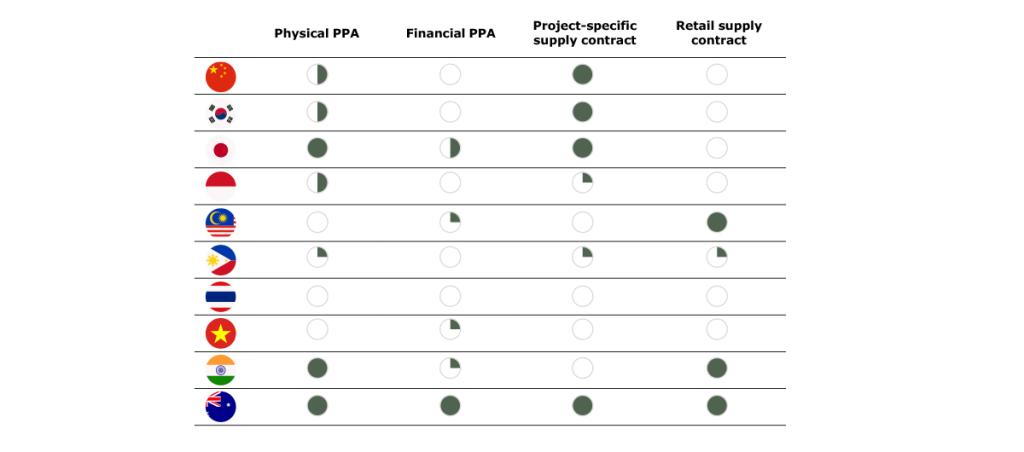

Procurement routes vary significantly across markets

RE100 came out with an updated guideline in 2022 to provide the much-needed clarity on corporate renewable electricity procurement. In this guideline, five general procurement approaches are acknowledged:

- Self-generation: The corporate owns assets that generate renewable energy for its own use.

- Direct procurement: A direct agreement between a renewable energy developer and a corporate consumer, either through physical or financial form.

- Contract with electricity supplier: An agreement between an electricity retailer or utility with a corporate offtaker, either through a tailored renewable electricity contract, such as a green tariff programme, or through an ‘off-the-shelf’ arrangement.

- Unbundled Energy Attribute Certificates (EAC): The corporate purchases attribute certificates of renewable energy separately “unbundled” from its electricity.

- Passive procurement: Default delivery of renewable electricity from the grid, supported by EACs or in a market where at least 95% of the generation mix is renewable.

As each geography has its own power market arrangements and EAC mechanism, applying RE100’s guidance to implementation requires corporates to develop a nuanced view of each market. In several liberalised markets or those in transition, such as Australia, Japan and mainland China, power purchase agreements (PPA) allow corporate consumers to have a direct contract with power generators. This gives end users a substantial degree of flexibility on where to source electricity. By contrast, in regulated markets such as Thailand and Indonesia, corporates are constrained to procuring power solely from the utilities and thus have lower flexibility. Increasingly though, governments have been coming up with schemes to enable corporate consumption of renewables, though specific workings may vary depending on the local regulations and rules. In short, there simply isn’t a “one-size-fits-all” approach.

Figure 2: Selected available procurement options across APAC

Source: AFRY analysis

For corporates preferring to procure unbundled EACs for the time being, the risk of double claiming is worth cautioning. In several markets, competing EAC mechanisms have made it challenging for corporates to make credible claims based on such a purchase and avoid being perceived as “greenwashing”. In response, the leading global organisation Science-based Target Initiative (SBTi) recently opened a Call for Evidence regarding corporates’ use of EACs to achieve meaningful emission reduction. While policymakers are taking steps to enhance market design, the onus ultimately falls upon the corporate to ensure that its use of renewable energy is real and unique.

There is a business case for renewable energy

Though a range of procurement options are available in each market, not all carry the same weight. We recommend that a corporate’s strategy towards renewable energy be calibrated against the following four key considerations:

- Credibility: Ensuring that the renewable energy claim is based on real and unique consumption is paramount to a corporate’s climate leadership positioning.

- Supply availability: Existing renewables capacity may initially constrain procurable volumes, but projected strong growth across APAC markets indicates that the near-term tightness will unwind.

- Market design readiness: The rules of play for renewable energy trading are relatively nascent in APAC markets. Where possible, starting with pilots can be helpful for companies to develop competence in due diligence needed.

- Cost competitiveness: Thanks to the falling technological costs, renewable electricity may offer potential cost savings, especially when secured via long-term contracts.

Though the purchase of unbundled RECs is common for corporates making a first move towards renewable energy, risk of double claiming is now driving many to seek more credible options such as via direct trading. And where market maturity and fundamentals allow, direct trading of renewable electricity may be economically competitive, too. Furthermore, those with the ambition to bring additional renewables capacity to the system will venture into direct investment and access renewable generation at cost.

To leverage renewable energy for both decarbonisation and commercial wins, sustainability executives are now needing to develop energy market competence as strategic buyers, traders, or even investors. Businesses can take a role in shaping the playbook too. Where renewable electricity sourcing options are limited, companies can proactively engage with utilities and policymakers to advocate widening supply access.

By investing in our own production, we ensure that more renewable energy is added to the electricity market.

Karol Gobczyński, Climate and Energy Manager, IKEA Group, quoted from RE100 report

Despite prevailing challenges in the diverse APAC renewable energy markets, there is a way forward for companies who dare to venture into them. Those with a market-focused view on renewable energy will stay on top of rapidly evolving power market rules and dynamics and achieve renewable energy procurement – competitively and with credibility.

Footnotes

- 1. //sciencebasedtargets.org/companies-taking-action a↩

- 2. https://www.there100.org/re100-most-challenging-geographies a↩

- 3. In APAC AFRY’s modelling coverage includes mainland China, Taiwan, Japan, South Korea, Singapore, Indonesia, Malaysia, the Philippines, Thailand, Vietnam, Cambodia, India, and Australia. a↩

- 4. https://windeurope.org/intelligence-platform/product/wind-energy-in-europe-2022-statistics-and-the-outlook-for-2023-2027/; https://www.solarpowereurope.org/press-releases/new-report-reveals-eu-solar-power-soars-by-almost-50-in-2022 a↩