Regulation complexity

Navigating climate policy on both sides of the Atlantic

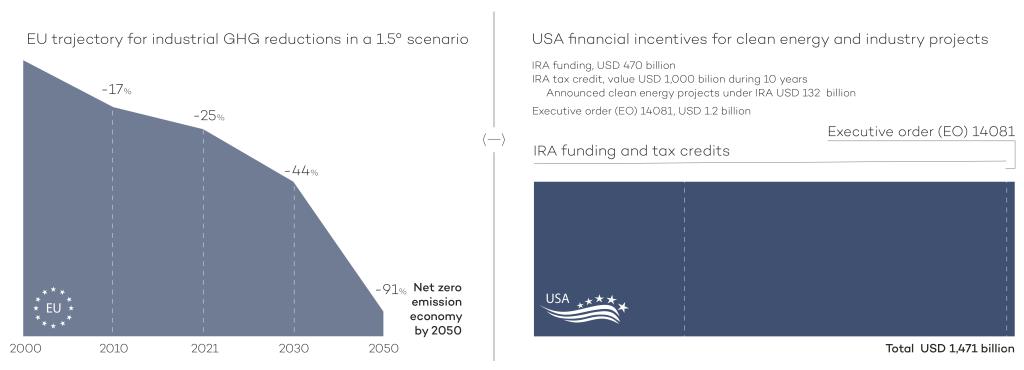

The increasing amount of global regulations is shaping an intricate web of interconnected crossroads where each step matters. While the EU climate change policy focuses on minimising emissions by setting

reduction targets, the USA relies mostly on financial incentives.

The United States (USA) and the European Union (EU) are each other’s largest overall trade and investment partners, with over USD 1.3 trillion in trade from goods and services and over USD 5.0 trillion in direct investments. Recently, the relationship has been strained by several factors, including mixed signals regarding US commitment to combating climate change and the new regulations that effectively support domestic industries through restrictive trade policies. Some expect this tit-for-tat exchange to continue, so it is critical to monitor developments between the two regions as the economic impact could be quite severe.

With respect to climate-change policy, the EU’s regulatory approach focuses heavily on minimising GHG emissions by setting emission reduction targets. The US relies mostly on financial incentives to promote renewable energy projects, with the Renewable Fuel Standard being an outlier.

The EU’s approach clearly shows the emission reduction path required to meet the 2030 goal, but the financial incentives to push industry and other economic sectors to GHG reductions are disorganised. Conversely, the US approach lacks a clear pathway and instead emphasizes the end result of achieving at least a 50% reduction in GHG emissions by 2030. However, it has been analysed that the Inflation Reduction Act (IRA) itself will cut GHG emissions by 33% to 40% by 2030, while the rest will be achieved through transportation and industry emission standards and through mainstreaming low-carbon technology, both supported by the IRA.

Both approaches show weaknesses. In the absence of clear emission reduction targets, the US must confidently ensure that tax breaks and other financial incentives steer the industry towards emission cuts, especially in cases where more polluting options would be cheaper. Additionally, in 2022, the US Supreme Court restricted the Environmental Protection Agency’s power to regulate carbon dioxide emissions (West Virginia v. EPA). Although the IRA largely addresses this issue, there is a possibility of similar challenges emerging in the future.

On the EU side, the Net Zero Industry Act and the relaxation of the EU’s state-aid rules provide some clarity regarding the financial incentives – a policy shift from the more traditional, stricter Single Market antitrust rules in the EU.

The EU's motivation behind this policy shift is the fear of losing financial investments to the US, as these incentives are tied to production in the US. However, this does not imply that the EU lacks financial incentives altogether. For example, the EU Innovation Fund, Projects of Common Interest funding, funding under the RePowerEU plan and different Member State funding programs all provide financial support and incentives.

The world today is a significantly different place than it was in the 2000s. The promises of expanded globalisation and free trade have been supplanted by protectionist policies that have the potential to undermine the global world order ushered in after the end of the Second World War. This is most apparent in the industrial sector, where trade barriers and tariffs are increasingly impacting global markets.

From the perspective of climate change, the focus of the regulations has evolved from operational standards and requirements to a larger market-driving force that creates and directs markets to reduce GHG emissions.

Yet, global markets for carbon dioxide are still untested, which is shown all too painfully in recent scandals involving the markets for carbon offsetting. This is why business leaders must be vigilant in understanding regulations and their impacts. Ignorance is not bliss, and being uninformed can lead to severe penalties for non-compliance. On the other hand, generous and unprecedented incentives laid out in recent policies could ease the economic pain and provide financial incentives that can accelerate the transition.