Smoother curves in pulp price rally

Why is market volatility increasing? What does China as an end consumer have to do with it? And how can the effects be mitigated?

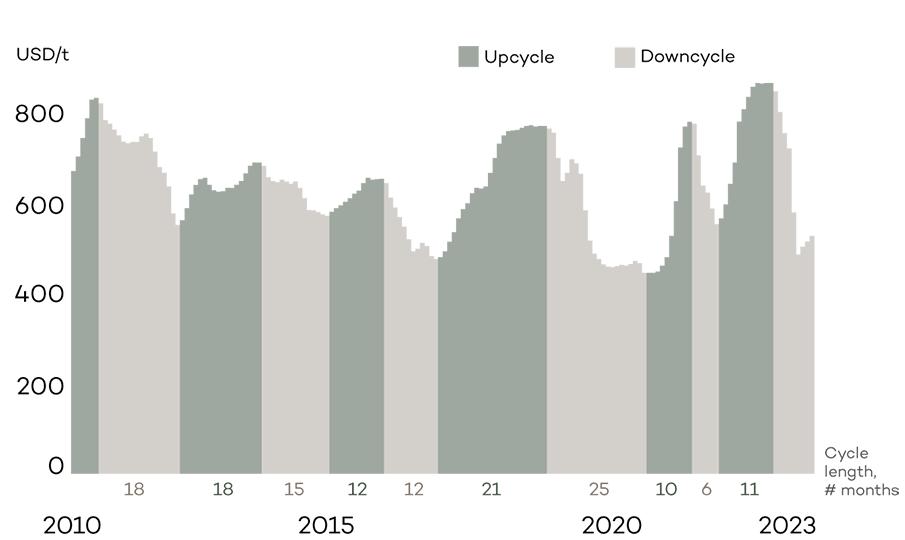

Price volatility has picked up

Since the start of the decade, the pulp market has travelled a winding road from boom to bust. The market has suffered from unexpected events – from demand fluctuations and logistical bottlenecks, driven by the global pandemic, to surging energy prices due to geopolitics, rising wood costs and unforeseen production outages. Market pulp as a global commodity has always been subject to cyclical fluctuations and price volatility. However, there are clear signs that overall volatility is growing and that the predictability of the changes is weakening. A significant factor fuelling long-term volatility is China's expanding presence as an end-use market, currently accounting for over 40% of global demand. Moreover, market dynamics in this region diverge significantly from those in the Western world.

Market behaviour in China is more speculative, with shorter contract periods, recurring negotiations and aggressive inventory management, with less focus on working capital. Furthermore, volatility is strengthened by the larger scale of pulp suppliers, which has made them more resilient to market changes and more flexible to take market downtime or geographically reallocate volumes based on demand fluctuations.

Positive or negative?

There are advantages and disadvantages when it comes to price volatility. As Anita Skjong, Chief Commercial Officer of NOREXECO, states, volatility is a sign of a functional and efficient market, because it reflects changes in market fundamentals. The question is how the industry adapts to these changes. João Pereira, Managing Director of Altri Sales, underpins that volatility ensures the industry stays sharp and keeps chasing opportunities. Being on the pulse of the market has become more critical than ever within an increasingly volatile price environment.

However, there is also a flip side of the coin: strong volatility means less predictability of earnings and margins, raising the financial risk for any company in the pulp market – essentially hitting market capitalisation. Brian Dillon, Director at tissue and hygiene company Essity, sees volatility as a value-destroying factor, especially now, as the magnitude of these changes has grown increasingly extreme. The tissue and hygiene business is typically more stable by nature. However, amid the current volatility, the commodity-driven nature of the pulp market is also commoditising some segments of the tissue market more than ever before. “We have to find mechanisms to mitigate the volatility”, Brian Dillon underlines.

How to mitigate the impacts?

Both Anita Skjong and João Pereira agree that there is no reason to expect pulp price volatility to fade. Currently, prevailing pricing mechanisms with recurring negotiations are enhancing short-sightedness and feeding overall volatility, with both buyers and sellers chasing the last dollar. Additionally, pulp suppliers have become more resilient and capable of moving the market. Furthermore, as João Pereira outlines, different pulp grades and products have become more interchangeable, especially driven by the increased share of tissue end use that is tightening competition in the market.

In an environment of strong and even strengthening volatility, it becomes more critical to stay close to the market pulse and focus on sharp market intelligence – in order to anticipate the cyclical turning points. Even though volatility has largely been perceived to be “business as usual”, there are ways to mitigate its implications.

Seeking alternative pricing models is one of the potential measures to mitigate the implications of price volatility. In consumer markets such as tissue, time becomes an important factor – passing price increases down the value chain invariably comes with a delay. It is why Brian Dillon from Essity sees potential in, for example, time-lagged pricing mechanisms, which could provide a way to smoothen price volatility along the value chain. Implementation of such mechanisms would require longer contract periods and long-term commitment from both buyer and seller.

Hedging provides another alternative or complementary solution for price volatility mitigation. In many other commodities, such as energy, metals and agriproducts, hedging is already a widely used financial instrument for price-risk mitigation. In turbulent times, according to Anita Skjong, market pulp futures have also gained increasing traction with pulp buyers – especially with those who have already been exposed to hedging, for example, in natural gas and electricity. However, international futures markets in pulp are still building liquidity, requiring higher traded volumes and, in practice, a higher participation of pulp suppliers in the market. With more liquidity, pulp hedging would provide attractive opportunities for both buyers and sellers, for example, by stabilising or improving earnings and margins – but also by enhancing customer service.

Pulp price volatility is here to stay, and it remains one of the key business fundamentals and critical success factors to mitigate related risks. In this regard, seeking new solutions, building trust, and long-term commitment play a central role. Large buyers and sellers are in a position to drive change, upon which many others will follow.

Bioindustry Management Consulting

Our service offerings from corporate strategy to design of processes and from market insights to operational efficiency backed up by an understanding of best practices, detailed in-house databases and analysis led by experts in the field ensure your outstanding performance. We want to be your trusted partner.