Three indicators that oil majors could maintain their dominance throughout the energy transition

With investors collectively adopting a green-conscious agenda, robust decarbonisation strategies are becoming increasingly important to a successful business.

Among the most impacted by this decarbonisation initiative are the integrated oil and gas companies (“oil majors”) that have historically built their business models around finding, extracting, distributing and selling hydrocarbons. Today, many of the oil majors are diversifying their traditional revenue streams away from fossil fuels to cleaner, lower-carbon energy sources. In many cases, their transition strategies will require a radical diversification of their existing offerings. BP, for instance – which has over 10 billion barrels of oil reserves – intends to cut oil production by 40% and instead divert capital toward building 50 gigawatts of renewable generation capacity by 2030. The Italian oil major, Eni, plans to double its significant 1.1 million tonnes per year of biofuels refining capacity by 2024 to reduce greenhouse gas emissions in the transport sector.

Despite adopting a wide variety of transition strategies, the common theme is that oil majors are entering new markets with brand recognition, big balance sheets and proven infrastructure – everything required to make their influence tangible. Below we highlight three key strategies they are employing to position themselves for continued dominance in the new energy world.

1. Building vertically-integrated positions across the power supply chain

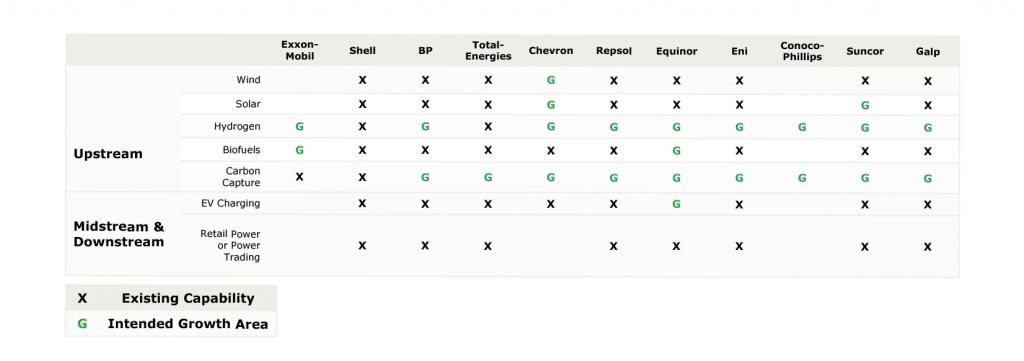

By diversifying away from existing fossil fuel-dependent revenue streams and into multiple low-carbon sectors, oil majors are securing a presence in the future energy economy. They are investing in alternative forms of energy production – like solar and wind, biofuels and clean hydrogen – and are supplementing these with additional investment further down the power supply chain in electric vehicle (EV) charging, renewable power trading and retail power.

The vertical integration strategy mirrors exactly that which made each of these firms dominant in the oil and gas industry. A sizeable midstream and downstream presence in the renewable power supply chain assures demand and increases price resilience for their upstream power generation assets. Conversely, a sizeable upstream presence assures supply for their midstream and downstream businesses. The key takeaway is that vertical integration puts these firms in an advantageous position to enhance margins, insulate from the impact of competition and prime their business for growth.

We are seeing many of these integration strategies play out quickly. To highlight one example, we look at Shell’s activity in the EV charging sector. Over the last five years, Shell has acquired NewMotion, Greenlots and Ubitricity to build their public-access EV charging network across the US and Western Europe to 60,000 charge points. In a recent investor presentation, Shell’s CEO announced that they intend to grow that number to 2.5 million by 2030. By securing downstream power customers and pushing new sources of demand, Shell hopes to strengthen the return profile for its sizeable wind and solar development pipeline.

Another example of the diversification advantage can be seen from Equinor, which is actively rebranding its image away from an oil and gas firm to a premier offshore wind producer. Its low-carbon energy business is comprised of ~500 MW of offshore wind capacity and a large pipeline of offshore wind projects in the United States and Western Europe. Equinor entered the midstream section of the power supply chain with their opportunistic acquisition of power trader Danske Commodities in 2019, thus allowing them to insulate their renewable production from market price volatility and enhance margins by removing a third-party presence in their value chain.

2. Targeting markets with the most positive economic indicators

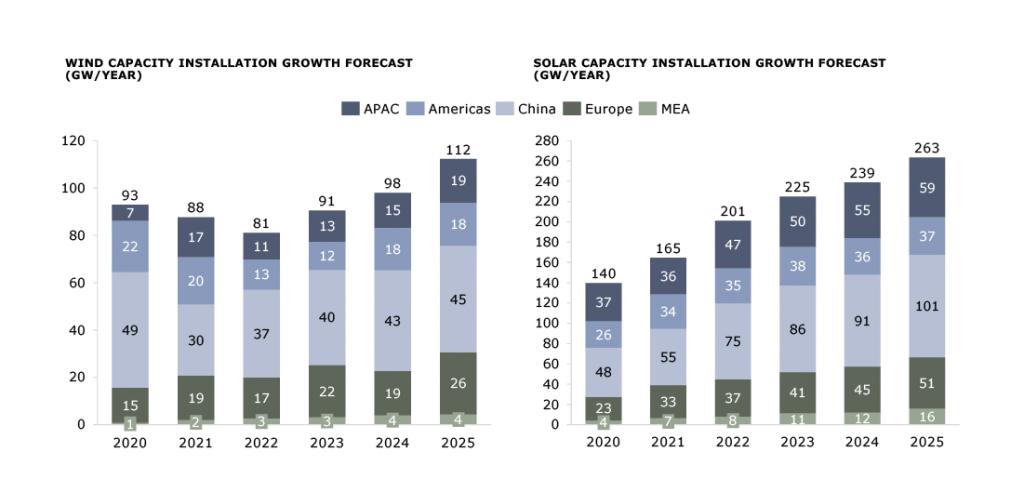

From the perspective of the oil majors, most of their renewable generation market penetration has remained close to home in Western Europe. However, strategic partnerships and acquisitions have allowed many to establish a presence in high-growth foreign markets – namely China, India, and the United States.

Most notable is the growing accessibility for oil majors in the burgeoning Chinese renewable market, which accounted for 41% of all wind and solar capacity growth from 2010 – 2020 (IRENA) and is forecasted to continue leading capacity installation. A 2019 joint venture between TotalEnergies and Envision Group provided the French oil major with a foothold in China. The combined entity, TEESS, will develop B2B, on-site distributed generation solar projects for the C&I sector – which accounts for two-thirds of Chinese power consumption. Another 2019 joint venture between BP and EV charging giant Didi gave the British oil major a foothold in the Chinese EV market. The joint entity, BP Xiaoju, intends to buildout their Chinese EV charging network to 35,000 charge points in over 2,000 locations by 2030.

In India, Shell and TotalEnergies have acquired minority shares in local renewable firms to establish their presence. Shell, through its venture capital arm Shell Technology Ventures, invested $20 million in Husk Power Systems in 2018 to obtain a presence in the Indian low-carbon mini-grid market. And in 2021, TotalEnergies acquired a 20% minority stake in Adani Green Energy Ltd, which afforded them significant exposure (~25% of their development pipeline) to the fast-growing Indian renewable generation market.

Lastly, significant acquisitions of US-based renewable generation capacity by Shell (Silicon Ranch Corp.), BP (7X Energy) and Repsol (Hecate Energy) have allowed European oil majors to build their presence in the Americas. As a result, these firms are positioned to capitalise on renewable-friendly initiatives introduced by the Biden administration.

Although opportunities have been weighted towards these markets, oil majors have taken a non-discriminatory approach to geographic expansion. For example, Eni is developing renewable generation capacity across Continental Europe, the Middle East, North Africa, North America and Australia; Repsol is steadily building a dominant market presence in Chile in addition to its home market in Spain; and Shell is developing South Korea’s largest floating wind farm.

3. Leveraging existing fossil fuel businesses to enter new markets with unmatched financial strength

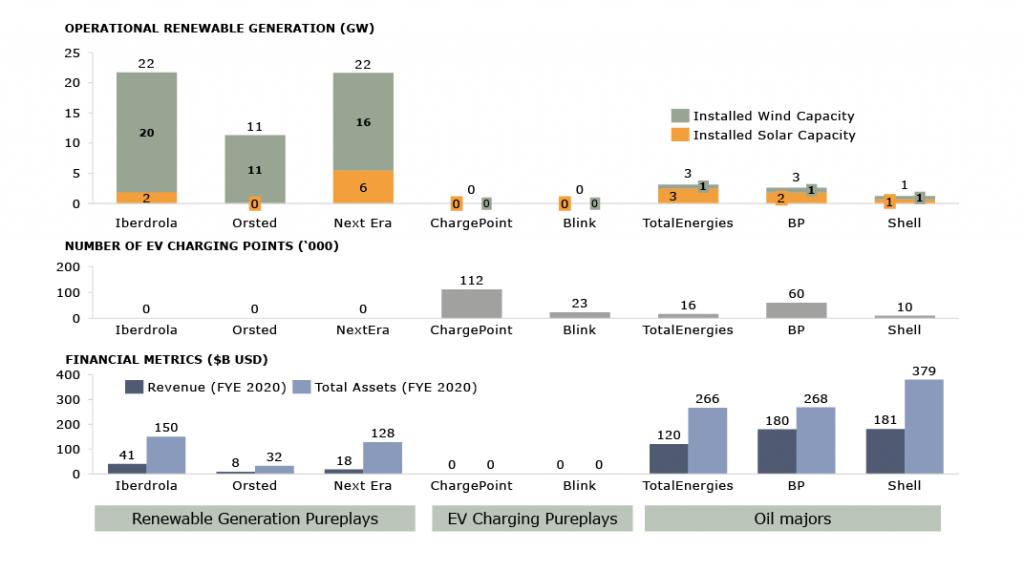

Low-carbon sectors have formidable incumbents with established market share, personnel and operational expertise. However, oil majors entering these new markets have the distinct advantage of big-brand influence and lobbying setups, large balance sheets, and the ability to fund capital projects from their fossil fuel-based income streams.

Benchmarking key metrics of these low-carbon pure plays against integrated oil and gas firms, we see that the heavyweight oil and gas firms have significantly larger revenues and balance sheets (chart above).

With large existing income streams at their disposal to fund energy transition strategies, oil majors have the potential to penetrate low-carbon markets and steal significant market share. For example, when the British Crown Estate auctioned seabed leases for premier offshore wind development sites in early 2021, consortiums led by BP and TotalEnergies out-muscled their competition by paying hefty premiums. BP’s CEO justified their bid by citing that synergies with their power trading business will recuperate the premium.

Furthermore, the global reach of existing oil and gas assets and customer relationships lessens the entry barriers to virtually any new market. For example, many firms – Shell, TotalEnergies, BP, Galp, and Repsol – are building EV charging businesses that enjoy remarkable synergies with their existing retail petrol station footprints. Competing EV charging pureplays must either bear the real estate capital burden for new stations, or concede value by partnering with a third-party.

Key takeaways

With such strong resources at their disposal, oil and gas firms will not be limited by their financial firepower or development capabilities, but by their commitment to the energy transition. The global economy still has substantial demand for fossil fuels, and low carbon assets often do not offer the same financial returns as their traditional exploration and production business. So, oil majors will continue to walk a fine line between low-carbon diversification and value optimisation for their existing hydrocarbon assets. This balancing act will continue until fossil fuel demand subsides or low-carbon investment returns gain parity with hydrocarbon investment returns.

In the meanwhile, the least regrets approach would appear to be a diversified entry at scale throughout the power supply chain to maximise synergistic benefits. This way, when traditional hydrocarbons are no longer primary fuels, oil majors will already be positioned in the low-carbon energy hierarchy with a familiar dominance.