Are the U.S.' Hydrogen Hubs the Kickstart Needed to Accelerate the Clean Hydrogen Revolution?

President Biden and U.S. Secretary of Energy Jennifer M. Granholm have released a plan to fund hydrogen hubs across the U.S. to encourage the clean energy transition and cut 25 million metric tons of CO2 emissions through the production of 3 million metric tons of clean hydrogen.

This investment is a part of the Biden administration’s Bipartisan Infrastructure Law, passed in 2021, which set aside $65 billion for clean energy investments, including $7 billion in funding for a Regional Clean Hydrogen Hubs Program (H2Hubs). The H2Hubs program is designed to support the development of clusters with co-located clean hydrogen producers, end-users and connective infrastructure with broader goals of driving decarbonisation, improving energy security, and bolstering economic development.

A Closer Look at the Hubs

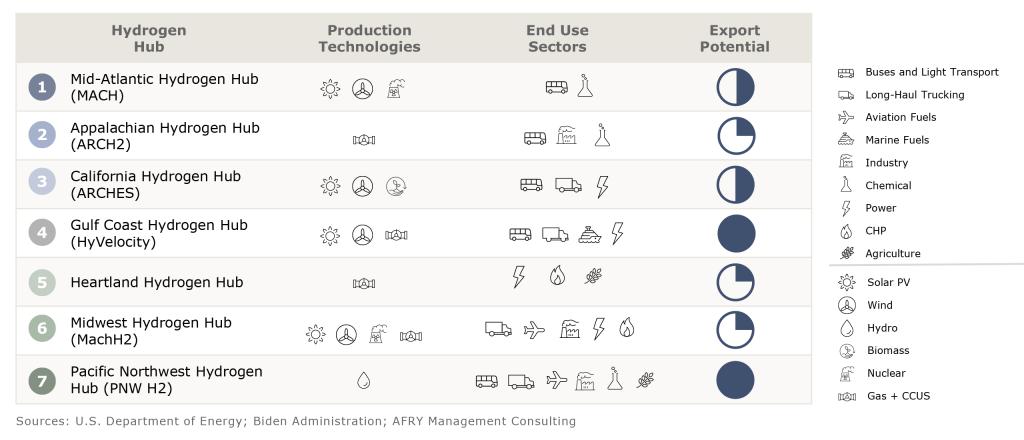

The hydrogen hub program has garnered much attention. Of the 79 applications submitted, seven hubs were chosen by the U.S. Department of Energy (DOE) to receive a total of up to $7 billion in grants. Together with the Inflation Reduction Act’s (IRA) tax incentives for clean hydrogen, this funding marks a crucial step towards the development of the hydrogen economy in the U.S. and signals a strong commitment to hydrogen as a key ingredient of the clean energy transition.

The U.S. DOE has considered several key criteria when awarding funds to selected Hydrogen Hubs:

- Minimum production capability – at least 50 metric tons/day of clean hydrogen

- Scalability – ability to grow and expand the production footprint

- Market competitiveness – ability to reduce costs over time and attract end-users

- Workplan – realistic timeline from initial planning to first production

- Management team and project partners – reliable and experienced team with project execution expertise

- Community Benefits Plan – focus on community engagement and job creation

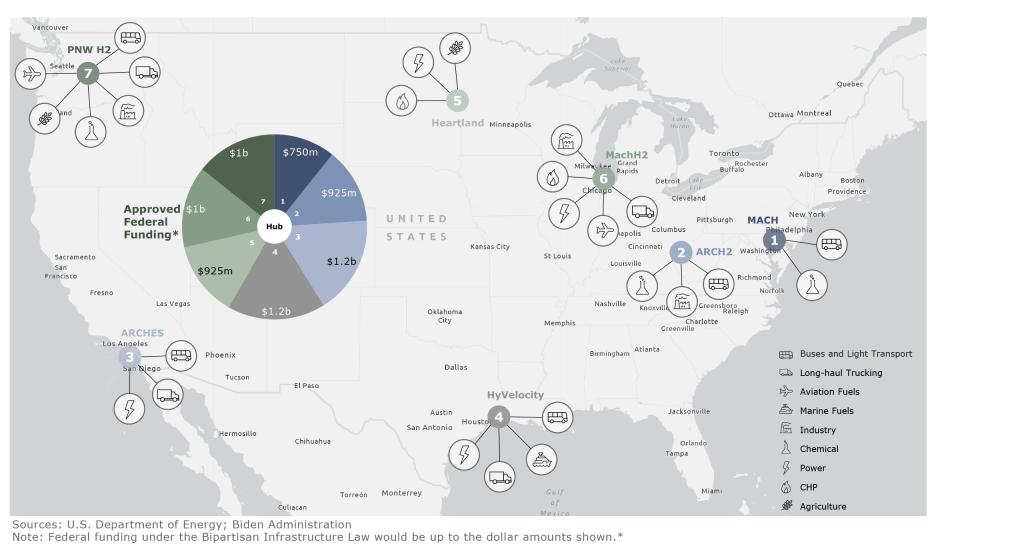

The seven selected hubs are strategically located, and will drive technological innovation, job creation, and regional development. The Mid-Atlantic, California, and Gulf Coast hubs are located in regions with increasing demand for power (Texas, California, Northeast states). All three of these hubs along with Pacific Northwest Hub are also located in regions that are well-positioned for hydrogen exports to markets in Northeast Asia and Northwestern Europe.

The landlocked hubs of Appalachia, the Midwest, and the Heartland will focus on decarbonising hard-to-abate industrial sectors, power generation, as well as road and air transportation. The Heartland Hub is the only hub that is aiming to decarbonise fertiliser production and agriculture through low-carbon ammonia production. The impact on the cost of food production will likely limit the scale of this end-use until the cost gap between blue or green hydrogen and grey hydrogen is narrowed.

The California Hydrogen Hub and Gulf Coast Hydrogen Hub were awarded the largest amounts of funding, followed closely by Midwest Hydrogen Hub and Pacific Northwest Hydrogen Hub. Mid-Atlantic Hydrogen Hub received the smallest amount of funding, at $750 million. It is worth noting that projected production capabilities significantly vary across hubs (50-45,000 metric tons/day); however, higher production capability does not correlate with funding amount. It is possible that the DOE took the potential for private investments for each hub into account when allocating funding.

A common theme among winning proposals is backing from a coalition composed of high-level state government leaders and influential industry partners suggesting the preference for public-private partnerships. For example, The Gulf Coast Hydrogen Hub, is composed of many large industrial partners such as Chevron, ExxonMobil, AES Corporation, Air Liquide, and Mitsubishi Power, as well as academic partners like the University of Texas at Austin and non-profits like the Center for Houston’s Future and Houston Advanced Research Center. Many hydrogen hubs also represented a partnership between multiple states. For instance, the Mid-Atlantic Hydrogen Hub represents a partnership between Pennsylvania, Delaware, and New Jersey, and the Appalachian Hydrogen Hub is a partnership between Ohio, Pennsylvania, and West Virginia.

While there is strong support for renewables across most hubs, there is also a tacit acceptance that electrolytic, or green, hydrogen is not cost-competitive just yet, and it is too early to exclusively focus on renewables further upstream. There is room for biomass in California and natural gas (plus carbon capture) in Texas, indicating that there is a need to balance the growth of supply and liquidity in the market as well as the carbon intensity of the produced hydrogen. Use of nuclear energy to produce “pink” hydrogen also earned a nod in the Mid-Atlantic and the Midwest regions. The successful May 2023 test of blending 38% hydrogen with natural gas for power generation by Constellation Energy – the U.S.’ largest operator of nuclear power plants – likely tipped the scales in nuclear energy’s favour.

Uncertainty and Risks

The hydrogen market is poised for significant growth, but there are several remaining sources of uncertainty and risk. Key among of them is the tension between the high cost of low-carbon hydrogen and the low willingness-to-pay by current users and early adopters of hydrogen as a decarbonisation option. Hydrogen adoption is critical to generating momentum on the supply-side to drive production costs down and eventually bridge the gap with customers’ willing-to-pay. Although the DOE’s grants are a welcome step in the right direction, are they stretched too thin to generate much-needed momentum? The Gulf Coast Hydrogen Hub and California Hydrogen Hub are earmarked to be funded at the top-end of the grant range, but are also some of the most industrialised, heavily populated, and geographically vast hubs. With an average of $1 billion in grant funding per hub, there will need to be significant private investment to drive supply-side growth and generate the much-needed liquidity to kick-start the clean hydrogen market.

The IRA’s tax incentives for hydrogen are also awaiting guidance from the U.S. Department of the Treasury on rules pertaining to additionality, geographic, and temporal correlations. Developers and investors alike will be hoping that, at the onset, the rules will be sufficiently relaxed to ensure the full extent of the IRA credits are available to projects under development. Indeed, AFRY’s hydrogen project optimisation and levelised cost modelling shows a significant reduction in cost if time-matching is relaxed from an hourly to a monthly or quarterly frequency.

The hubs, with the co-location of producers and end-users, will certainly help reduce the cost for infrastructure investment and delivered costs to consumers but more support will be required to attract early adopters of hydrogen. But, there is little demand-side support in the United States. Europe, on the other hand, has initiated buyer-oriented schemes and the export potential to markets in Northeast Asia and North-western Europe is an exciting prospect for U.S.-based hydrogen producers and may partly address the overarching offtake concerns oft-cited by project financiers.

Our Hydrogen Expertise

At AFRY we are a leading advisor to the hydrogen industry, providing a “one-stop-shop” for clients across the whole value chain at whatever stage in their transition to clean energy. We can support your business through thought leadership and advisory services, business concept design, feasibility studies, and project implementation and financing. A top consultancy in hydrogen innovation, we have delivered over 200 projects globally in over 30 countries since the beginning of 2021.

Interested in how we can support your hydrogen projects in North America? Please contact our experts below.