Acquiring sustainability

Mergers & Acquisitions supporting acceleration towards achievement of sustainability goals.

Whilst headlines continue to highlight the death toll the pandemic has levied upon humanity, some might say that we have neglected to pay attention to the health of our planet. The symptoms of the years of harm that consumers and industry have inflicted upon our planet are increasingly evident. A slow and painful death now appears inevitable.

What more evidence of the gradual destruction of our planet do we need than the astounding floods in Germany and China, the uncontrollable fires in Canada, California and Greece and most shockingly the fact that rain, rather than snow, is falling for the first time at the melting summit of Greenland.

Whilst companies grapple with the stultifying economic impact of Covid, it may seem unfair to expect them to focus on expensive and distracting projects designed to meet ambitious sustainability targets which governments have imposed and which they, in pre-Covid times, happily committed to. However, if we really are to save this planet and reverse the impact of our indulgent and wasteful lives, our habits must change and this starts with the industries and companies which feed those habits.

With great power comes great responsibility

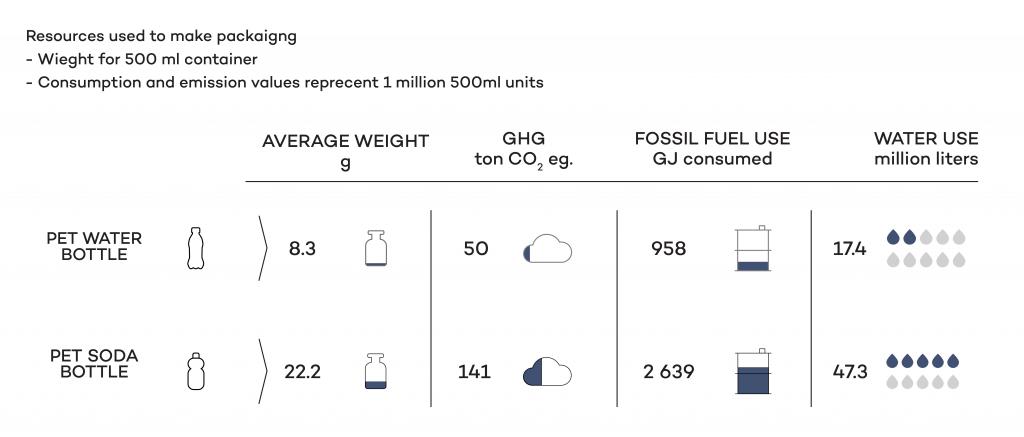

The manufacturing and industrial sectors have the heaviest environmental footprint. The reality is that companies that manufacture will emit CO₂. Packaging companies particularly so.

Worse than that, not only do packaging companies emit CO₂ in their manufacturing processes (e.g. glass furnaces run at 1,300 - 1,500 degrees centigrade 24/7, whilst the manufacture of one ton of corrugated board creates 538 kg of CO₂), the output of these processes, once used, is ubiquitous and associated with global pollution. Their products are one way, short life, disposable waste.

Packaging companies are painfully aware of the need to minimise their environmental footprint and whilst each substrate makes the most of its positive associations (and we have heard them all: "fully recyclable, recycled, prolongs shelf life, reduces transport, 100% biodegradable" etc.), the painful truth is that the packaging industry still needs to run as fast as it can to reverse global meltdown.

Joining forces for a greener tomorrow

Billions of dollars are being spent across the packaging industry in R&D for efforts to find solutions for recycling, downgauging, minimising CO₂ and enhancing the inherent packaging qualities. Whilst some companies are happy to do so and will continue to be the drivers of innovation, others are taking a shortcut through M&A – and why not?

New infrastructures or technologies, which can support the achievement of environmental goals of the global packaging industry, if acquired and deployed by bigger and broader concerns, will have a bigger and broader positive impact on our planet.

Packaging companies are learning from each other, integrating and combining knowledge and technology – either through acquisitions or the creation of JVs. Teamwork makes the dream work – working together, using each others skills, ideas, investments and knowledge will accelerate our race to reverse or at least slow down environmental damage.

M&A is being used by packaging companies who wish to accelerate their journey towards a more sustainable future. Doing so brings benefits in the form of lower tax bills, lower penalty charges and a profile which is more likely to attract the new environmentally aware consumer. Recent examples of sustainability driven M&A can be seen in the table below.

M&A across the substrates – an expedited path to improved sustainability

The EU has announced that taxes will be applied if bottle manufacturers fail to achieve certain levels of recycled content in their products and FMCG companies are using the promise of recyclability and recycled content in their packaging as a marketing tool. These sustainability drivers are forcing plastic packaging companies to rapidly accelerate the use of Post Consumer Recycled (PCR) content in their production.

Development of this capability, particularly when using mixed waste sources is complex and therefore companies such as Alpla and Resilux have been scanning the market for acquisition targets which they can integrate into their company to provide ready access to both the technological know-how and the recycled materials. For example, in October 2021, Alpla announced the acquisition of BTB PET Recyling – a company which recycles 20,000 t/a used PET bottles and earlier in the year, the company also announced a JV with PET recycling company Targu Mures and the UK’s Biffa, all of which are destined to help Alpla support its needs in recycled pellets. Meanwhile Resilux is also focussed on obtaining access to the manufacturing of food grade PET by acquiring Swiss recycling company Poly Recycling in Switzerland.

To some it may seem ironic that AP Moeller, the family holdco which defines itself by its investments in businesses that have a positive impact on society “nyttig verksomhed”, has recently acquired the plastic packaging company called Faerch. However, those in the know will appreciate that Faerch has in fact achieved the most impressive levels in producing plastic packaging from recycled content. The company is ahead of its competitors already achieving 70% recycled content in its trays and has recently acquired MCP, a US manufacturer of recycled trays. This is the company’s first step into the US market and represents another example of how companies can accelerate towards their sustainability goals through acquisitions.

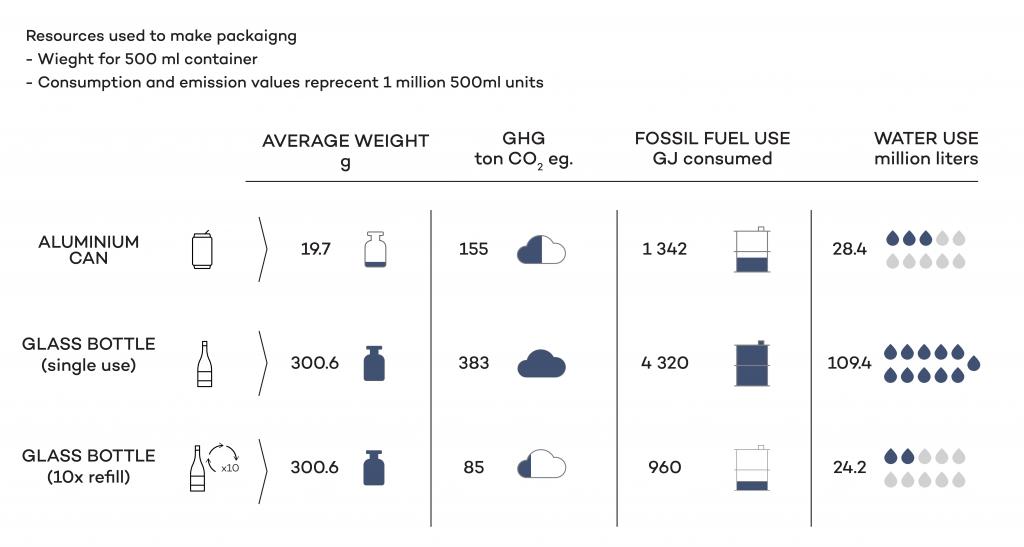

Metal and glass packaging substrates are also in pursuit of stretching sustainability goals and are targeting acquisitions that will help accelerate their journeys. Both metal and glass packaging containers are recyclable and the availablility of the recycled content is often better managed than for plastics.

However, it is the production process of both glass and metal substrates which are of concern. 2% of the world’s human caused CO₂ emissions are from the aluminium production process, that is 1.1 billion tonnes of CO₂ emissions per annum. Aluminium is the metal of choice for packaging companies and so there is still much to be done in this area.

Similarly, running furnaces at 1,300 to 1,500 degrees centigrade 24/7 clearly has an impact on the environment. In response, glass packaging companies in Europe have for the first time agreed to jointly invest and colloborate in order to research the possibility of step change in the CO₂ emissions of the industry. The “Furnace for the Future” programme brings together 19 European glass packaging companies to invest in a 350 t/d furnace which will have 60% lower CO₂ emissions than normal. This will be made possible, because 80% of the gas used to heat the furnace will be replaced with electricity and the process will use a high quota of recycled glass.

Whilst this is not strictly an M&A route to improved sustainability, it is nonetheless a great example of leaning on each other’s expertise to accelerate achievement. Teamwork is once again helping to make the dream work.

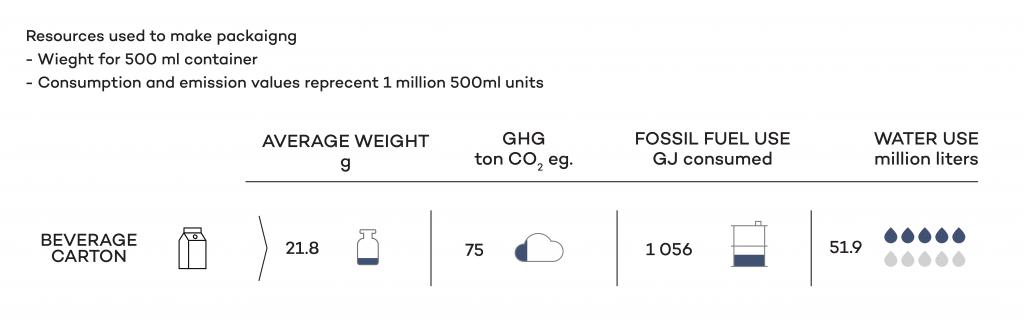

Companies active in the forestry and paper-based packaging segments are benefitting from the positive shift to their biodegradable and environmentally favoured substrate. However, the overall CO₂ footprint is not as favourable as perhaps the consumer may initially think, because whilst their end product is recyclable the process of manufacturing creates CO₂ emissions and effluent. These fibre-based packaging companies also recognise that they need to address their environmental shortcomings whilst also not missing a trick to fully exploit the positive consumer perception of paper.

Forward thinking companies are looking for ways to further improve their sustainability credentials through M&A whilst deploying their fibre based know-how. Stora Enso for example has recently acquired Cellutech, which produces sustainable wood-based foam materials to enable its clients to replace polysterene with fully recyclable inserts for packaging.

Sustainable financing – a new imperative to support M&A

Packaging companies live with the threat of penalty payments should they fail to achieve governmental sustainability targets. They have the additional pressure of having to support the sustainability promises made by their FMCG customers.

In addition to these two important drivers, packaging companies are now also under pressure to demonstrate their ESG credentials in order to access both bank and capital market financing. Credit committees at financing banks were once solely focused on the creditworthiness of their prospective clients. They are now obliged to “de-select” those companies which do not pass muster on their ESG credentials. No doubt banks have developed an environmental conscience, but the threat of their brand being associated through a loan to a company which has a poor track record in sustainability is perhaps a bigger risk than the potential of a default of the loan itself.

Capital markets investors are now also focused on “green funding”. Pension and investment funds around the world are increasingly selective about the sustainable profile of the assets they invest in. The Swedish invention of Green Bonds has now garnered popularity around the world and is being used as a tool to encourage companies to focus on their environmental footprint.

In every other way, these bonds are exactly the same as normal bonds. However the funds raised with their issue must be applied to finance an environmentally driven project, which may include the acquisition and integration of a company that will serve to enhance the acquirer’s environmental footprint.

Examples of Green Bonds in the packaging sector: Logoplaste, Smurfit Kappa, O-I, Graphic Packaging, Ardagh.

In summary, it is fair to say that our universe of packaging companies does not only want to, but is also obliged to, meet the sustainability agenda. Covid has created a temporary mist. However, government direction, incentives, penalties, the sustainability commitments of their client base and the ongoing need to access financing ensure that packaging companies will continue to focus on improving their CO₂ footprint. The critical condition of our planet demands that they do this urgently; and M&A will continue to be one of the most useful instruments in their strategic toolbox to support them.