Are record GB system balancing costs here to stay?

Over the last 2 years, the costs of balancing the GB system have risen to record levels. A large part of this relates to the operation of the Balancing Mechanism.

Through the Covid-19 lockdowns in 2020, low demand increased system operability challenges. Lower inertia and more transmission network congestion led to the System Operator taking much larger volumes of actions in the Balancing Mechanism. In the latter part of 2021, tight capacity margins coincided with mounting commodity prices. The result has been generators setting very high BM offer prices.

Whilst there are factors that are unlikely to repeat in the future (e.g. national lockdowns), AFRY’s modelling suggests that higher balancing costs of the last few years are symptomatic of trends that are going to continue into the future.

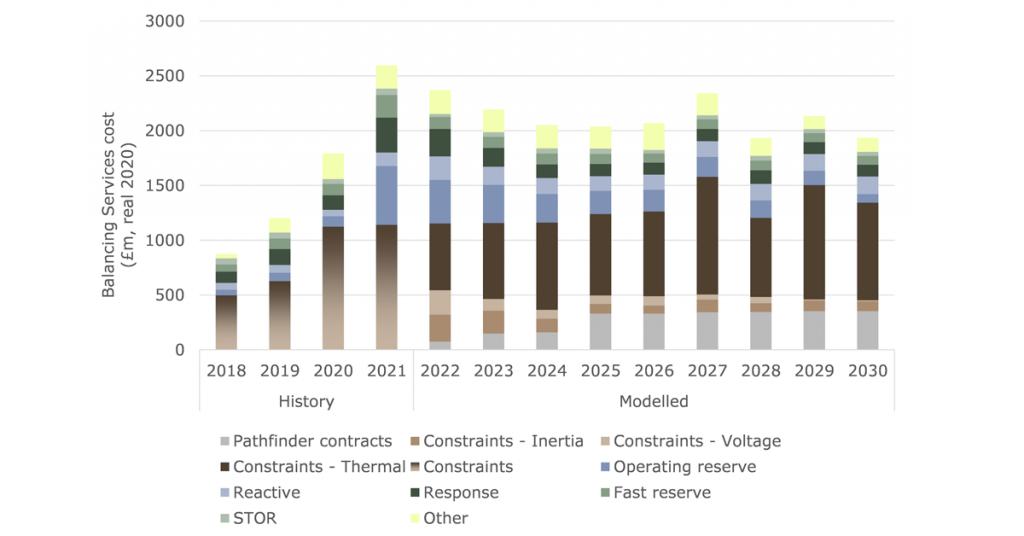

AFRY models the balancing of the system in a granular bottom up basis, using our proprietary power market model, BID3. This includes an 11 zone approach to transmission constraints, as well as modelling of other balancing needs and ancillary services. Our most recent projections of balancing costs, across all dimensions of BSuoS costs, are shown in Exhibit 1.

Exhibit 1 – Historical and projected annual balancing costs (£m, real 2020)

Balancing costs will be heavily impacted by the higher commodity prices in the shorter term. However, aside from this important driver, there are other trends that we expect to observe over the next 10 years.

1. Reform of markets will lead to new technologies providing balancing services. This process has already been happening in relation to li-ion batteries. Introduction of new response products and better access to other markets has contributed to rapid growth in li-ion battery capacity, and over 1GW is under construction. New market opportunities also exist for inertia and voltage services. NG ESO are currently running tenders for provision of these services, as part of their target to balance the grid with zero carbon solutions. These Pathfinder contracts are expected to bring forward investment in technologies such as synchronous compensators or inverter based generators with added grid forming capability.

2. New technologies are already often a cheaper solution than traditional thermal generation, and costs will decrease further over time. Procurement of balancing services via new markets has the potential to widen the pool of technologies able to participate. This would tend to lead to a reduction in costs. In the case of innovative technologies, some learning in capex is reasonable to expect, as has been the case for li-ion batteries. Many of the new low carbon solutions also have the benefit that services can be provided more efficiently, since they do not add excess MW of active power to the grid at the same time. In addition to the example of Pathfinder contracts for inertia, AFRY’s scenarios feature 4hr and 6hr li-ion batteries from the mid-2020s onwards. These and other storage technologies are able to contribute to growing operating reserve needs, without requiring counter balancing actions in the BM as a CCGT would, thus reducing costs.

3. Prices for balancing services are expected to fall on a per unit basis. Due to increased technology options (some with potential for cost decreases) many balancing services will become more competitive. These services are projected to see falling prices on a per unit basis as a result. Other system changes (e.g. increased maximum RoCoF) will also help reduce costs.

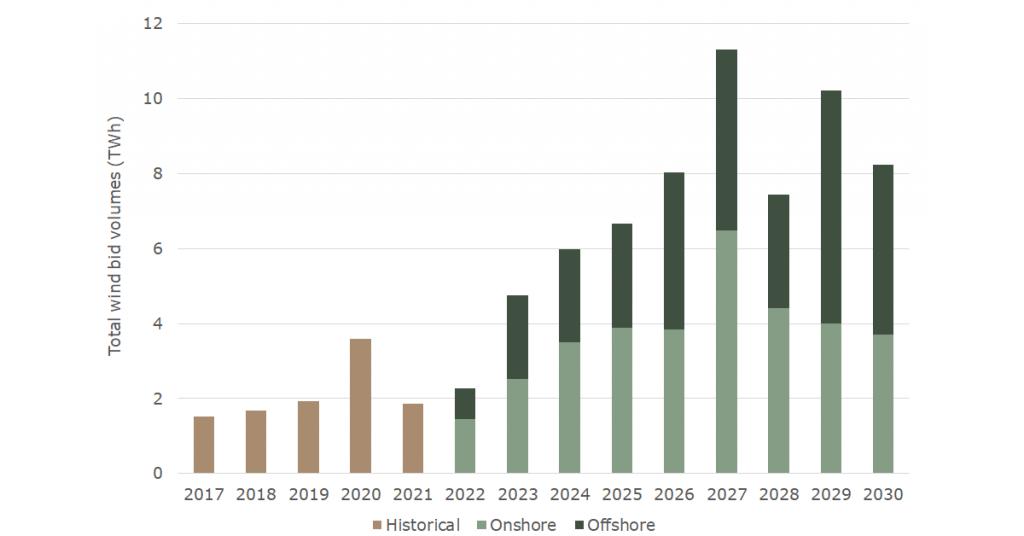

4. Reductions in balancing costs are offset by greatly increased transmission constraint volumes. Based on our modelling, significant new wind capacity behind major transmission constraints is expected to lead to around 10TWh of wind curtailment per year. Constraint costs are typically driven by the bid price of wind and the cost of replacement actions. In future, CfD backed wind with lower strike prices is likely to bid less negatively than ROC supported onshore wind. Nevertheless, transmission constraints are expected to become the single largest component of costs in the BM. Storage technologies can help here, but the short durations of many options limit their ability to reduce constraint volumes. New HVDC Eastern Links ultimately will be required, and they contribute to the reduced wind bid volumes in 2028 and 2030 in Exhibit 2.

Exhibit 2 – Historic and projected wind total bid volumes (TWh)

AFRY’s standard modelling of multiple weather patterns further highlights how low and high wind periods can drive balancing costs beyond the values presented here.

Going forwards, our modelling indicates balancing costs are expected to remain high. However, understanding the degree to which value will disappear from one pool of value or increase in another will be key to developing successful business models. The next 10 years will be key to resolving some of the existing system operability challenges. In a more weather driven system, factors like location will be increasing drivers of value. New storage capacity and other low carbon technologies will be required to provide balancing services.

AFRY is helping developers make the most of these opportunities by deploying its models to quantify them.