China expects to achieve its 2030 wind and solar ambitions ahead of schedule in 2025

In a ground-breaking achievement, China is well on track to achieve its 2030 renewable energy targets five years ahead of schedule, underscoring its commitment to a sustainable and greener future.

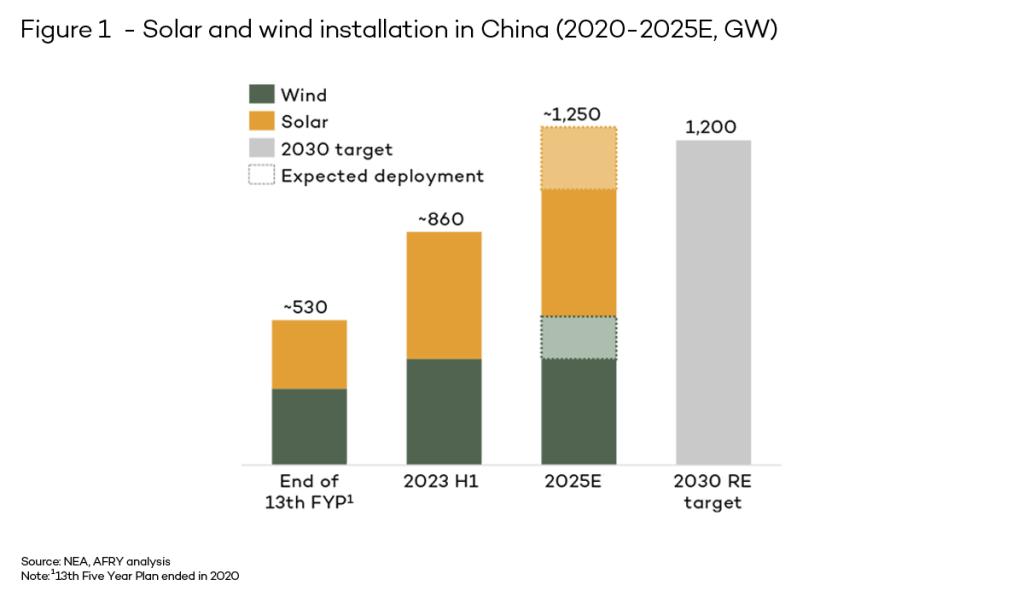

AFRY’s analysis shows that China is making substantial strides in the adoption of renewable energy, reaching over 1200GW by the end of 2025, a milestone that surpasses the government's original 2030 target.

Ten years of progress in one Five-Year-Plan period

During the United Nations Climate Ambition Summit of 2020, President Xi Jinping articulated China's commitment to tackling climate change head-on, outlining ambitious objectives that include achieving a total installed capacity of 1200GW of wind and solar energy by 2030. Given current provincial plans and the pace of deployment, this target could be met in 2025.

Recently there has been a remarkable surge in renewable energy deployment in China, with an eye-watering 60% increase from ~530GW in 2020 to ~860GW in just two and a half years. As we find ourselves midway through the 14th Five-Year Plan (FYP), at AFRY we have reflected on progress made to date and as a result anticipate that China will reach the renewable target of 1200GW. This would be a remarkable achievement, delivering five years ahead of schedule. Among the total new installed capacity during the 14th FYP period (2021-2025), we anticipate that renewables will account for more than 70%.

Furthermore, our analysis indicates that the total installed capacity in China will reach approximately 3200GW, surpassing the government's target of 3000GW by the end of the 14th FYP.

Renewable deployment in China has been hugely successful, but the game is changing

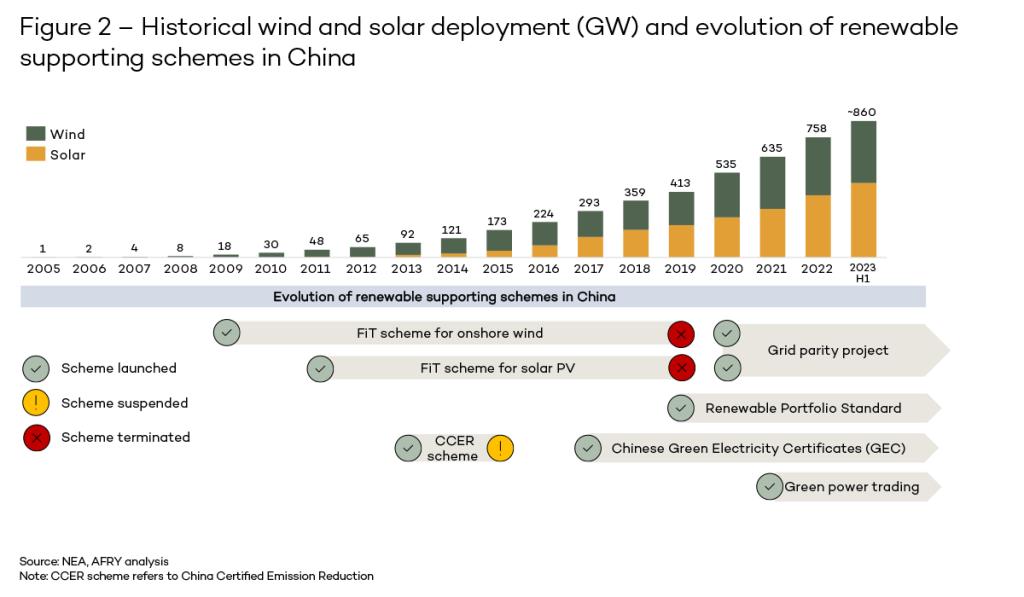

Installed capacity for solar PV and onshore wind in China is now approaching 1 terawatt, having been near-zero less than two decades ago. The remarkable success of Chinese renewable deployment can be traced back to aggressive policymaking that has encouraged deployment and improved manufacturing efficiency, leveraging economies of scale to accelerate deployment

The Chinese government has launched a range of support schemes to promote renewables deployment since 2009. The Feed-in-Tariff (FiT) spurred initial growth; however, Chinese policymakers were not afraid to adapt to the evolving landscape. As renewable technology costs plummeted, the FiT scheme was no longer representing value for Chinese consumers and has since been replaced with a raft of measures. Currently, new solar and wind projects are either grid-parity projects (receiving provincial regulated equivalent to prices paid to coal generators) or market-based projects trading through forward markets, green power markets or the spot market (depending on provincial liberalisation progress).

At AFRY, we are applying our internationally recognised power price forecasting methodology using our BID3 model to understand potential future revenue streams along with ongoing market development. Going forward projects will be increasingly exposed to wholesale electricity prices and associated price risk. We believe understanding the potential trajectory of China’s future energy landscape is essential for developers, investors, and utilities to identify opportunities and risks for their existing projects and project pipelines.

Whilst energy revenues constitute a significant portion of total project income, the maturing markets in China are embracing renewables with additional value streams. Innovative schemes for green attributes are gaining prominence in the form of green certificates. These certificates, whether through unbundled (Chinese Green Electricity Certificates) or bundled certificate trading (green premium trading), add an extra layer of financial support. These evolving revenue streams play a crucial role in incentivising developers to maintain the rapid pace of deployment and are poised to remain a pivotal component in driving the ongoing decarbonisation efforts of China's power sector.

Power market liberalisation is the key to unlocking the clean energy transition

The power market in China is undergoing profound reform, with market liberalisation a key focus for policymakers and energy companies alike. The government is seeking to unlock savings through encouraging competition across both generation and retail. The liberalisation of wholesale electricity markets will see China moving away from centrally-determined ‘benchmark’ prices where technologies receive a fixed price per unit of electricity generated based on technology to a market-based pricing scheme, reflective of the marginal cost of generation.

The implementation of spot markets will be crucial for China to manage the growing and increasingly intermittent system emerging from a historically thermal dominated system. The limitations of central management for such a large and complex system are clear. It is becoming increasingly difficult for centralised decision-making to unlock the flexibility required under the new paradigm. The inception of dynamic pricing, characteristic of wholesale electricity markets, will allow for the economic allocation of resources. In an energy system so large, even small efficiency gains will result in vast savings for Chinese energy users.

Spot market pilots have been rolling out across China since 2018, the 1st and 2nd batch of pilot markets covers many of the biggest energy producing and consuming provinces to maximise impact across China.

Recent announcements from Chinese government have underlined the importance of liberalisation in China’s energy strategy. In the Energy Work Guidance for 2023 (a document that sets out the government’s energy priorities) published earlier this year, a dedicated section explores the significance of market reform in the overall energy landscape. The plan outlines a series of measures designed to expedite the establishment of a unified nationwide electricity market and strengthen the interactions between forward, spot, and ancillary service markets. In a bid to align with a modern energy market, a comprehensive set of working plans and guidance documents is poised to fundamentally reshape the energy sector.

A more intermittent system will bring new challenges for energy security

China’s extraordinary growth in renewables poses new challenges for the energy system in China. Energy security has risen on the agenda since recent geopolitical events shook global energy markets. The global commodity crisis came against a backdrop of extreme weather events within China. Extreme dry conditions reduced the ability of China’s power system to rely on their usually abundant hydropower, resulting in power shortages in some provinces. The extremely tight situation that China’s power system observed in many provinces over the past couple of years has precipitated a barrage of responses from central and regional governments within China. As a short-term measure, new coal and gas plants have been approved, particularly in severely affected regions, but this alone won’t be sufficient to fix systemic weaknesses.

To ensure a resilient power system in the future, China will need to adapt. Balancing the intermittent nature of renewables, fortifying supply chains for renewable technologies, and addressing grid reliability are among the key facets of the next stages of China’s evolution. The Energy Work Guidance for 2023 outlines an expansive strategy to address these challenges, including:

Enhancing Energy Supply Security:

- Emphasis on domestic production for coal, gas, and oil in the Northwest and Southwest regions.

- Storage facilities for coal and gas (LNG) will be augmented to ensure fuel security and flexible dispatch.

- Coal generators are required to retrofit to address three key dimensions – flexibility, heat supply, and energy efficiency.

- New large-scale flexibility, in particular from pumped-hydro plant.

Completion of Energy Legislation and Policy Framework:

- The policy framework and market rules for the smooth transition from current arrangements, ultimately to a national inter-linked power market.

- Further increase the trading volume in both forward and spot markets, accelerating liberalisation.

- Other related policy frameworks to address industrial standards & schemes for emerging technologies such as energy storage, hydrogen and CCUS.

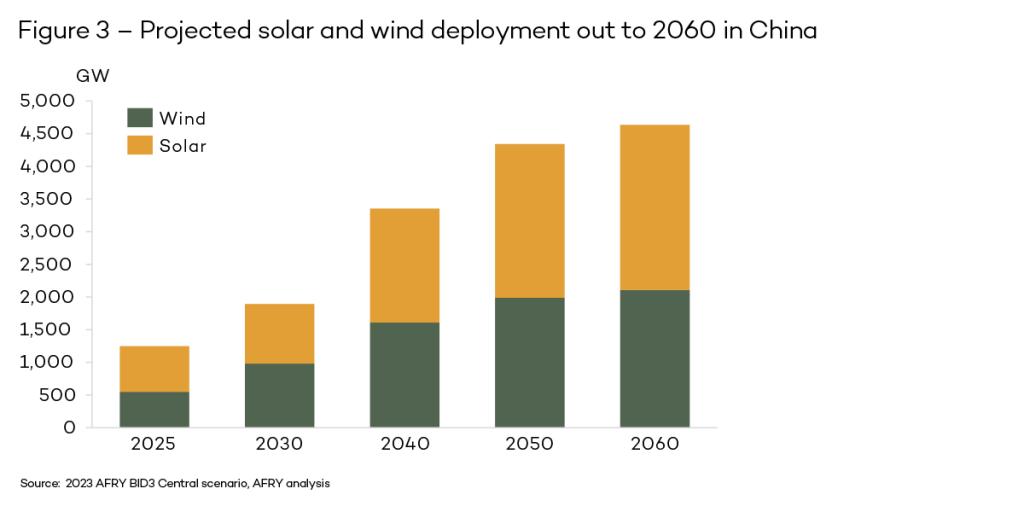

China will have to strike a delicate balance between continued rapid deployment of renewable technologies and energy security. Policymakers are acutely aware of the challenges they face, but also the opportunities presented by the green transition. China is already home to vast manufacturing bases for renewable technology components and is the world’s biggest generator of renewable electricity. AFRY expects China to reach over 4300GW of wind and solar by 2060, five times the installed capacity today.

Reaching China’s net-zero commitment by 2060 represents a vast opportunity for investors, but understanding the local energy market dynamics in China will be key to managing risks throughout China’s energy transition.

AFRY’s power market model - AFRY BID3

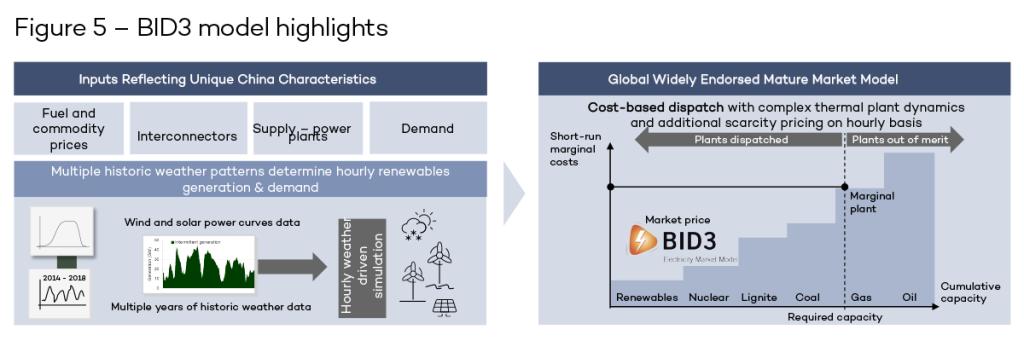

AFRY’s BID3 model has been well-recognised in the industry for decades as we provide “Independent, Trusted and Bankable” projections and analysis to our customers. In AFRY China, we have provided power market projections since 2018 for domestic, private, and foreign companies across generators, investors, consumers, and financial institutions. Our model covers 31 provincial markets in China, providing hourly economic dispatch and optimisation over the whole modelling horizon until the year 2060.

BID3 is a dispatch model that simulates optimal dispatch of power markets on an hourly basis – day ahead (and for some geographies, balancing market). Key outputs include electricity prices, dispatch/generation of power plants (including plant start-ups) and flow across interconnectors. BID3 works cohesively with our commodity market models, receiving the commodity prices, as well as the demand for heat and transport from; and feeding back the power demand for the commodities and the electricity prices to these models.

Learn more about BID3 here.