District Energy: The Key to Decarbonising the UK's Heating Sector?

District energy is seen as a key solution for large-scale decarbonisation of the heating sector to achieve net-zero by 2050.

The heat sector in the UK currently accounts for more than one-third of the UK’s greenhouse gas emissions. The UK’s heat and building strategy, published in October 2021, identified district energy as a key solution for large-scale decarbonisation of the heating sector to achieve net-zero by 2050.

Though there are more than 14,000 heat networks in the UK, they only serve ~2-3% of the national heat demand, in stark contrast to their contribution in many NW European countries where heat networks can account for up to 50% of heat supply. However, multiple studies, including those undertaken by Government, estimate that district heating solutions may account for 18-20% of UK heat demand by 2050.

To support this ambitious growth, the UK government has initiated a range of financial and regulatory support measures including:

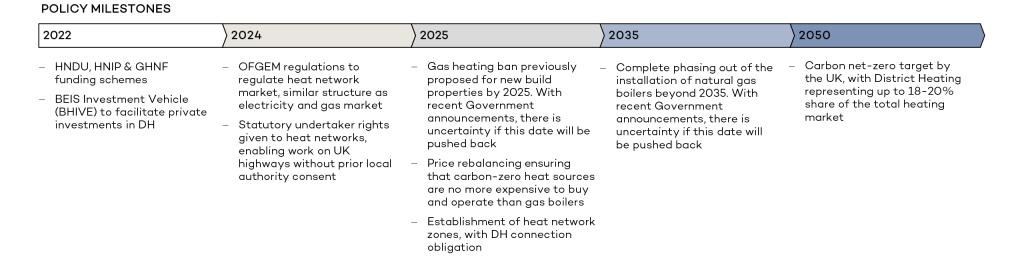

- Commitment to capital funding for district heat networks through various grant programs: The key funding programs are the Heat Networks Investment Project (HNIP) with a total grant and loan investments of £320 million in England and Wales (2018 – 2022) and the Green Heat Network Fund (GHNF), which was initially a 3 year, £288 million capital grant fund supporting the commercialisation and construction of new low and zero carbon heat networks and retrofitting and expansion of existing heat networks. The fund duration has been extended to 2028, with the extension including £220 million across 2026-2027.

- Gas Boiler phase-out: Ban on the installation of gas boilers on new buildings in 2025 with a complete phase-out of gas boilers by 2035 in the UK. With recent Government announcements, however, there is uncertainty if this date will be pushed back.

- Heat Network Zones: Piloting heat network zones across 28 locations in the UK which will require buildings to connect to a heat network. These are areas where heat networks have been identified to be the lowest cost low-carbon solution.

- New Regulatory Framework: In December 2021, Ofgem was appointed as the regulator for heat networks although legislation is currently being drafted. Ofgem’s role will be to ensure consumers receive fair prices and a reliable supply of energy.

This provides substantial opportunities for developers and investors in the space. However, there are also challenges and uncertainties that need to be overcome:

- Decarbonising existing heat network supplies: the primary fuel source across the UK’s heat networks is natural gas (>95%) with a limited contribution from electric and biomass boilers. Natural gas sources will need to be replaced with low-carbon sources which may include higher uptake of electric or gas boilers, hydrogen sources (although the market is very nascent) or localised sources such as heat pumps.

- Competitiveness with stand-alone low-carbon alternatives: Gas boilers are the current incumbents in the UK market. Alternative technology include localised heat-pumps which offer high decarbonisation potential and can be deployed in urban settings but are expensive to install. District energy systems bring economies of scale and are typically the most economical solutions in urban settings. The Levelised Cost of Heating (LCOH) for district heating solutions could be lower than communal/independent AHSP over the medium to longer term making it a more economically attractive technology.

- Clarity on the regulatory regime: Although Ofgem was appointed as regulator, legislation is still uncertain including the strategy to roll out Heat Network Zones as well as future pricing regulation.

- Lack of standardisation on production and supply contracts and termination risk: Fee structures and contract lengths lack standardisation and vary from project to project. Initial Capex cost to build out the heat network, subsequent Capex and O&M costs are typically recovered through a combination of one-off connection fees and recurring annual fixed charges, with the balance and utility costs being recovered through ongoing heat tariffs. Contract specifics (e.g. level of fixed charges vs connection fees) are subject to discussion and agreement with customers. Typical revenue contracts are of an annual rolling nature or a hybrid between an initial fixed period followed by annual rolling periods. Heat purchase contracts, however, are typically fixed and long-term in nature (up to 25 years) which can give rise to a termination risk.

AFRY has completed several district heating projects with the provision of due diligence services in the UK and Europe, including being the Commercial, Technical and ESG advisor on the acquisition of Pinnacle Power by DIF.

If you would like to discuss things further or analyse the impact it might have on your investment decisions, please reach out to our experts below.