Headwinds or tailwinds? The impact of nuclear restarts, firm and non-firm connections on Japan offshore wind curtailment risk

In the aftermath of the Great East Japan Earthquake and subsequent Fukushima disaster, coal, oil and particularly LNG have been the primary resources powering Japan’s position as one of the largest economies in the world. In addition, significant energy conservation efforts and strong uptake of distributed solar generation have brought Japan new optimism.

Currently, Japan is facing new challenges on the path towards net-zero by 2050. To reach net-zero, Japan set-out ambitious decarbonisation targets for the power sector, and across the wider economy. A key feature is the accelerated uptake of renewable generation, but so far, uptake of large scale solar and onshore wind has been problematic, due to – among other things –regulatory restrictions on land use and complicated permitting processes. Japan has now arguably successfully turned its policy towards stimulating the uptake of offshore wind as well as the use of more nuclear energy, both of which will help reduce carbon emissions. But can these twin pivots co-exist?

Following last year’s announcement to accelerate the restart of nuclear plants that were mothballed after the Great East Japan Earthquake, the Japanese cabinet this year approved a policy to allow new nuclear power reactors to be constructed and the operation of existing reactors to be extended possibly beyond 60 years. Increasing nuclear generation will help reduce greenhouse gas emissions in the short- and possibly long-term. It will also ease Japan’s LNG dependency – a valuable move, in the wake of the global energy crisis. On the other hand, the prospect of increasing nuclear generation in Japan will tend to increase curtailment risk for renewables, including offshore wind. This increased curtailment risk is not necessarily the result of the alleged inflexibility of nuclear plants, but more likely a consequence of existing curtailment guidelines applied by OCCTO.

The opportunities for offshore wind are attracting global interest from the world’s largest developers, but it may take a decade before substantial capacity is installed and operating. Significant investment is required in both the offshore wind supply chain as well as Japan’s weakly interconnected transmission system from offshore wind hubs in Kyushu, Hokkaido and Tohoku to load centres in Tokyo, Kansai and Chubu.

Transitional measures to reduce carbon emissions in the short-term in Japan were in the past focussed on increasing gas generation, but without any substantial gas reserves, Japan has become completely dependent on imported LNG. In the winter of 2021 Japan experienced significant gas shortages, a risk that has now compounded due to the Ukraine war and high world gas prices during winter 2022/23. Japan has doubled down on subsidising the development of green hydrogen, by forming strategic alliances with countries like Australia to produce it at low cost, import it to Japan and co-fire it in gas turbines. Yet, this is more of a mid-term transitional solution as the cost of green hydrogen is still too high to become a serious competitor to other resources, including gas.

Therefore, a viable short-term solution to Japan’s immediate transitional problems, and resource dependencies, is the plan to accelerated restart of nuclear power plants that have been idle since the Great East Japan Earthquake. This plan has been met with some scepticism, but social acceptance has been growing, due to rising power prices and devaluation of the Japanese Yen, which are arguably the result of Japan’s extreme reliance on imported resources.

The improving attitude towards the restart of nuclear plants may come at a price, though. The more “liberal” view on the use of nuclear generation has led to other favourable measures approved by government, such as extending the operating life of the existing nuclear plants and even allowing new builds, or “under construction” plants since Fukushima, to resume. From a greenhouse gas emissions perspective these are positive developments and they do not necessarily conflict with larger volumes of renewables – in fact a larger share of nuclear capacity could possibly be optimised to accommodate integration of variable renewable generation into Japan’s power grid.

However, the key caveat is embedded in OCCTO’s Transmission and Distribution Operational Guidelines (Clause 173 and 174). This policy explicitly puts nuclear generation last in the curtailment order, before wind and solar. So by increasing the nuclear capacity (and generation) in the grid, the risk of curtailment of renewables (including offshore wind) may significantly increase in the long-term in connection with larger shares of nuclear generation.

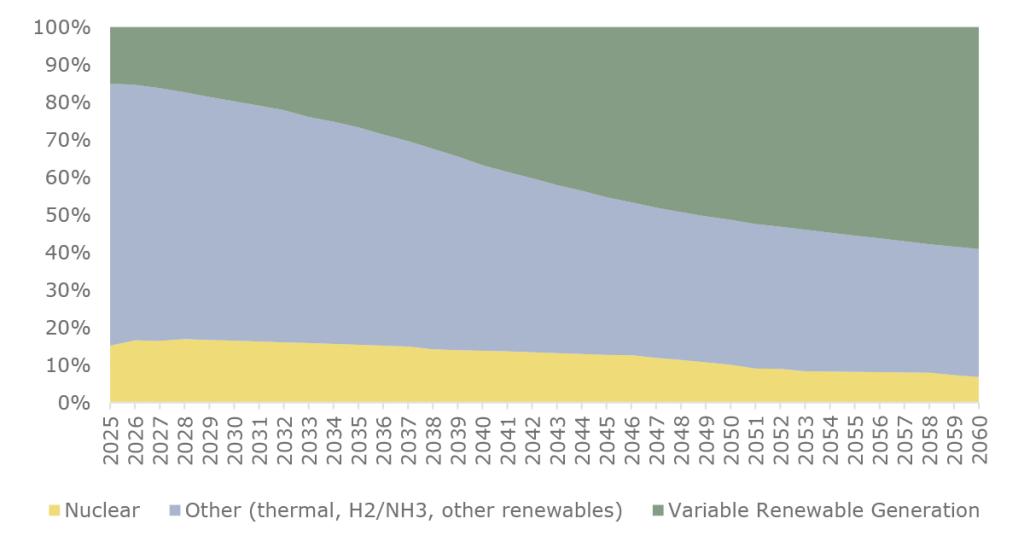

Figure 1: AFRY Central scenario - projections of generation shares in Japan

Prioritising nuclear generation increases curtailment of offshore wind

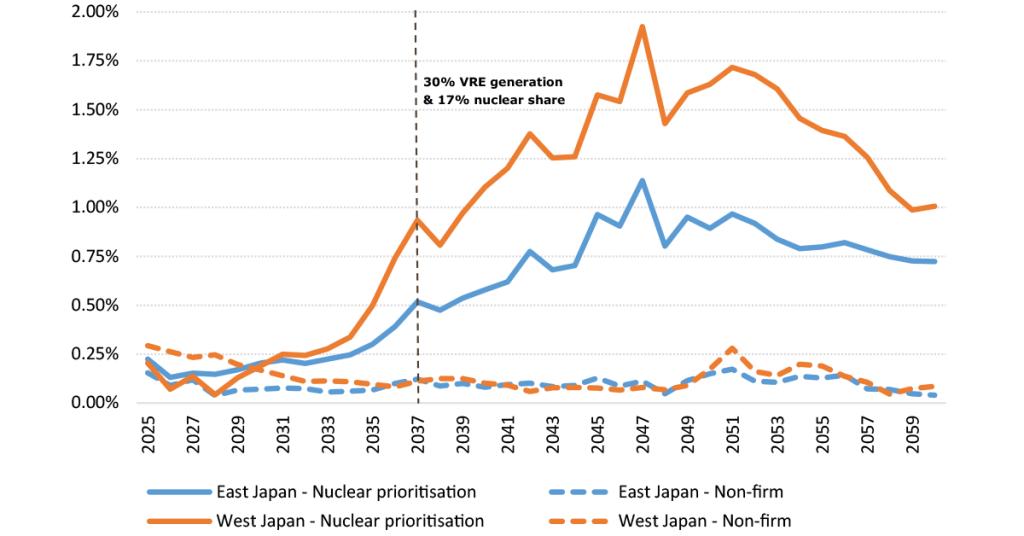

By designating nuclear plant as “must run” in our power market modelling, we found that average curtailment of offshore wind may increase by 1.9% and 1.1%, for West and East Japan, respectively, relative to our reference case, AFRY’s Central scenario. In our Central scenario, curtailment is purely based on economics (relevant cost including fuel, stop and start costs) and interconnector capacities. The annual curtailment increases, due to the inclusion of nuclear prioritisation, are included in Figure 2, with the orange solid line representing the additional expected curtailment in West Japan and the blue solid line representing the same for East Japan.

Figure 2: Curtailment risk resulting from OCCTO merit order policy, which prioritises nuclear generation over RE

Firm and non-firm connections

Another measure to accelerate the energy transition in Japan is the introduction of the non-firm connection policy (“connect and manage”), which has been applicable nation-wide since 2021 for the entire power system and extended to all forms of new generation in 2022. This measure introduced another barrier for renewable uptake as plants on a non-firm connection agreement would be curtailed first, regardless of their marginal cost or emission levels (e.g., a coal plant with a firm connection agreement could keep generating while a wind farm on a non-firm connection is curtailed). Moreover, most recently the merit order policy, and thus the prioritisation of plants, has been updated to allow for consideration of marginal cost and carbon emissions. Overall, these adjustments are considered good news for renewable plants, since marginal costs as well as emissions are (near) zero.

However, the new policy is likely to impact the curtailment of future renewable generation connected on a non-firm basis, as a significant share of renewables (mostly solar PV) has been connected on firm contracts. It follows that those ‘firm’ plants will be among the last to be curtailed under the new merit order rules. AFRY modelled the potential curtailment risk and found that the average offshore wind curtailment in Japan could increase by 0.25% as a result of the firm renewable generation already connected, compared to our Central scenario reference case. The curtailment is disproportionally skewed to (offshore) wind power, since there is limited (offshore) wind generation connected on firm connection agreements. A visualisation of the annual curtailment increases for non-firm offshore wind is included in Figure 1, with the orange dashed line representing the additional expected curtailment in West Japan and the blue dashed line representing the same for East Japan.

Regional differences can be significant

The above analysis shows the average impact of nuclear prioritisation and non-firm connections on offshore wind curtailment in East and West Japan. However, regional differences can be significant, depending on the key characteristics of a particular region, including the share of nuclear generation, renewable penetration levels of onshore wind, offshore wind, and solar, installed storage capacity and other factors. AFRY can provide detailed regional curtailment assessments, including a number of sensitivities, for your projects out to 2060.