The Price Is Right

Could the United States be a frontrunner in the next generation of sustainable textile fibres?

The global fashion industry is being forced into rethinking how it does business. Governments across the world, especially in the European Union, are mandating industry participants to lower their environmental impact and develop more sustainable approaches to textile design, production and end-of-life management 1 . In response, the fashion industry, through its Fashion Industry Quarter for Climate Change, has pledged to achieve net-zero greenhouse gas emissions by 2050.

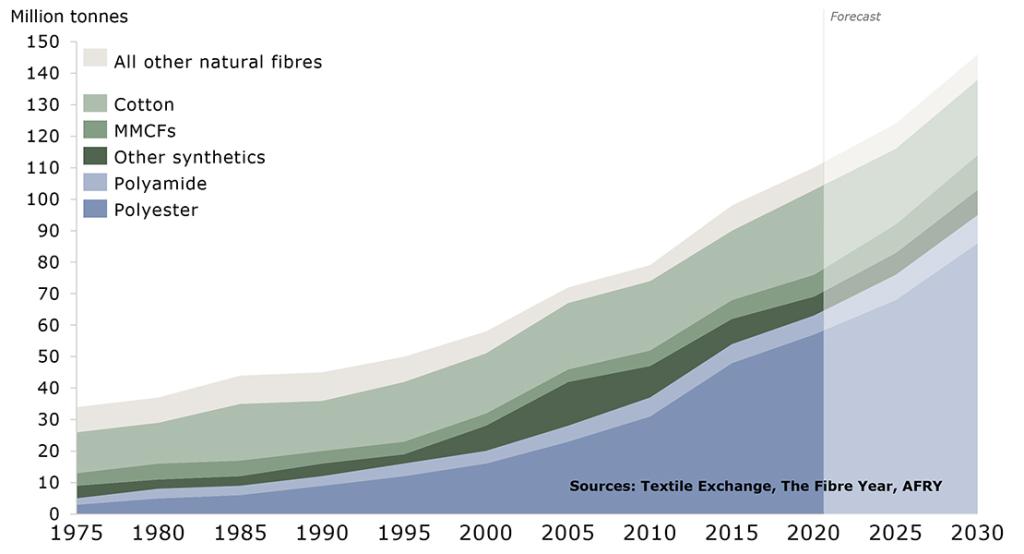

Achieving this goal will not be easy. The global textile industry produces over 109 million tonnes of fibre annually. In the process, it generates 1.2 billion metric tonnes of carbon dioxide emissions, more than the emissions from all international flights and maritime shipping combined 2 . In terms of end-of-life management, less than 0.5% of post-consumer textiles are recycled 3 .

Cotton is the second most-produced textile fibre in the world after polyester, accounting for almost 25% of global fibre production. It is by far the most widely used natural fibre, with major producers being India, China and the United States (see Figure 1). Cotton production (in terms of tonnes of fibre produced) has not increased significantly over the years. Any small increases observed have been attributed to improved genetics and agronomic practices, but yields overall have remained flat since the early 2000s.

As with any crop, cotton requires the availability of arable land. As such, it could be argued that cotton cultivation is in direct competition with crops that could otherwise be grown for food. Extreme weather conditions now taking place at virtually all the world's major cotton producers are profoundly impacting cotton production. Heavy rains and the influx of pests in India have reduced cotton crops, so much so that the country is now importing cotton supplies. In China, nationwide drought warnings have raised concerns about the upcoming harvest season, and in the United States, forecasters expect farmers to abandon more than 40% of the 12.5 million acres of cotton crops as a direct result of severe drought conditions 4 .

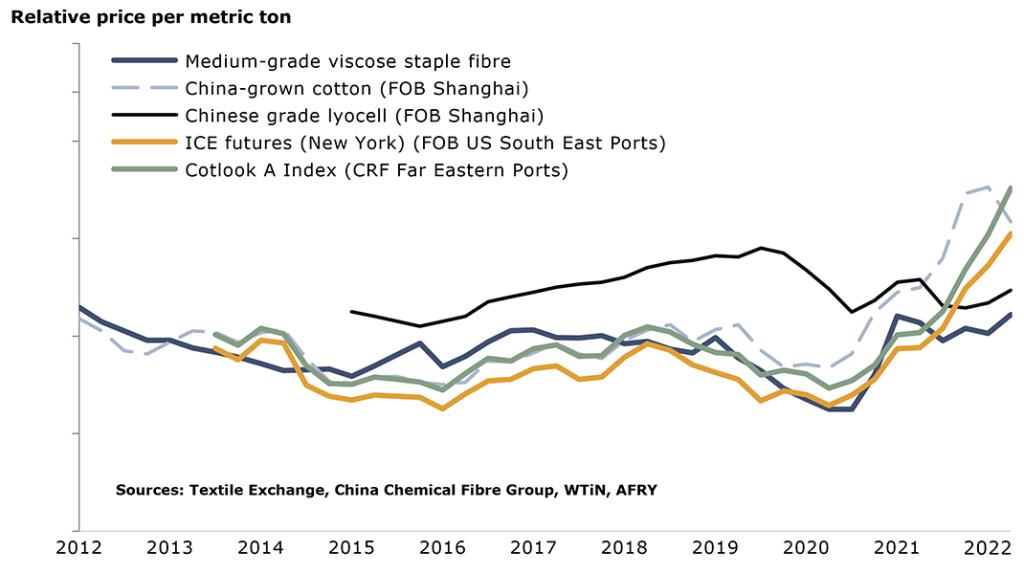

Growers in the U.S. Southwest, who rely almost exclusively on irrigation to grow their crops, have abandoned fields as the extreme heat has decimated cotton crops. Prolonged drought conditions have led to unprecedented water shortages in western reservoirs and a rethinking of water management in the region, especially water directed to agriculture. Consequently, the price of cotton has skyrocketed to greater than $3,000 per tonne, and with it, opening the door a little wider for alternative natural fibres like hemp, which can be grown on marginal lands not used for food crops, as well as man-made cellulosic fibres (MMCFs) such as viscose and lyocell (see Figure 2).

When originally introduced onto the market, MMCFs were positioned as a substitute for cotton because of their comparable fibre properties, including their ability to absorb moisture. Unlike cotton, their production does not require the use of arable land, as almost all MMCFs are produced from wood (specifically dissolving wood pulp). Yet, despite being commercially available for over a century and production volumes doubling in the last 30 years, the market share of MMCFs in today's textile and nonwovens industries is still only about 6%.

The linear economy: one day you're in, the next day you're out

Against the backdrop of our climate in crisis is our ever-increasing demand for fashion and, therefore, textile fibres. In the last 15 to 20 years, the number of clothing items produced globally has more than doubled, but clothing utilisation (i.e., the number of times a new item of clothing has been worn) has seen a dramatic decline.

Currently, the United States has the highest per capita consumption of textiles, at about 40 kilograms per person (some 88 lbs per person). However, Americans wear a given article of clothing around a quarter of the number of times as the global average. The high turnover rate in clothing results in generating a significant amount of textile waste. According to the U.S. Environmental Protection Agency (EPA), some 85% of all textiles in the U.S. – over 17 million tonnes annually – is either incinerated (waste-to-energy) or sent to landfill 5 .

In stark comparison, nearly two-thirds of all wastepaper generated in the U.S. is collected and reused. Wastepaper collection and reuse is arguably the greatest success story when it comes to material waste recycling. The recycled linerboard industry has been particularly successful as it recovers over 90% linerboard used to produce corrugated boxes. Instead of directing wastepaper to landfills, the paper industry reclaims waste materials, isolates the fibre, and uses it to produce new packaging substrates. Could this be a model for the textile industry?

Innovator's solution: a circular economy

Unlike the paper industry, recycling of textile waste back into textiles is still in its infancy. However, major developments are taking place across the globe, including in the U.S. Today, it is already possible to mechanically separate textile waste into different fractions (e.g., cotton and polyester). Advancements in chemical separation of both cellulose-based and petroleum-derived fibres are developing at a rapid pace.

As MMCF processes regenerate cellulose from their feedstock into textile fibres, their technology is perhaps the ideal platform for the recovered cellulose reaction. Large, established MMCDF producers such as Sater, Lenxing and Birla Cellulose have already started to incorporate some portion of textile waste into their fibres, and all have announced ambitions to scale up this offering. In addition, we are also seeing a plethora of innovative, next generation textile fibre start-ups, such as U.S.-based Circ and Evernu, Finland-based Infinited Fibre Company, and Sweden-based Renewcell, all of which use textile waste as a feedstock for their processes.

Of course, the conversion platforms for converting waste textiles into recycled fibres are just one, albeit important, step in transitioning to a circular textile economy. Equally important is educating consumers on the benefits of textile recycling, establishing appropriate incentives across the supply chain that can stimulate textile recycling, and building the infrastructure needed to collect and sort waste streams.

An American dream?

The U.S. is one of the largest exporters of wood pulp and a global leader in supplying wood pulp fibres used to produce MMCFs. Yet, the production of MMCFs as well as the production of woven textiles and finished clothing is largely based in China and the rest of Asia. Is now the time to rethink the supply paradigm and reshore the production of MMCFs within the U.S.? Continued shortages in global cotton supply due to the negative effects of climate change coupled with industry goals to reduce carbon emissions could easily make the case for expanded domestic production of MMCFs to both make up the anticipated supply shortfalls and meet sustainability goals.

There is also a strong case to be made for America to step up and establish itself as a frontrunner in the new circular economy for textiles. As discussed, the recovery and reuse of waste textiles in the U.S. is nearly nonexistent. As such, the opportunity to recover and reuse waste textiles and achieve success akin to the paper industry's management of wastepaper is enormous.

For either of these opportunities to be realised, supporting government policies will need to be put in place, collection systems for textile waste will need to be established and further developed, and appropriate funding and investment schemes will need to be made available.

Government policies are expected to play an important role in waste textile management, especially as local governments place limits on landfills and the types of materials that can be landfilled. Consider California's ban on waste carpets in state landfills and what this would mean if similar bans were extended to textiles.

Collection systems are essential to waste textile recovery as the lack of a collection infrastructure creates a chicken-and-egg dilemma for would-be recycling technology providers. This is why funding and investment schemes will be critical in jumpstarting the industry and allowing innovative new approaches to waste textile management to be realised.

And, of course, close partnership and collaborations between textile value chain players, providing positive market signals, will also go a long way to speed up time-to-market.

This article was initially published in the International Fiber Journal, Issue 6, 2022.

Next generation textile fibres

Footnotes

- 1. Legl, C. (2022). Why The Circular Economy Is The Perfect Fit For The Fashion Industry, Forbes. a↩

- 2. Ellen MacArthur Foundation (2022). Redesigning the future of fashion. a↩

- 3. Scott, A. (2022). Transforming textiles, Chemical & Engineering News, 100 (11) 22-28. a↩

- 4. Dezember, R. (2022). Drought Devastates U.S. Cotton Harvest, Wall Street Journal. a↩

- 5. United States Environmental Protection Agency (2021). Facts and Figures about Materials, Waste and Recycling: Textiles. ↩