Supply chain hero - Containerboard

Brown containerboard shipping boxes are the unappreciated heroes of the global supply chains. With the growth of online shopping, containerboard boxes have stepped out from warehouses and behind the scenes of supply chains, to people's front porches and unboxing videos.

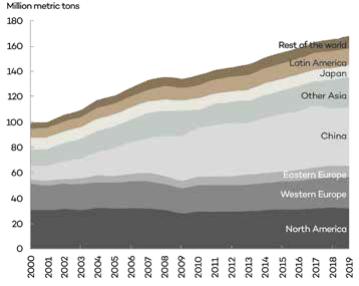

At the same pace of growing consumption of goods in the world, the containerboard segment has become the largest segment of the pulp and paper sector with a consumption of 165 million metric tonnes per year globally. China is the largest containerboard manufacturing region with over 90 million metric tonnes of installed capacity – quite the growth from 34 million tonnes of installed capacity in 2010, with demand close to reaching a double-digit growth rate since 2000. The Western markets of Europe and North America are equally large containerboard consuming regions with a demand of 32 million metric tonnes each and growing.

Movers and makers

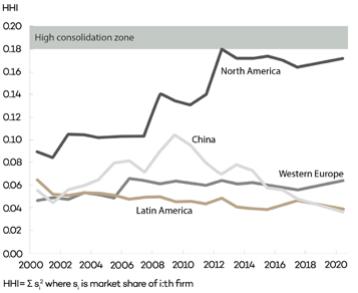

With the growing market demand, the manufacturing companies of containerboard and containerboard boxes have grown in equal measure. In China, the growth strategy has focused on building up new capacities. The leading players, Nine Dragons and Lee & Man, have grown their capacity by 60% since 2011, and have invested in huge containerboard mills with 2-4 million tonnes of capacity at one site. The Chinese containerboard market has stayed in the hands of domestic companies that pursue aggressive organic growth strategies, yet rely much on recycled fibre materials imported from other regions. In North America, until recently, the containerboard sector’s growth strategy was driven by inorganic growth. Since 2000, the North American containerboard market share of the top 5 players has increased from 53% to 78%. M&A activity remained strong until 2018, when in the latest “needle-moving” acquisition, WestRock acquired Kapstone. Over the past 3 years, we have seen a ramp up of new builds and machine conversions of declining newsprint and publication paper machines into containerboard production. These conversions have ultimately attenuated the industry’s consolidation level from its previous peak, yet the North American containerboard industry is by far the most consolidated market in global comparison.

Resilient, sustainable and versatile

Containerboard consumption has stayed resilient through demand disruptions, even though the demand has a high sensitivity to manufacturing industry conditions, during a recession and recovery. All the major economic depressions like the 2008-09 global financial crisis and the COVID-19 pandemic, have negatively impacted containerboard markets across global regions. But in the absence of other economical, solid performing and sustainable packaging solutions, containerboard demand is bound to recover and show its resilience and sustainability yet again. The seemingly simple brown box has not only been resilient, but also adapted to the growing pressure such as more sustainability, the evolving needs for added functionalities and eCommerce packaging. The brown boxes have started to take new shapes and becoming “right-sized” for eCommerce shipments. In markets like China, where easy recycling is an imperative, eCommerce box packages that do not require tape are commonplace functional innovations developed for the needs of the eCommerce channel and the closed-loop fibre value chain.

Both in eCommerce and brick-and-mortar channels, corrugated boxes continue to evolve with the macro-trend of light-weighting to conserve fibre resources, save cost throughout the supply chain, and to align with many brand owners‘ packaging-related sustainability initiatives. Needs for added marketing “pop” and retail-ready packaging solutions have been answered by containerboard manufacturers by adding white liner on top. AFRY estimates that in the European retail environment 30-50% of the boxes are retail-ready packaging formats with white/printed surface, which also help retailers save labor costs and improve shelf-stocking efficiency. Containerboard box manufacturers have answered the need for packaging and product sustainability by innovation in coatings added on the top layer of containerboard to absorb ethylene from produce to extend shelf life, or to obtain water resistance for fish and other protein that is packaged.

Closed-loop champion

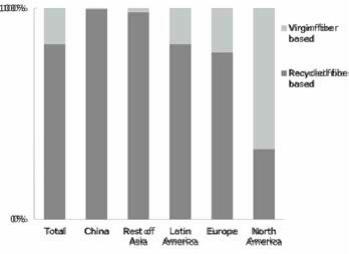

Containerboard is perhaps one of the most “closed-loop” products in the world. 83% of the containerboard boxes in the world are manufactured out of recovered fibre based furnish, mainly using old corrugated boxes, which are collected and shipped to mills to be processed into containerboard again. Driven by increased online shopping and deliveries, residential curbside collection of old corrugated boxes has been growing, which is also negatively impacting the

quality and cost of recovered fibre material available to containerboard mills. Mixed paper represents about a quarter of containerboard fibre furnish in Europe. The composition of mixed waste used in containerboard manufacturing is changing as the consumption of newspapers, magazines, and print, in general, continues to decline. Containerboard mills continue to innovate around fibre raw material. Globally, on average, recovered fibre represents over half of the manufacturing costs for linerboard. Investments in trash handling, fibre cleaning, and screening have enabled mills to process lower quality or contaminated recovered fibre materials and improve fibre yield to maximise the utilization of every fibre. Some mills have been able to include even paper coffee cups and other foodservice items in their fibre portfolio to allow for more fibre sources.

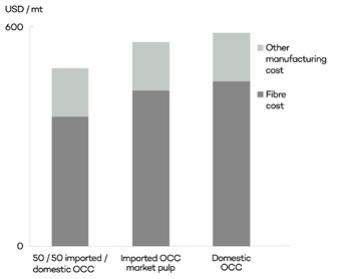

China implementing the National Sword program to restrict waste paper flow into China has changed global recovered fibre flows. A complete recovered fibre import ban to China is expected in 2021, leaving the 90 million tonne Chinese containerboard industry, which has been relying on close to 30 million tonnes of imported recovered fibre, in need of new ways to secure fibre raw material to supply boxes to the Chinese manufacturing sector. Processing the old corrugated containers into a pulp format before shipping them for consumption in China has emerged as an option for the Chinese containerboard mills to import needed fibre raw material. Pulp lines able to process old corrugated containers into pulp are being built in North America as well as in South East Asia, in countries like Laos, Myanmar, Malaysia. Importing OCC pulp can add over USD 70/tonne on Chinese board mills‘ cost structure, but without fibre raw materials, there won‘t be containerboard production. Wood fibres can be reused about six times in paper and board making. Hence, the fibre loop needs fresh virgin fibre to keep turning. Two thirds of the global virgin fibre based containerboard capacity is located in North America amid the vast southern softwood fibre basket and caters both to the large scale domestic market, as well as to export market needs for higher strength and higher quality boxes for applications such as banana boxes in Latin America. Russia has one of the world's largest untapped softwood fibre baskets in the world, and is in close proximity to the fibre-starved Chinese market. Going forward, Russia may emerge as another key source of virgin fibre based containerboard to the global markets, especially to China.

Count on me

Containerboard boxes are a cornerstone of global manufacturing and supply chains. Economic growth, as well as eCommerce growth, have attracted large scale organic and inorganic investments. However, the sector is not protected from economic downturns. Through the reliance on the demand that containerboard boxes meet, and through the alignment with the macro trends of sustainability and the reduction of plastic waste, containerboard boxes and their manufacturers are well positioned to stay relevant, to continue to grow, and to navigate the changing landscape of market demands and fibre input disruptions.