Critical mass

Mining, quarrying, refining and processing minerals and metals is one of the most sizeable industries that pillars nearly half of the global economy.

It supplies us with essential means and solutions to continue shaping the world around us, for buildings, infrastructure, vehicles, machinery and electronics. The catch is that these benefits are linked to environmental harm and climate change.

Written by Josie Armstrong, Ilya Gasparishvili and Nani Pajunen

Terrain disruptions, pollution and contamination have formed a negative image of the mining, minerals and metals industry. The overall land area stressed by mining and quarrying is estimated to have reached 800,000 km2 globally, which is comparable to the size of Germany, Austria and Italy combined. Metal production and related mining processes are estimated to account for up to 10% of global GHG emissions.

Although most of our high-tech products are heavily dependent on the mining, minerals and metals industry, the industry itself is quite traditional, very energy intensive and has, in fact, been underfinanced for decades. However, there are some fundamental changes happening right now that are calling for a sustainability turnaround.

This sustainability turnaround is a must, it is unavoidable, and it is driven by the consumer interest in green and ethical products along with transparent and responsible performance.

This quest for sustainability provides bespoke growth opportunities – a high and rapid increase of demand for metals and minerals, and new investment requirements to engineer and build the future. How will the sustainability turnaround reshape the industry?

Energy transition

The increase in pressure for increased sustainability in the natural resources industry has made mining and metals companies target emissions reductions across their entire value chains. At the production stage, metals producers are seeking to decarbonise both through process improvements, such as energy efficiency investments, and via the use of alternative energy or feedstock sources, including greater use of scrap and renewable energy supplies (RES). RES, in particular, offers an attractive opportunity to decarbonise, and at the same time, addresses emerging needs around security of supply, becoming especially attractive to those who have been using expensive off-grid power at mines generated from diesel and other fossil fuels, and for those facing higher electricity and fuel costs.

More fundamental changes are also necessary in the decarbonisation of commodities production. For example, in the steel industry, a shift from blast furnaces using coke to green hydrogen-based direct iron reduction (DRI), could mean a paradigm change. Ironmaking, e.g. DRI, could become decoupled from steelmaking, and competitive DRI producers will be those with access to low-cost renewable energy sources and high-quality iron ore. In the aluminium industry, new materials need to be developed, while inert anode technology for electrolysis in the smelting process should cut emissions. However, reductions in indirect emissions from power generation offer the largest emissions abatement in aluminium smelting.

For some mining and metals companies, fundamental shifts to new production methods or feedstocks pose too high a risk, or too large capital expenditure and operational costs. Alternatively, the time to implement solutions is too long to meet company or policy targets, and, therefore, transition solutions are required. Carbon capture, utilisation and storage (CCUS) is one technology that is being investigated for some metal producers, especially, those where the CO2 concentrations are higher and, therefore, more suitable for capture, for example, in steel. CCUS enables them to maintain the use of fossil fuel-based production routes, whilst also reducing emissions.

Mining companies are also seeking to reduce emissions in transport applications used for production and transport of materials. A number of mining companies are developing hydrogen-fuelled or electrified mining trucks. As the emphasis grows on reducing scope 3 emissions, including emissions from the transport of raw materials and end products, attention is switching to the fuels used to power commodities transport. For example, mining companies, including Anglo American, Rio Tinto, BHP and FMG, are considering various shipping decarbonisation options, ranging from vessels fueled by ammonia, biofuels and, in the shorter term, LNG.

Circularity

The CDP report Riding the Wave, published just before the UN 2023 Water Conference in March, illustrates financial opportunities that exist for companies that integrate water into their business strategies. Water stewardship is no longer just a question of risk management but of real value ready to be captured. Water has become a topical issue in boardrooms, with major companies investing in new products and services to address the water challenge and seize market share in a world in which we will have to do more with less.

Financial opportunity

Mineral-based materials in clean energy technologies, such as wind turbines, devices needed in smart technology, and electric vehicles, are essential for the green transition. The availability of many of these valuable raw materials necessary to numerous industrial sectors is already reaching a critical point of supply. Additionally, in materials processing, there are also sustainability concerns, such as the availability of clean water.

The growing need for mineral resources results in an increase in greenfield exploration and alternative mining methods, such as deep-sea mining.

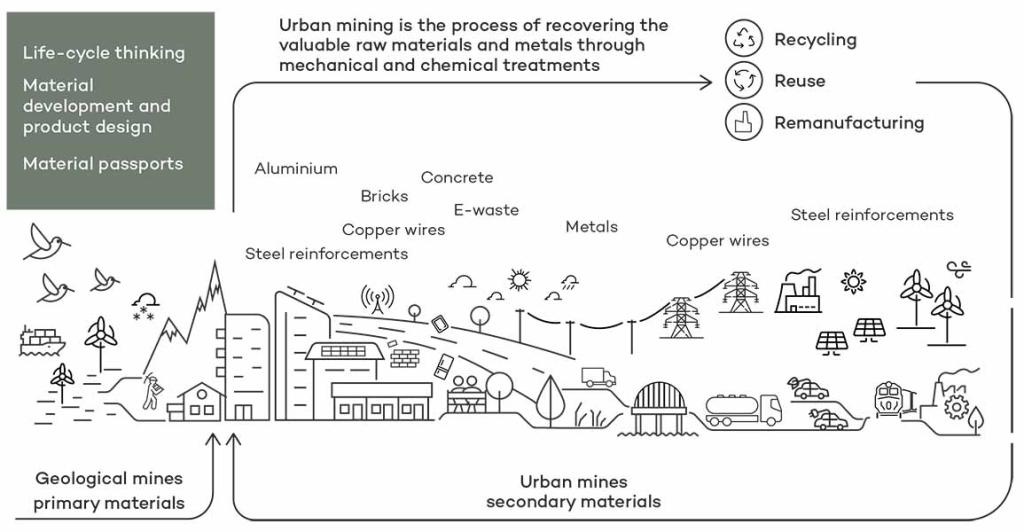

Increasing demand calls for a transition in thinking to reduce, reuse and recycle natural resources in a sustainable and efficient way.

In other words, how to get by with less via the adoption of carbon-neutral circular economy solutions in many sectors, including the mining and metals industry.

The material development and product-design phases are the most important decision-making phases to enable a transition towards a circular economy. The goal should be to design “everlasting” products, where recycled materials, parts and components are in use, and are easier to repair and maintain. In addition, it is important to minimise environmental impacts in the use phase and keep products in use as long as possible. Therefore, new maintenance and repair services that extend product life cycles are needed.

From a material recycling perspective, the biggest challenges are non-comprehensive take-back systems, the low value of recycled materials, the lack of cost-efficient recycling technologies and the costs of recycling. For the transition towards a circular economy society, more efficient use of materials that tackles all of the above challenges will be critical.

In the future, the sustainable use of natural resources means that whenever we use raw materials, we ensure at the beginning of the life cycle that they remain in use after their first use. Tools, such as material and product passports, have been created to support this transition.

The core of the green transition is to integrate carbon neutral circular economy solutions and actions in business strategies and plans.

Circular economy provides a win-win situation from both an economic and an environmental point of view.

Financial solutions

The CDP report Riding the Wave, published just before the UN 2023 Water Conference in March, illustrates financial opportunities that exist for companies that integrate water into their business strategies. Water stewardship is no longer just a question of risk management but of real value ready to be captured. Water has become a topical issue in boardrooms, with major companies investing in new products and services to address the water challenge and seize market share in a world in which we will have to do more with less.

Bio is part of the solution

Various bio-based materials and methods in ore processing, wastewater treatment, production of metals and some applications like batteries provide another possible route to a more sustainable industry.

Bio-based (bacteria, microalgae, fungi, proteins, etc.) laboratory-developed solutions used in the exploitation of rare earth elements, magnesium and platinum group metals are ready for industrial use. These biomining processes are proven to reach high recovery yields (≥90%) and selectivity (>95%) and be environmentally safe and cost-efficient.

Sometimes, they even allow elements inaccessible by conventional mining methods to be extracted.

As the energy transition gains pace, there are bio-based solutions that could help traditional metallurgical methods to achieve a better environmental performance.

Biocoal could be used in the iron ore sintering process, and it could also partially substitute coking coal in coking blends and pulverised coal injections into blast furnaces. Biocoal may also be used as charge carbon and biochar as a foaming agent in electric arc furnaces. A combination of these solutions could reduce up to 25% of fossil-based CO2 emissions.

A myriad of approaches is required

Scientists and engineers are working on various bio-based techniques for further applications, e.g. battery manufacturing. There are, for example, multiple applications for lignin: lignin-based anodes for lithium-ion and sodium-ion batteries, lignin-based organic expanders for lead batteries, lignin-based bio-solvents to replace toxic dipolar aprotic solvents, such as NMP, lignin-based vanillin as electrolyte in redox-flow batteries and many more.

There are some constraints and limitations associated with each of the above routes and particular solutions, but a careful selection of initiatives could lift the environmental performance of companies along the mining and metals value chains, thus leading to a fundamental sustainability transition in the whole industry.

This article was originally published in AFRY Insights 2023 autumn edition.

Bioindustry Management Consulting

Our service offerings, from corporate strategy to process design and from market insights to operational efficiency backed up by an understanding of best practices, detailed in-house databases, and analysis led by experts in the field, ensure your outstanding performance. We want to be your trusted partner.