Welcome the Golden Age of Advanced Fuels?

The second half of 2022 is shaping up to be a watershed year for the advanced fuels and bio-based chemicals industries.

New regulatory frameworks to address climate change are providing a catalyst for what will be unprecedented growth in these sectors.

In the US, the Inflation Reduction Act, through the Energy Infrastructure Reinvestment Financing Program, will inject $250 billion in loans to repurpose energy infrastructure and $40 billion for projects eligible under section 1703 of the Energy Policy Act of 2005.

Across the Atlantic, the European Commission recently approved $5.2 billion in public funding for hydrogen projects, including the development of large-scale electrolysers. To meet the targets of its Green Deal, countries in the European Union (EU) will allocate €584 billion in new investments. Perhaps, at least in terms of available incentives, the Golden Age of Advanced Fuels has finally arrived.

HVO Leading the Way

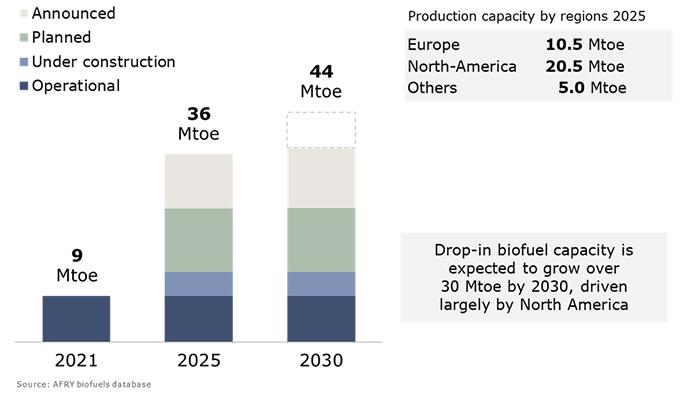

Arguably the most active sector in biofuels is the hydrogenated vegetable oil (HVO) or renewable diesel market. As shown in Figure 1, the current global supply of HVO is about 9 million metric tonnes of oil equivalent (Mtoe).

AFRY estimates that the global supply of HVO will increase 4-fold in the next three years, reaching 36 Mtoe. By 2030, HVO will reach 44 Mtoe, which implies an annual growth rate of nearly 20%.

Of course, the question behind this growth will be the availability of feedstocks. Where will they come from? We agree with what has been stated many times in the Digest, that the control of feedstocks will be the most important factor in the renewable diesel market.

The Promise of Advanced Biofuels?

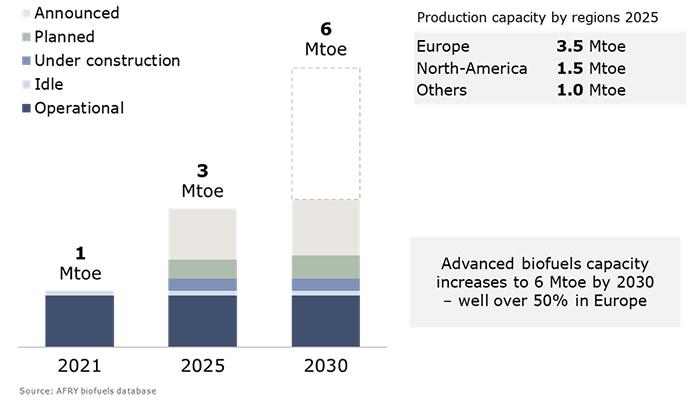

In comparison, the current global advanced biofuels supply is a relatively modest 1.0-1.2 Mtoe. While comparatively lower in volume, it is also expected to see significant growth in the coming decade (see Figure 2). Supply will consist mostly of advanced HVO, that is, HVO made from advanced feedstocks such as tall oil and palm oil mill effluent (POME) and 2G ethanol.

It should be noted that crude tall oil (CTO) and POME—so-called Part A feedstocks—are eligible biofuel feedstocks in Europe but not in the United States due to differences in national policy. The eligibility of CTO in Europe has created market distortions within the pine chemicals industry, which relies on CTO as a chemical feedstock. POME, on the other hand, has acceptance challenges that limit growth as many question the sustainability of palm oil and its derivatives.

By 2030, the global supply of advanced biofuels is expected to increase to 6 Mtoe. However, many of the announced projects do not have a designated start-up year, or their project development is stagnant.

Aside from some notable exceptions, namely Fulcrum’s Reno, NV plant, the leading global development focus for advanced biofuels is taking place in Europe. Increasing supply is expected to come from biomass-to-liquids (BtL) fuels and lignocellulosic ethanol, or 2nd Generation Ethanol (2GE), led by Raízen.

Advanced feedstocks, like POME and CTO that are used in the production of HVO, will likely constitute a large share of advanced biofuels supply by 2025, but their availability is limited. Predominant feedstocks in 2GE and BtL fuels production will be agricultural wastes, woody residues, and the biogenic component of municipal solid waste (MSW).

Apart from advanced biofuels from novel raw materials and production pathways, fuels from food waste, POME and biomethane also contribute to the advanced biofuels supply, especially in Europe. However, their growth potential is more complex to assess, as technology development and scale-up have not fully been commercialised, and multiple hurdles must still be overcome.

Will high prices trigger new investments?

The price development of biofuels, especially advanced biofuels, has been a rollercoaster ride during the past year, driven first by the turmoil in global commodities, followed by new biofuel regulations and war in Ukraine. A few years back, all feasibility studies were painting long-term price levels for advanced biofuels at around 1500–2000 USD/mt, which by late 2021 and 2002 turned into 3000–4000 USD/mt.

Elevated price projections are giving a huge boost to the profitability of new projects, while also highlighting the high risks in regulatory-driven markets. Regulatory risks coupled with fluctuating commodity pricing may become unbearable hurdles for project financing based on infrastructure funds and debt lenders. Higher prices for renewable fuels have resulted in increased feedstock prices of waste fats and oils, together with increased demand. As a result, solid biomass, like wood, with more stable price development, is becoming increasingly more attractive as a feedstock.

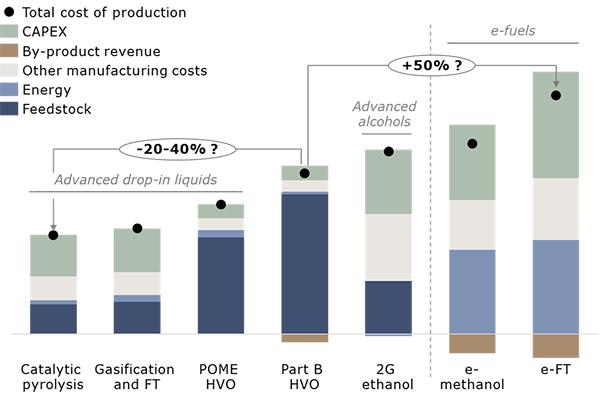

The new political push towards renewable hydrogen and e-fuels can also promote the deployment of advanced biofuels, especially if an “all the above” strategy is used to minimise overall carbon intensity. With the high costs of new e-fuel technologies and the relatively high costs of additional renewable electricity, these e-fuels could set the benchmark for sustainable fuels (see Figure 3). So, is the market finally getting into a stage where advanced biofuels have their own premium pricing mechanisms which enable investments in high CAPEX solutions?

Lessons Learned

US and European regulations have created a very large market for advanced biofuels. Companies are racing to build out HVO capacity but are facing the harsh reality that feedstock availability is the key driver for growth, and that feedstock control is key for long-term success. In comparison, lignocellulosic biofuel technologies are still at the “flagship stage.” While promising large-scale projects are coming on stream, they remain largely unproven with respect to continuous operation. The injection of government-led investment programs will certainly help to offset the typically high capital costs associated with lignocellulosic-based fuel pathways. However, technology providers will likely need to reduce capital intensity if they expect to achieve widespread success.

So, what can companies, project developers and investors that are developing new conversion technologies and working to bring new supplies of advanced biofuels learn from the success story of HVO? We believe that adherence to five basic principles will be needed:

- Proven technical concept. The appetite for jumping the queue when it comes to technology readiness is long gone. Early-stage companies must demonstrate their technology platforms at the appropriate scale and only then consider deployment at a commercial scale.

- Competitive feedstock supply chain. A critical element to success. Vertical integration in feedstocks will likely be a best practice amongst future participants.

- Strong balance sheet. Commercialisation plans will inevitably succumb to cost overruns and start-up delays. Companies that do not have a strong balance sheet will be unable to stay the course.

- Disciplined approach to project management. Given the complexity of advanced biofuels projects, the ability to create cross-functional teams that can address all critical business functions—research and development, design and engineering, operations, regulatory, and sales, as well as environmental, social, and governance (ESG)—with clear purpose and accountability is a must. Adherence to best practices will accelerate project delivery. Cutting corners will lead to failure.

- Off-take partners. Another critical element is the ability to secure off-take agreements. However, given the insatiable demand for low-carbon fuels, attracting off-take partners is probably the least concern for projects that adhere to principles 1 through 4.

Long-term Competitiveness

As prices are and will remain volatile and depend on uncertain regulations and commodity markets, relative competitiveness against other players will be critical to assess new project viability. An advantaged cost position among future leaders is the best way to ensure competitiveness in the long term. Cost-effective feedstock supply, low utility costs, economies of scale, and reliable technology are the cornerstones for future competitiveness.

In the Golden Age of Advanced Fuels, assessing future competitiveness will require a keen understanding of advanced fuel regulations, the cost of supply, and pricing mechanisms that govern the entire value chain.

This article was originally published in The Biofuels Digest on 10 November 2022.