Full of wind: the impact of moving to 40GW of offshore wind

The growth of the UK offshore wind industry has been a real success story. There is now around 14GW installed or under construction, with a further 6GW awarded in last year’s CfD Allocation Round 3 (AR3) auction and due to commence construction shortly. The levelised cost of offshore wind has decreased from around £150/MWh to around £50/MWh, as a result of larger turbines and projects, technology maturity, and industry learning.

In early 2019 the UK Government agreed the Offshore Wind Sector Deal with the offshore wind industry. This sets an ambition of a reaching a total of 30GW of offshore wind by 2030, and this vision gives the industry the confidence to invest further in developing the supply chain needed to achieve this.

In its manifesto for the December 2019 general election, the Conservative Party pledged to achieve 40GW of installed capacity by 2030. Now that the Conservative Party has formed a new Government, we await the Energy White Paper which will hopefully set out how this will be achieved.

AFRY’s Central scenario assumes that offshore wind deployment plateaus at around 31GW by 2030. This is based on our view of what is affordable under the existing announced subsidy budget, and is broadly consistent with the Offshore Wind Sector Deal ambition. It should be noted that based on our Central scenario view of future power prices, new offshore wind (including the AR3 projects) still requires a small positive subsidy – it is not yet ‘subsidy free’.

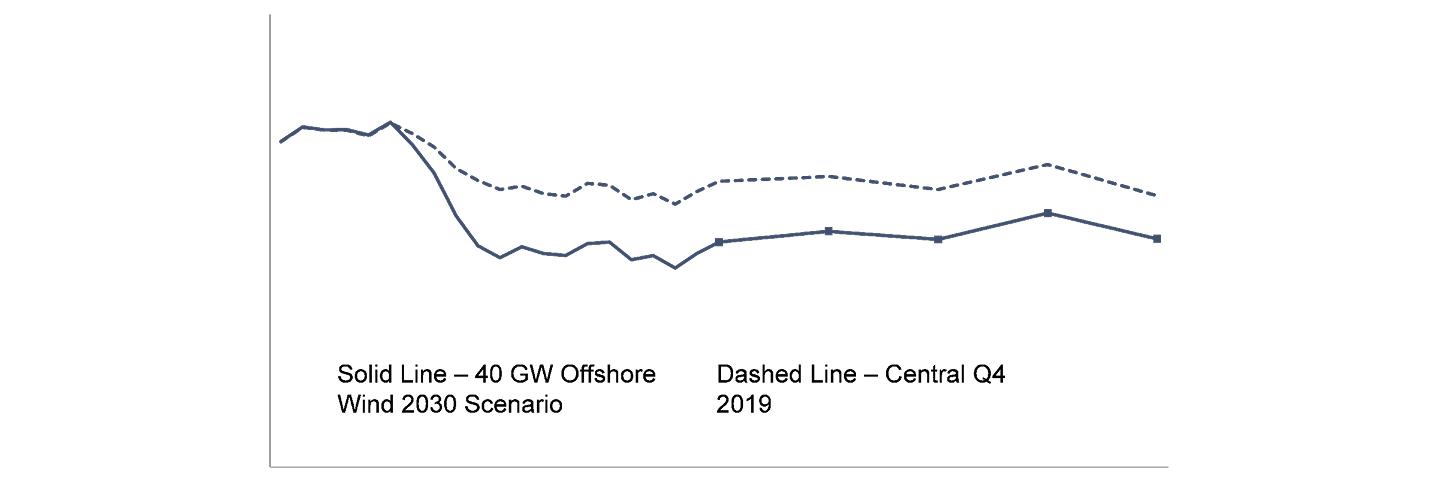

Given the 40GW manifesto pledge, we have run a sensitivity case on our Q4 2019 Central scenario update to investigate the potential impact of building an addition 9GW of offshore wind by 2030. We have implemented this by forcing the additional offshore wind build, and reducing new build of gas-fired generation such that the overall level of system security is maintained at the same level.

The chart shows the impact on offshore wind capture prices of adding the extra 9GW of offshore wind. There is a significant drop – around £7-10/MWh from 2030 onwards. In this sensitivity case we have not adjusted the amount of merchant onshore wind which is deployed. In reality this may no longer come forward and so would offset some of the impact of the extra offshore wind. However, as the Government is consulting on re-opening the CfD scheme to onshore wind, this onshore wind may be built anyway as CfD capacity rather than merchant capacity.

This illustrates a significant risk faced by merchant renewables projects today – the risk that their revenues will be further cannibalised by further build out of CfD-supported capacity in the future (onshore or offshore). This is also a risk facing current ROC and CfD generators operating in the ‘merchant tail’ after the end of their subsidy period.

The Government suggested that the Third CfD Allocation Round was ‘subsidy free’ in that the clearing strike price was below the Government’s view of future market prices. Our view, based on a lower price outlook in our Central scenario, was that CfD payments to generators would still be required on a net basis. Adding another 9GW of offshore wind will increase this requirement by further depressing market prices. Hence our view is that even if offshore wind technology costs are able to reduce further, subsidies will be required for some time yet.