Day-ahead STOR markets – all or nothing?

The hotly anticipated day-ahead STOR market has recently been launched; what is there to learn from the first week of market operation for both providers of flexibility and the customers who are ultimately paying for it?

Due to the Clean Energy Package, NG ESO has moved STOR to day ahead procurement. Whilst this removes some long term price certainty for generators, it allows the underlying system conditions to manifest in prices each day. This should ultimately more accurately reward flexibility.

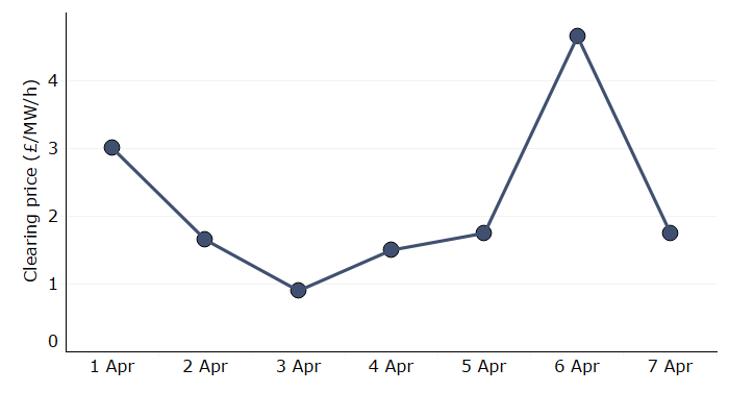

Prices from the first week of STOR auctions have been relatively low, but volatile. As with any movement from long-term tenders to close to real time procurement, in a market driven by underlying system conditions (e.g. how windy it is, expected demand, capacity outages etc.) volatile prices should be expected as the norm. Successful generators have predominantly included the expected mix of reciprocating engines and OCGTs. There are, however, a few quirks emerging as a result of participant bidding behaviour.

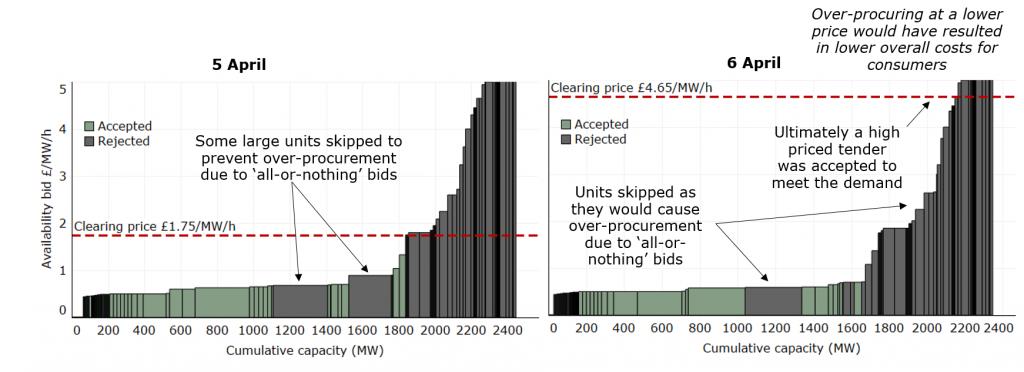

We’ve noted that there is a tendency in these early stages for participants to submit ‘all-or-nothing’ bids. This is where providers are only willing to accept the obligation to provide STOR if the entire capacity of their asset is accepted. Whilst this is an intentional option provided to participants, the effects on a market where over procurement is prohibited is stark. The clearing algorithm discounts bids that would take the total procured volume over the total target procurement capacity. Due to the all or nothing nature of participant bidding, this has led to many bids below the ultimate clearing price being rejected.

Whilst over procurement can be a problem, this must be balanced against the total costs to consumers who pay through their electricity bills. As the market is pay-as-clear all successful participants receive the clearing price, in most cases accepting a 1-2% over procurement in capacity volumes would reduce the total costs, potentially saving customers millions of pounds per year, as compared to taking the exact capacity but clearing the auction at a higher price. By way of cross reference, the auction process of the capacity market already follows a relevant cost minimisation process to determine the clearing price.

This point is illustrated by the 5th and 6th April, where a very similar tendered volume led to very different clearing price outcomes

It should be noted that NGESO assess the expected costs of making capacity available within-day to cover STOR requirement and will reject bids on this basis, meaning overall the new design should deliver a benefit for customers. It also remains to be seen as to whether participants bids will adapt over time as more information becomes available. It’s possible the invisible hand of the market will deliver the service at least cost to consumers in the long term.

Our analysis shows that the market for STOR is currently long due to the volume of gas recips that have successfully commissioned in the last few years, and that prices should be low at present. This would have been the case had the objective of the clearing algorithm been to minimise total costs. Of course, by holding some additional capacity for STOR, there may be an impact on wholesale market prices; the benefits and costs should not be ignored.

It should be the objective of market designers to inherently engineer efficient mechanisms into the architecture of the markets. The first question that should be asked – what are we trying to achieve for both buyers and sellers of flexibility services? A few small tweaks means that customers can have their cake, and eat it too. As NG ESO continue to reform their procurement of reserve, the details of the market design adopted will be important to facilitating the efficient balancing of the grid in a more volatile, weather driven system.