Vulnerabilities of the Battery Supply Chain for European Utility Storage Providers

Europe’s energy storage battery supply chain faces several challenges as demand for batteries globally grows rapidly.

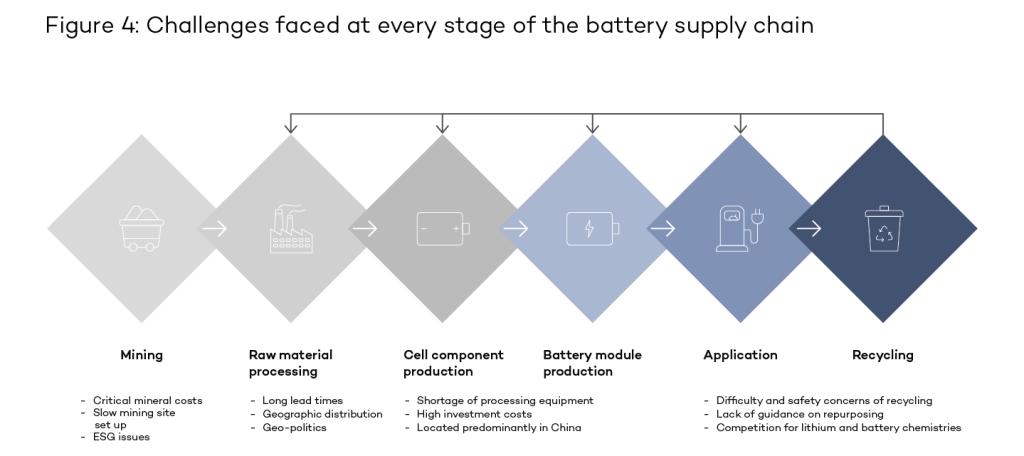

At each stage of the supply-chain process there are significant constraints, affecting mining, raw material processing, cell and module production, as well as application, re-using & recycling. By mapping these pressures, we can formulate targeted resilience measures that help prevent supply chain disruption from impacting batteries’ critical role in the net zero transition.

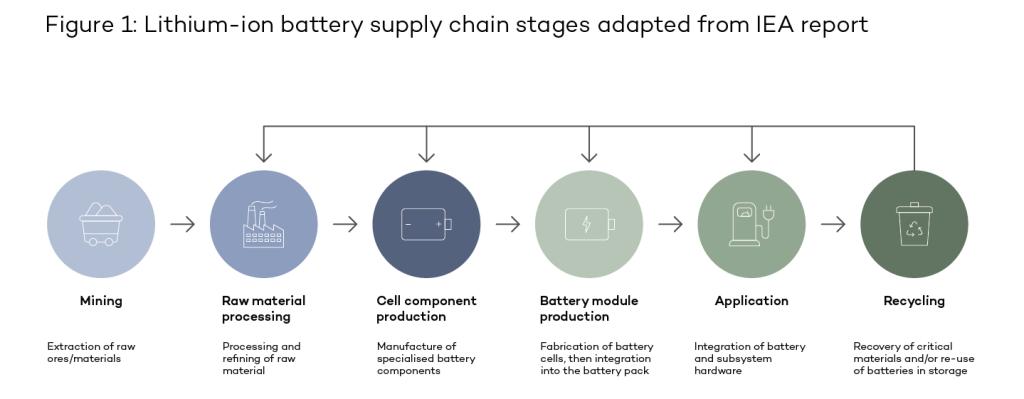

Exploring and understanding the vulnerabilities in the battery supply chain is essential. There has been a marked increase in demand for batteries in electric vehicles and for storing energy from intermittent renewables. Simultaneously, there have been pressures on supply, for example, the Russian invasion of Ukraine and the resulting sanctions have seen class 1 battery-grade nickel metal shortages exacerbated. Growing supply and demand-side tensions make a closer study of each stage of the supply-chain, shown in Figure 1, vital for European utility storage providers.

This article will address the vulnerabilities in the mining, raw material processing, cell and module production, application, and re-using & recycling stages of the battery supply-chain.

Mining costs for critical minerals are soaring, driven in part by ESG issues and a shortage of mining sites

Expensive materials contribute significantly to the cost of each battery and are driving an increase in battery prices for the first time in the last decade undefined . Significant battery metal price increases in 2022 reflect concerns of a tightening supply and underinvestment in mining. Despite energy transition prospects, companies have been quite cautious about committing significant capital to new mining projects. Though announced projects would see lithium supply capacity expand 3.5x to 2030, this will still not be sufficient to meet battery-related energy pledges set by countries worldwide undefined .

Globally, over 300 new mines will need to be built over the next decade to meet both EV and grid storage demands undefined . Given the regulatory and technical hurdles, it could take between 8-18 years (depending on the mineral) to set up a mine, with additional time required to have it working at expected production rates. Though there is significant unrealised potential for diversification of extraction for each of the minerals required for batteries, the quality of the resource ore is not fully known.

Between 2017 and 2019, there were thousands of public reports of governance-related risks by the mineral supply chain, including child labour, corruption, forced labour, and wider human rights abuses undefined . These were primarily related to the extraction of minerals in the lithium-ion battery, such as cobalt, nickel, and copper, and present a key issue to be addressed should mining sites be utilised sustainably.

Raw material processing is threatened by lengthy lead times and a vast geographical distribution of sites, exacerbating geo-political vulnerability

Following the mining process, materials will be refined and processed. If we consider lithium for example, there are two different ways it can be extracted: through lithium brine or spodumene ore, each requiring differing chemical processes and affecting the resulting metal’s qualities and applications. Whilst South American lithium brine is becoming a popular source for lithium extraction, the refining process is significantly longer than from spodumene ore, primarily found in Australia. Although 50% of the world’s lithium is extracted from Australia, almost none of it is refined and processed there, instead being primarily shipped to China undefined . The Australian government is aiming to refine 20% of the world’s lithium within national borders by 2027, however, opening new facilities can often be hindered by technical issues, lengthy delays, and runaway costs undefined .

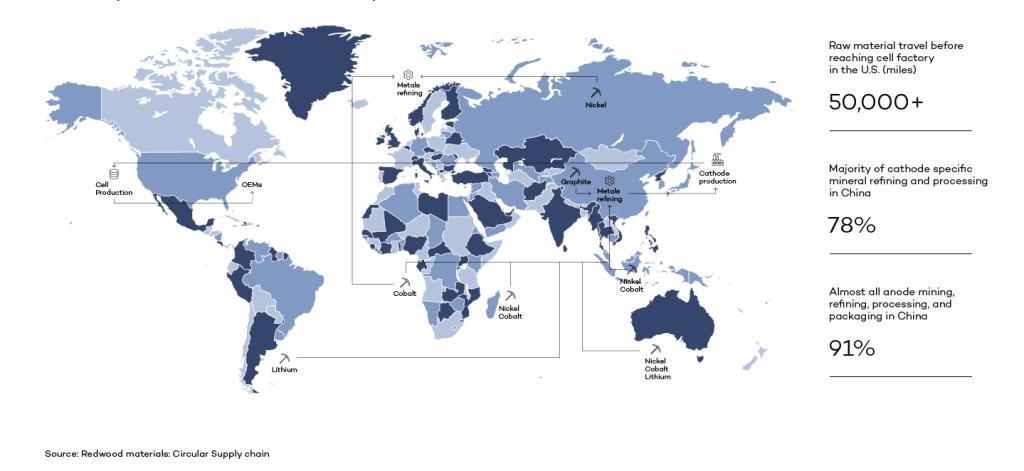

China’s prevalence in the downstream battery supply chain extends further than just lithium, with the majority of cobalt, nickel, manganese, and graphite being processed there. This creates an incredibly geographically spread supply chain, requiring tens of thousands of miles travel of metals from raw material to processing to cell factories. Additionally, this makes the supply chain particularly vulnerable to geo-politics. For example, the Canadian government has already forced three Chinese companies to divest from local lithium companies in a bid to temper foreign investments in domestic critical minerals companies undefined .

In 2021, Russia was the third largest producer of global nickel undefined . Specifically, they produced 20% of the class 1 nickel required for batteries. After Russia’s invasion of Ukraine, the nickel price went from $18,500/t to $100,000/t before temporarily closing. It then resumed at almost double the price of 2021 undefined . This highlights the dangers of reliance on a given supplier, and the need for additional resilience moving forward.

Figure 2: Battery materials move 50,000+ miles before they reach a battery cell factory in North America

Cell and module production continues to be located predominantly in China, as other countries struggle with a shortage of equipment and high investment costs

In the production of battery cells and modules, some processes, such as coating and electrolyte filling, are either unique or highly specific to battery cell manufacturing. Other processes, such as slitting, cell formation, and aging, are similar to processes that are widely used in other industries 8 . Equipment suppliers may prioritise orders from established manufacturers as opposed to new entrants in the battery market, creating a bottleneck in equipment supply. Most of the incumbent battery cell manufacturing suppliers are operating at more than 95% capacity and cannot take on additional capacity if shortages continue 8 .

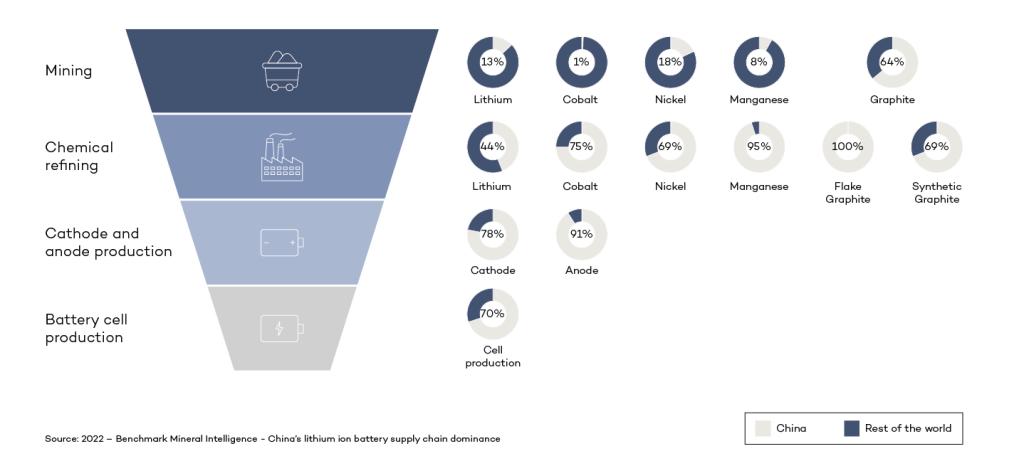

Most battery cell equipment suppliers are in China, Japan, and South Korea with just a few in Europe 8 . It is therefore not surprising that, again, this stage in the supply chain exhibits China’s primacy. China has a manufacture market share of 78% for cathodes, 91% for anodes (both used in battery cells), and 70% of battery modules. 80% of all cells deployed are from just 7 companies undefined .

Figure 3: The downstream battery supply chain is located predominantly in China

Metal recovery and battery repurposing are proving a challenge for the supply chain - as is competition from EVs for lithium-ion batteries

Within the mining, processing, and manufacturing processes, there are large amounts of waste that could be leading to valuable minerals being lost, requiring interventions such as improved metal recovery from processing waste in mines.

At the other end of the battery life cycle, when the battery reaches its end of life, there is difficulty in physical collection of batteries and concerns over a lack of safety with transporting used batteries; there is lack of clear guidance on re-packaging, certification, and standardisation of recycled or refurbished batteries. The recycling process is also expensive, thus removing a key incentive for the adoption of recycled batteries over those made with raw minerals. Lastly, there are also still technological barriers to having ‘second life’ application of batteries to grow at scale.

EV use of lithium iron phosphate batteries went up by 237% in the first half of 2022 compared to first half of 2021 10 . This technology is also primarily used in grid storage due to its cost effectiveness. This leads to a competition between EVs and grid storage for lithium battery cells. As electric vehicles will hold over 80% of the market share for batteries in the future, compared to just 5% for grid storage, alternative chemistries will have to be explored for utility storage providers to remain competitive in the market undefined .

So what resilience measures can we put in place?

Successful and widespread deployment of utility storage technologies will be key in the decarbonisation of our energy systems. It is critical for the net zero transition that these vulnerabilities in the supply chain are overcome, ensuring that battery supply and quality does not act as a bottleneck to European ambitions in reaching net zero.

In addressing these supply chain issues, we can utilise ‘Traditional Measures’, such as vertically integrating the supply chain; ‘Alternative Measures’, such as exploring different battery chemistries and emerging grid technologies; and ‘Circular Measures’, employing reuse and repurposing in the battery supply chain. We will discuss our recommended measures and areas for further research in our next article, “How can storage providers improve the resilience of their battery supply chains?”.